Gold price finishes Thursday’s session set to reach new all-time highs

- Gold price soars to all-time high of $2,225, defying rising Treasury yields and a robust US Dollar.

- Fed Governor Waller's hawkish comments and upbeat US data were no excuse for the advance in Gold and the US Dollar.

- Market anticipation builds for the upcoming release of the Fed’s Core PCE index.

Gold price rallied during the North American session on Thursday and hit a new all-time high of $2,225 in the mid-North American session. Precious metal prices are trending higher even though US Treasury yields are advancing, underpinning the Greenback. Hawkish comments by a Federal Reserve (Fed) policymaker and solid economic data from the United States (US) keep the US Dollar and Gold prices bid. XAU/USD trades at $2,221 and gains more than 1.20%.

Christopher Waller, a Fed Governor, noted the US central bank is in no rush to cut rates, even though he expects the beginning of the easing cycle. However, he needs to see a couple of months’ evidence that inflation is curbing toward the Fed’s 2% goal.

Data-wise, the US economy grew faster than expected. Meanwhile, according to the Initial Jobless Claims (IJC) report, the jobs market remains tight. Further data showed that consumer sentiment improved, according to a poll from the University of Michigan, while Pending Home Sales in February ticked higher than in January.

Ahead in the week, Gold traders are eyeing the release of the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) price index for the month of February.

Daily digest market movers: Gold price advances in tandem with the US Dollar

- Gold prices seem to be rallying based on speculation of a lower February inflation report in the US. The Core PCE is expected to slow from 0.4% to 0.3% MoM, while the headline PCE is expected to edge higher from 0.3% to 0.4% MoM.

- The US GDP rose by 3.4%, exceeding the preliminary reading of 3.2%, an indication of a strong economy. The Core Personal Consumption Expenditure (PCE) for Q4 2023 hit the Fed’s target of 2% QoQ.

- Initial Jobless Claims for the week ending March 23 increased by 210K, less than the consensus projection of 215K and lower than the previous week. The data could prevent the Fed from cutting rates sooner than market participants estimate.

- The University of Michigan Consumer Sentiment Index rose to its highest level since July 2021, climbing to 79.4, exceeding estimates of 76.5. Pending Home Sales recovered in February, increasing 1.6% MoM after plunging -4.7% in January and above the consensus of 1.5%.

- Money market traders predict a 63% chance that the Fed will slash rates by a quarter of a percentage point in June, lower than Wednesday's 70% odds.

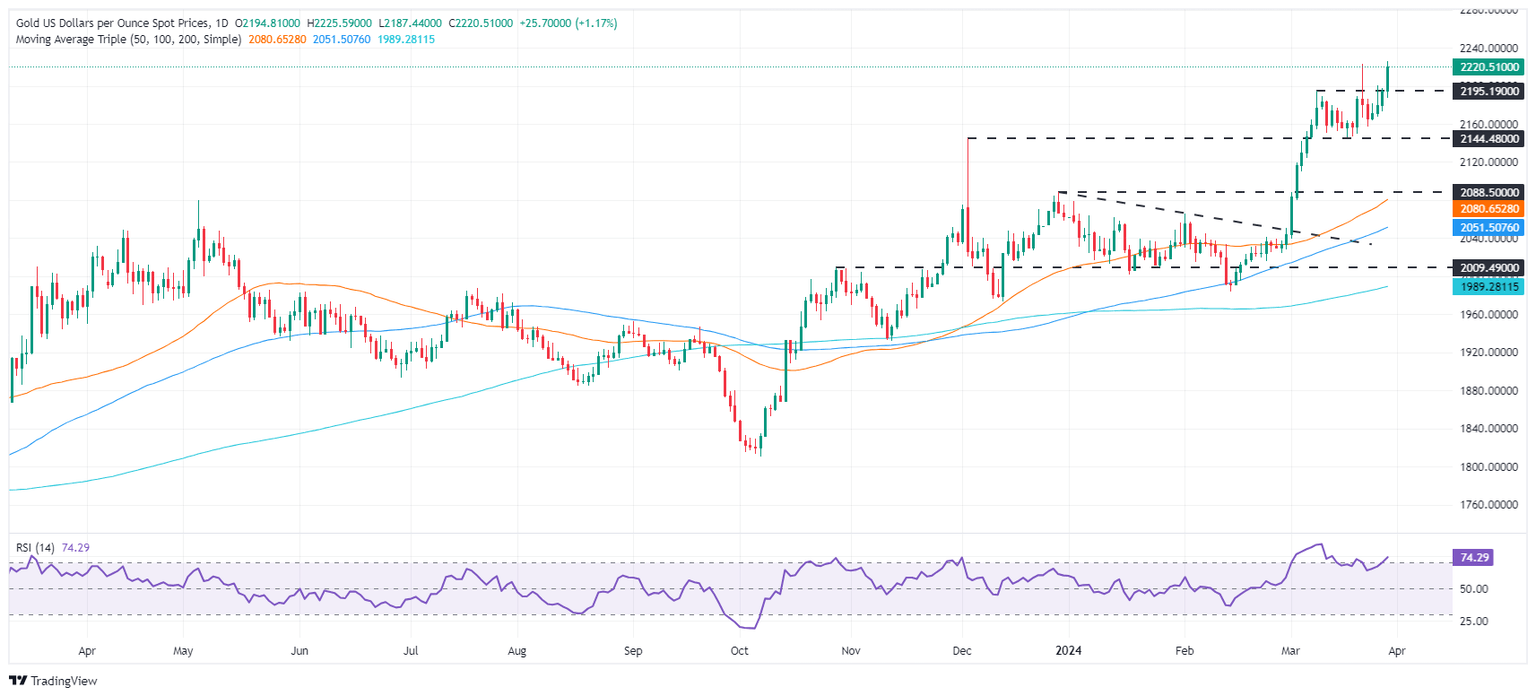

Technical analysis: Gold price pushes above $2,200 as buyers remain in charge

Gold’s uptrend remains intact, although the Relative Strength Index (RSI) is turning overbought as XAU/USD pierces the March 21 high of $2,223. When an asset experiences a significant uptrend, its RSI typically surpasses the 70 mark, signaling that bullish momentum is accumulating. An RSI reading above 80 is often considered indicative of an extreme overbought condition. Therefore, further upside is seen if buyers keep the yellow metal spot price above the latter, paving the way for challenging $2,300.

On the other hand, if XAU/USD dives below $2,200, look for a pullback toward the December 4 high, which turned support at $2,146, that could exacerbate a sell-off and send XAU/USD prices diving toward $2,100. The next support would be the December 28 high at $2,088.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.