Gold Price Analysis: Bulls back in the game, but resistance is strong

- Gold bulls are back in the driving seat but may face fierce opposition in coming days.

- Bears will be seeking for the daily resistance zone to hold and provide the next shorting opportunity.

In the following series of analysis, we look at the price action of gold in a top-down illustration and derive where the next bearish opportunity could arise for swing traders.

Starting with the monthly chart, we can work our way into the daily chart and sketch out the market structure and bias.

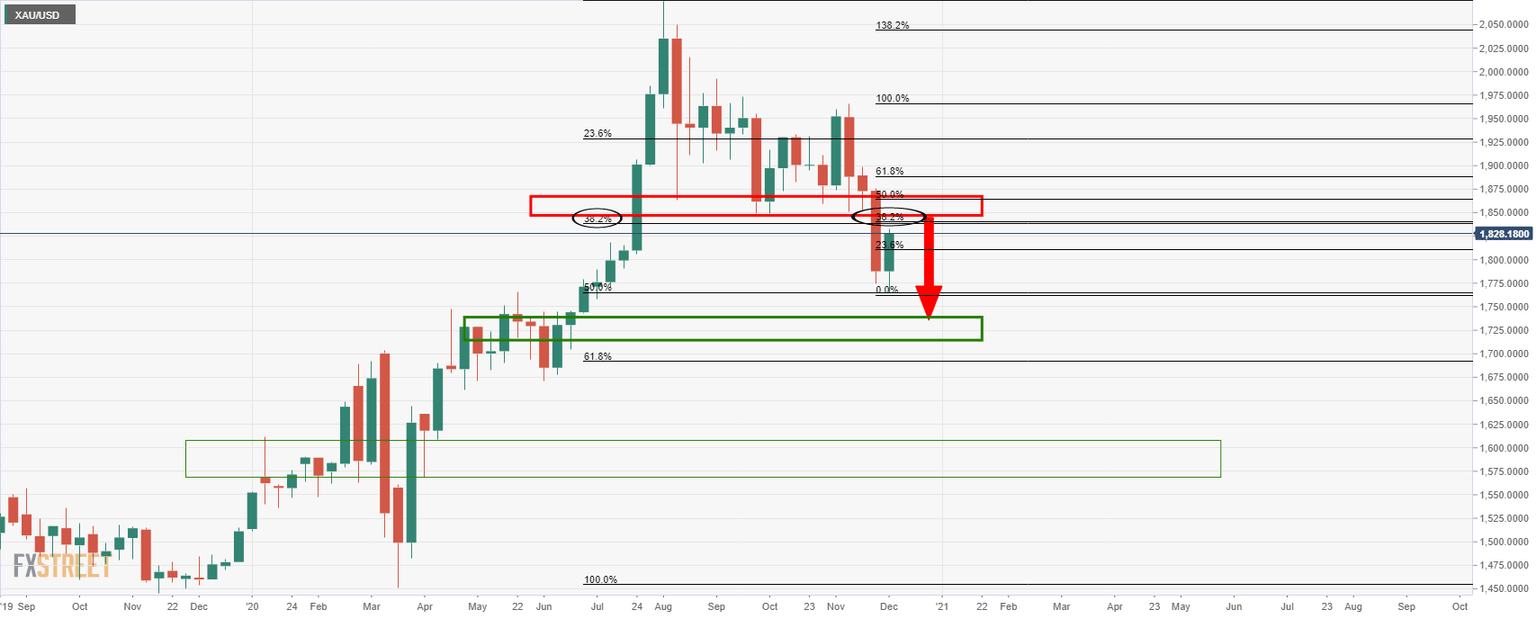

Monthly chart

The monthly chart shows that there are prospects of a downside extension following a correction of the first significant bearish impulse.

The 61.8% Fibonacci retracement of the bullish impulse aligns with monthly resistance and liquidity which offers a high probability target area for the bears to focus on next.

