Gold steady near $2,300, supported by lower US yields and weaker US Dollar

- Gold price soars, supported by weakening US Dollar in face of high Treasury yields.

- XAU/USD was boosted by Fed Chair Powell hinting at rate cuts within the year, contingent on sustained inflation decline.

- Despite a strong job market as shown by ADP data, indications of a slowdown in services activity contribute to the precious metal's gains.

Gold price climbs steadily, eyeing Wednesday's $2,300 psychological figure amid high US Treasury bond yields and a soft US Dollar. Speeches from Federal Reserve officials, strong jobs data, and a dip in services business activity weighed on the American currency. Therefore, the XAU/USD spot price is at $2,295, refreshing all-time highs and gaining more than 0.60%.

Recently, Fed Chair Jerome Powell stated the US central bank has time to deliberate about rate cuts, given the strength of the economy and the inflation readings. He reiterated that if the economy evolves as expected, they will cut borrowing costs “at some point this year.”

Nevertheless, Powell emphasized that could happen once they “have greater confidence that inflation is moving sustainably down.”

Earlier, Atlanta Fed President Raphael Bostic acknowledged the robust momentum of the economy yet stressed the necessity for both growth and inflation to decelerate. He forecasts a rate cut in the final quarter of 2024 and envisions inflation aligning with the Fed's 2% target by 2026.

The US economic calendar highlighted employment figures and Services PMI. ADP reported higher-than-expected private sector job growth in March, indicating a robust labor market favorable to the US Dollar. However, signs of slowing business activity from recent S&P Global and ISM Services PMI reports have limited the US Dollar's recovery.

Daily digest movers: Gold price shrugs off hawkish Fed speakers amid mixed data

- The ADP Employment Change for March exceeded expectations, reporting 184,000 jobs added, outperforming the anticipated 148,000 and February's 155,000.

- In service sector activity, S&P Global noted a decrease in the Services PMI to 51.7 from 52.3, with the Composite Index also dipping from 52.5 to 52.1. The ISM's Non-Manufacturing PMI fell to 51.4, below the expected 52.7 and the previous 52.6, indicating a slowdown in service sector expansion.

- Cleveland Fed President Loretta Mester expressed that current data does not support a rate cut by the May meeting, but she anticipates three rate cuts in 2024, highlighting the Fed's task of balancing inflation and employment risks.

- Similarly, San Francisco Fed President Mary Daly emphasized the need to evaluate the duration for maintaining current interest rates. While Daly supports the possibility of three rate cuts, she clarified that this outlook should be seen as a projection rather than a guarantee.

- In terms of the Federal Reserve's future interest rate movements, the CME FedWatch Tool indicates that traders currently assign a 58% likelihood to the prospect of the US central bank reducing borrowing costs.

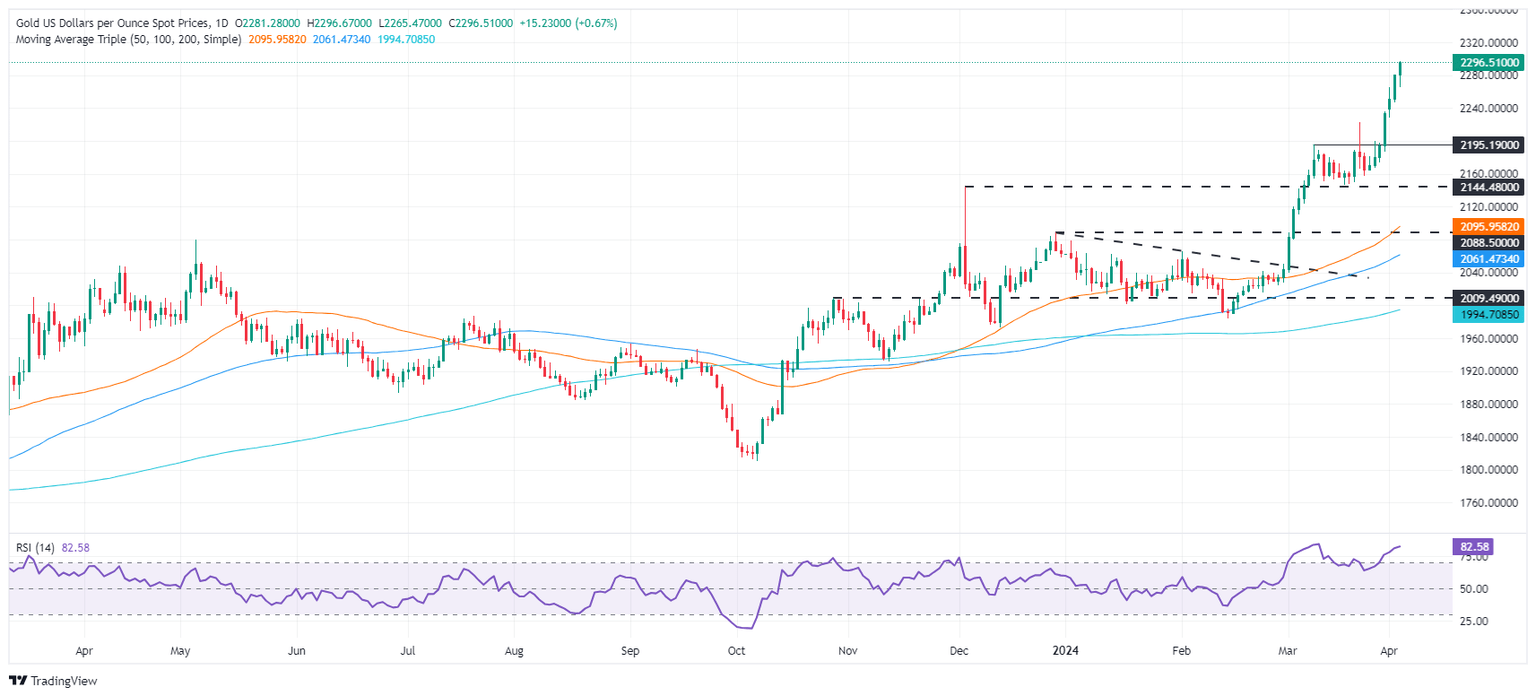

Technical analysis: Gold rally to extend as buyers target $2,300

The XAU/USD daily chart suggests the yellow metal is headed toward the $2,300 figure amid renewed buying pressures observed in the Relative Strength Index (RSI). On Monday, I mentioned that “The XAU/USD daily chart depicts Gold's last uptick to new all-time highs, achieved on lower momentum, as depicted by the Relative Strength Index (RSI).” However, as of writing, the RSI has punched above the 80.00 threshold, an indication that buyers are in charge.

With price action at uncharted territory, the next resistance level would be the $2,300 mark, followed by the $2,350 psychological figure. Up next would be $2,400.

On the other hand, if XAU/USD drops below $2,250, that could sponsor a correction. The first support would be the $2,200 figure, followed by the March 8 high turned support at $2,195, ahead of extending its losses to $2,150.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.