Gold shines bright as soft US ADP report ignites rate cut expectation

- Gold price is gaining 1.18% amid mixed US economic data and lower Treasury yields.

- US 10-year Treasury yield drops to lowest level since April, following a softer-than-expected jobs report.

- US Dollar Index increases 0.22% to 104.7 but fails to curb Gold’s advance.

Gold’s price remains range-bound and advanced on Wednesday, making a U-turn to Tuesday’s price action following the release of mixed US economic data that could warrant lower borrowing costs set by the US Federal Reserve (Fed). Therefore, US Treasury yields dropped, and the Greenback rose, yet failed to put a lid on the yellow metal. The XAU/USD trades at $2,353, up 1.18%.

The US 10-year benchmark note coupon added to its weekly losses as it went down three basis points to 4.297%, its lowest level since April, following a softer-than-expected US jobs report.

The Institute for Supply Management (ISM) showed the US economy continues to expand in its service sector, boosting both the Greenback and the golden metal.

The US Dollar Index (DXY), which tracks the Greenback’s performance against a basket of six currencies, rises 0.22% to 104.7.

US yields continued to edge lower due to investors beginning to price in more than a 25-basis-point (bps) rate cut toward the end of 2024. Via data from the Chicago Board of Trade (CBOT), specifically the December 2024 fed funds futures contract, traders project 37 bps of easing.

The golden metal was also boosted by commodity prices stabilizing following Tuesday's plunge, which witnessed a more than 4% drop during the first two days of the week. Additionally, upbeat Caixin PMI data from China hints that the economy might continue to grow.

Consequently, US Treasury bond yields dropped, and the Greenback extended its losses to three straight days. The US 10-year Treasury bond yields plunged eleven basis points to 4.392%.

Daily digest market movers: Gold price capitalizes on falling US Treasury yields

- US ISM Services PMI in May expanded by 53.8 to its highest level since August 2023, exceeding estimates of 50.8 and April’s 49.4.

- “Survey respondents indicated that overall business is increasing, with growth rates continuing to vary by company and industry,” wrote Anthony Nieves, ISM Services Business Survey Committee Chair.

- ADP Employment Change revealed that private US hiring in May rose by 152K, below estimates of 175K and missing April’s 188K.

- Last week, the US Core Personal Consumption Expenditure Price Index (PCE), the Fed’s preferred inflation gauge, stabilized, boosting hopes for potential rate cuts.

- Traders are currently pricing about a 57.4% chance of a rate cut in September, according to the CME FedWatch Tool.

- The US economic docket during the week will feature Initial Jobless Claims for the previous week on Thursday, followed by May’s Nonfarm Payrolls on Friday.

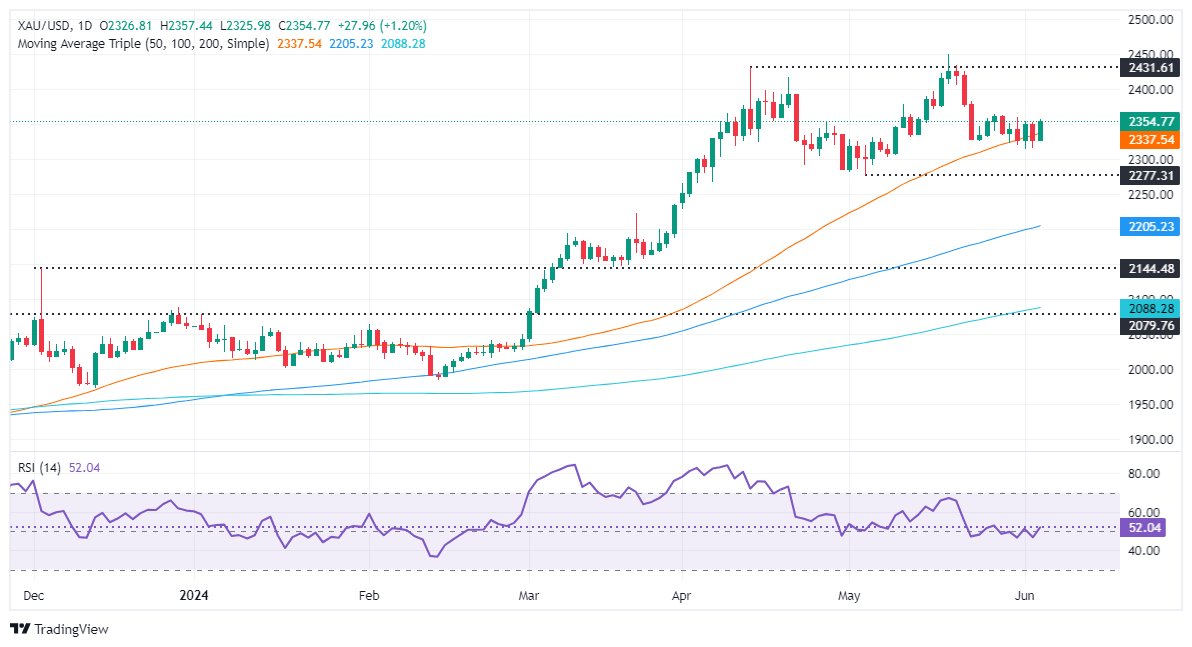

Technical analysis: Gold price shrugs off strong US Dollar and edges higher above $2,350

Gold’s uptrend remains in place yet consolidates within the $2,320 to $2,360 area, with neither buyers nor sellers able to push prices beyond the boundaries. Momentum suggests that buyers are in charge, as portrayed by the Relative Strength Index (RSI), which could pave the way for a bullish continuation.

In that event, Gold’s first resistance would be $2,360. Once cleared, the next stop would be $2,400, followed by the year-to-date high of $2,450.

Conversely, if XAU/USD drops below the 50-day Simple Moving Average (SMA) of $2,337, the next stop would be the May 8 low of $2,303, followed by the May 3 cycle low of $2,277.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.