GGPI Stock Forecast: Gores Guggenheim rises as Polestar unveils new SUV model

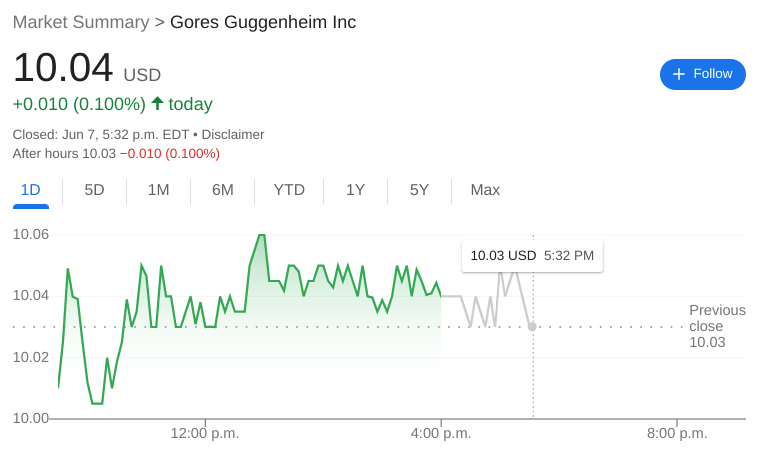

- NASDAQ:GGPI gained 0.10% during Tuesday’s trading session.

- Polestar unveiled its Polestar 3 high performance SUV model.

- Tesla stock rises as Musk threatens to back out of Twitter deal.

NASDAQ:GGPI looks to hold steady ahead of the vote for its merger with EV maker Polestar which is taking place on June 22nd. On Tuesday, shares of GGPI inched higher by 0.10% and closed the trading session at $10.04. The stock has stayed right around its NAV price of $10.00 after briefly hitting a 52-week high price of $16.41.

All three major indices climbed higher for a second straight day as the ten-year bond yields dropped back below 3.0%. The Dow Jones gained 264 basis points, the S&P 500 added 0.95%, and the NASDAQ rose by 0.94% during the session.

Stay up to speed with hot stocks' news!

Polestar finally unveiled its long-awaited SUV model that had initially been announced back at the company’s Investor Day in December. The Polestar 3 will have a dual motor setup with a total range of 372 miles on a single charge. The model will also feature LiDAR sensors and computer chips made by NVIDIA (NASDAQ:NVDA). Production for the Polestar 3 is expected to begin in the US in early 2023 at the South Carolina Volvo production plant. Polestar has already announced the Polestar 5 sedan, the Polestar 4 SUV and the Polestar O2 concept roadster.

GGPI stock price

In other EV news, Tesla (NASDAQ:TSLA) saw its stock rise slightly on Tuesday as CEO Elon Musk threatened to pull out of his takeover bid for Twitter (NYSE:TWTR). Through his attorneys, Musk stated that he has not been satisfied with Twitter’s responses to his questions about how many bots and spam accounts the platform has. Musk initially made an offer of $54.20 per share back in April.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet