Gold Price Analysis: XAU/USD consolidates near $1,900 as US dollar rebounds

- Gold bulls chipping away at the upside ahead of NFPs.

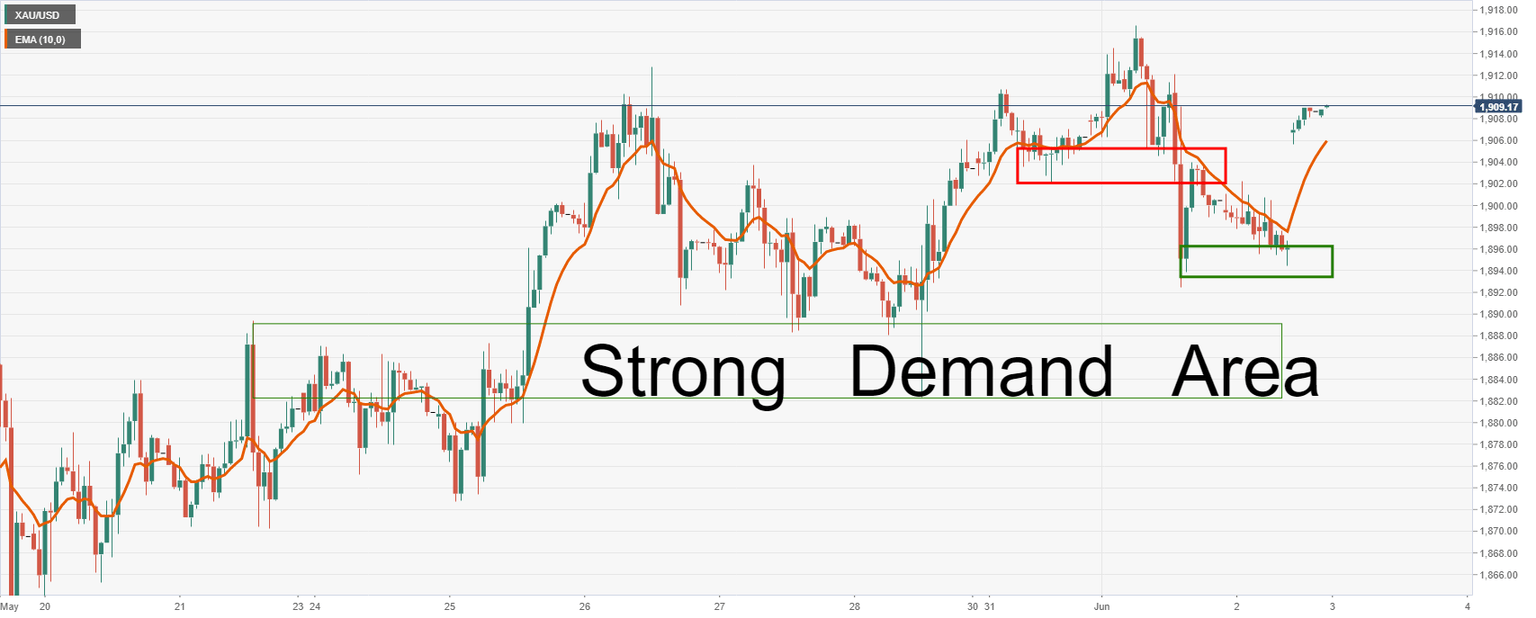

- Stong demand area holds and higher lows are encouraging.

Update: Gold prices trade lower amid some recent traction in the US dollar in the Asian session. As of writing, XAUD/USD was trading at $1907, down 0.10% for the day. The rebound in the greenback negatively affects the dollar-denominated commodity. The upbeat US economic data continued to boost the economic recovery hope and fuels the fear of persistent inflation. The anxiety among investors as a rise in inflation could prompt a quicker normalization of Fed monetary policy weighs on gold prices. Gold remains a safe bet against inflation and uncertainties. However, higher interest rates attract investors to the bond market. The rising corona cases in Asia-pacific countries dent the demand for gold for the time being.

Previous updates:

Gold (XAU/USD) fades the previous day’s upside momentum while refreshing the intraday low under $1,906, down 0.16% daily, during early Thursday. In doing so the qutoe again drops towards the key suppoer zone around $1,899.

The consolidation moves could be traced to the US Treasury yields that recently paused further losses, which in turn offered a breathing space to the US dollar bears and pulled back the gold prices. That said, the US 10-year Treasury yields gain 0.3 basis points (bps) near 1.59% whereas the US dollar index (DXY) licks its wounds around 89.92, up 0.03% intraday.

It should, however, be noted that the cautious sentiment ahead of Friday’s US Nonfarm Payrolls (NFP) and a lack of major catalysts during the Asian session keeps the metal ground while cheering the broad weakness of the greenback near the multi-month top.

The gold price was ending the North American day bid by some 0.4% following a rally off the $1,894.45 lows to a high of $1,909.14.

At the time of writing, gold is trading around flat in Asia ahead of the Tokyo open near the overnight highs.

The greenback edged higher on Wednesday, backing off of a near five-month low ahead of the highly anticipated US Nonfarm payrolls data on Friday.

The dollar index DXY, which measures the greenback against six rivals, was up back to flat by the late afternoon on Wall Street to 89.8930 after recovering from an 89.8570 low and albeit below the 90.2460 high.

The index paused just ahead of the Jan 7 levels of 89.533.

Friday's data will be critical for the precious metals markets riding the ebb and flow in the greenback.

April's much weaker-than-expected jobs data will be a reminder of the type of surprise that can rattle the markets and potentially play into the hands of gold as a safe haven substitute to an otherwise stronger US dollar.

US Nonfarm Payrolls probably rose strongly by pre-COVID standards, according to analysts at TD Securities.

''We see some downside risk versus the consensus again this month. That is our takeaway from the timely, albeit not fully comprehensive, Homebase data. Our forecast implies a still-sizable 7.7mn net decline from the pre-COVID level. The unemployment rate probably resumed its downtrend after a surprising rise in April.''

Meanwhile, manufacturing data on Tuesday came in above expectations which had initially supported the US dollar. However, the labour shortages during the month actually hampered the sector's growth potential, which is a potential weight for the greenback and something that will be put into the balance vs inflation expectations.

While being a little removed from gold, per se, investors are also weighing the implications of Chinese policymaker's steps to cool the advance of its currency, the yuan, including raising banks' FX reserve requirements.

Indirectly, as a consequence, gold may be affected by the relative strength in the greenback.

Gold technical analysis

Technically, gold is better bid and a higher low on the 1-hour chart is encouraging.

Solid daily support of 1,899 guards the strong demand area as illustrated above.

1,921 comes as the -272% Fibonacci retracement of the current daily correction’s range.

Related articles

Chart of the Week: Gold to be an exciting display of technicals

Gold Weekly Forecast: XAU/USD bulls not yet ready to give up on additional gains

Gold Price Analysis: XAU/USD battles support, eyes $1,1913 – Confluence Detector.

"The Technical Confluences Detector is showing that XAU/USD has strong support at $1,903, which is the convergence of the Bollinger Band 4h-Middle, the Fibonacci 23.6% one-week, the BB 1h-Upper and more," notes FXStreet analyst Yohay Elam.

Gold Price Analysis: XAU/USD set to plummet until the $1794 mark – Commerzbank.

Gold has charted a key day reversal as the yellow metal is seeing some profit-taking. Subsequently, XAU/USD is expected to correct lower short-term, in the opinion of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.