Gold Price Analysis: $1717 remains in sight for XAU/USD amid healthy resistance levels – Confluence Detector

Gold’s (XAU/USD) upside attempts appear limited, as the US dollar is likely to hold the upper edge across the board heading into the NFP week. The greenback continues to draw bids on the back of economic recovery and successful vaccine campaigns in the US.

Meanwhile, growing China worries and coronavirus cases worldwide boost the safe-haven appeal of the dollar at gold’s expense. However, rising inflation expectations and the US infrastructure spree help put a floor under gold prices.

How is gold positioned technically?

Gold Price Chart: Key resistance and support levels

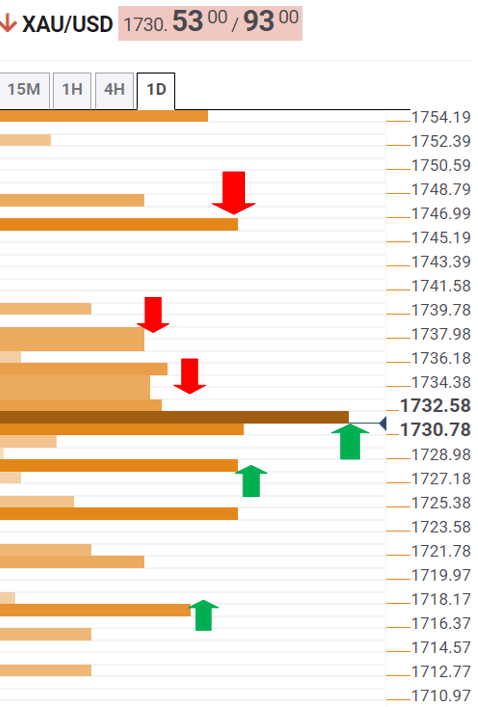

The Technical Confluences Detector shows that gold is likely to face a tough time on its road to recovery, as a dense cluster of resistance levels is aligned around $1735.

That area is the confluence of the SMA200 one-hour, Fibonacci 23.6% one-day and previous high four-hour.

The next hurdle is seen at $1737, the convergence of the Fibonacci 61.8% one-week and previous day high.

The XAU buyers would then target the $1745 barrier, where the pivot point one-day R2 and pivot point one-week R1.

Alternatively, a failure to resist above the powerful support at $1730 could prompt the sellers to resume the downtrend.

The level is the meeting point of the SMA5 four-hour, Fibonacci 38.2% one-day and one-week.

The next relevant cushion is seen at $1727, where the Fibonacci 61.8% one-day coincides with the Fibonacci 23.6% one-week.

Further south, the pivot point one-day S1 at $1724 could be back in play.

The previous month low at $1717 could be the line in the sand for the gold buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.