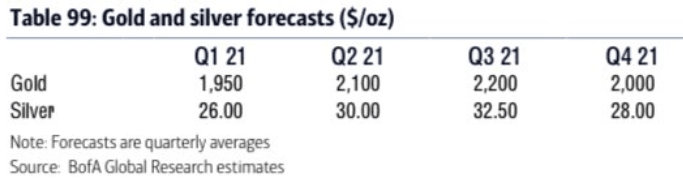

Gold and Silver: Outlooks look constructive – BAML

Analysts at Bank of American Merrill Lynch (BAML) noted a few factors that call for an upbeat outlook for gold and silver in the coming quarters.

Key quotes

“Uncertainty over how the interplay between nominal rates, breakeven inflation and real rates will play out has been the root cause of gold's volatility during 4Q20.”

“Confidence that global economies will reopen in 2021 as vaccines are deployed meant that financial markets have increasingly priced in a cyclical recovery, reflected for instance in a steeper US yield curve.”

“Importantly, rates re-priced not through an increase in breakeven inflation, but rather higher nominal and, importantly for gold, real rates, effectively putting a stop to the bull market. “

“We are following dynamics in the US closely, hoping for more fiscal support as the government

1) rolls over Covid-19 relief measures

and 2) gets to work on an infrastructure stimulus.”

“At the same time, the Fed should strengthen guidance that nominal rates will remain capped as the economy reflates, thereby reducing the drag from real rates. “

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.