Gold Price Forecast: XAU/USD bulls must defend $1,900 for a chance at recovery – Confluence Detector

- Gold Price drops to the fresh 14-week low as bears approach $1,903 key support confluence.

- Central banks bolster recession woes and underpin US Dollar run-up, weighing on XAU/USD.

- Hawkish Fed clues also favor the Gold sellers amid risk-off mood, holiday in China.

- Flash PMIs can entertain XAU/USD traders ahead of next week’s US inflation clues.

Gold Price (XAU/USD) remains on the way to posting the biggest weekly loss since late January as the US Dollar cheers the market’s risk-off mood, as well as the hawkish Federal Reserve (Fed) concerns.

Multiple central banks confirmed the “higher for longer” rates the previous day and flagged concerns about the economic slowdown, especially amid higher inflation and geopolitical woes. Adding strength to the risk-off mood are the mixed figures of the US second-tier data and the hawkish testimony of Federal Reserve (Fed) Chairman Jerome Powell. That said, Richmond Fed President Thomas Barkin joined US Treasury Secretary Jannet Yellen to flag economic fears earlier on Friday.

Amid these plays, the S&P500 Futures print mild losses after the previous day’s mixed closing of Wall Street and upbeat US Treasury bond yields. That said, the US 10-year and two-year Treasury bond yields rose the most in a week after the central banks’ play before recently easing to around 3.78% and 4.79% in that order. It should be noted that the US Dollar Index (DXY) picks up bids to extend the previous day’s rebound from the six-week low to around 102.55 by the press time. The same exerts downside pressure on the prices of Gold and directs it toward the key support.

Moving on, the first readings of June’s activity numbers for the UK, Germany, Eurozone and the US will be crucial to watch for the Gold Price watchers to confirm the recession fears. Following that, the next week’s Fed Chair Jerome Powell’s speech and inflation clues will be eyed for clear directions.

Also read: Gold Price Forecast: XAU/USD could see a dead cat bounce toward $1,942 on profit-taking

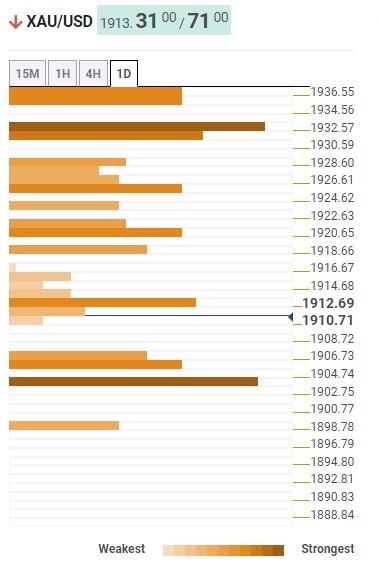

Gold Price: Key levels to watch

As per our Technical Confluence Indicator, the Gold Price drops towards the $1,903 key support comprising Pivot Point one-month S1. Ahead of that, Pivot Point one-week S2 and Pivot Point one-day S1, close to $1,907 at the latest, can prod the XAU/USD sellers.

That said, a downside break of the $1,903 support confluence will need validation from the $1,900 round figure, also comprising the Pivot Point one-day S2, before throwing a party for the Gold sellers.

On the contrary, the previous daily low and 5-HMA restrict immediate upside around $1,915 before directing the Gold buyers toward the Fibonacci 38.2% on one-day, around $1,922.

It’s worth noting that the previous weekly low and Fibonacci 61.8% on one-day, near $1,925, also acts as the additional second-tier hurdle for the XAU/USD bulls to cross before confronting the all-important $1,933 resistance confluence. That said, the previous monthly low highlights the mentioned key hurdle, per the Confluence Indicator.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.