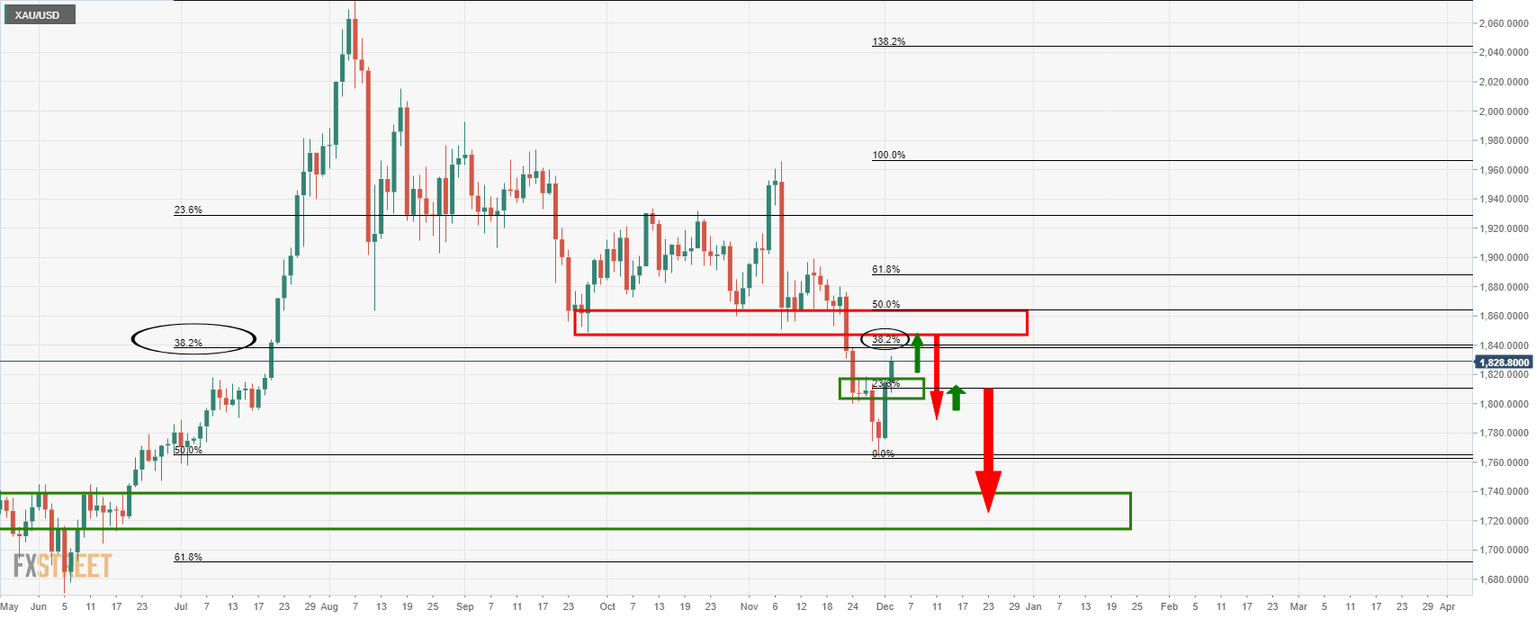

Weekly chart

The weekly chart illustrates that the price has yet to complete a 38.2% Fibonacci retracement which meets prior support structure which would be expected to now act as a strong resistance zone.

Bears would be prudent in waiting to see that this area does indeed deny the bull's from taking back control.

Daily chart

The daily chart shows that the price is now through old support which did not do the job of keeping back the bulls.

It is now likely to act as support again on a restest, but first, we are waiting for a daily close above the structure for initial confirmation.

From here, the bulls can enjoy some time in the driving seat, but the overhead resistance will be a huge hurdle.

A rejection from the structure will likely put the bears back in the driving seat.

An opportunity could be derived from there to catch the next bearish impulse tat would target the said 61.8% Fibo' retracement of the monthly bullish impulse.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.