GBPJPY Price analysis: Testing the neckline of an “H&S” pattern at 165.00

- The Pound fails at 167.10 and returns to the support area at 165.00.

- Below 165.00 the pair may activate an "H&S" pattern targeting 160.00 or lower.

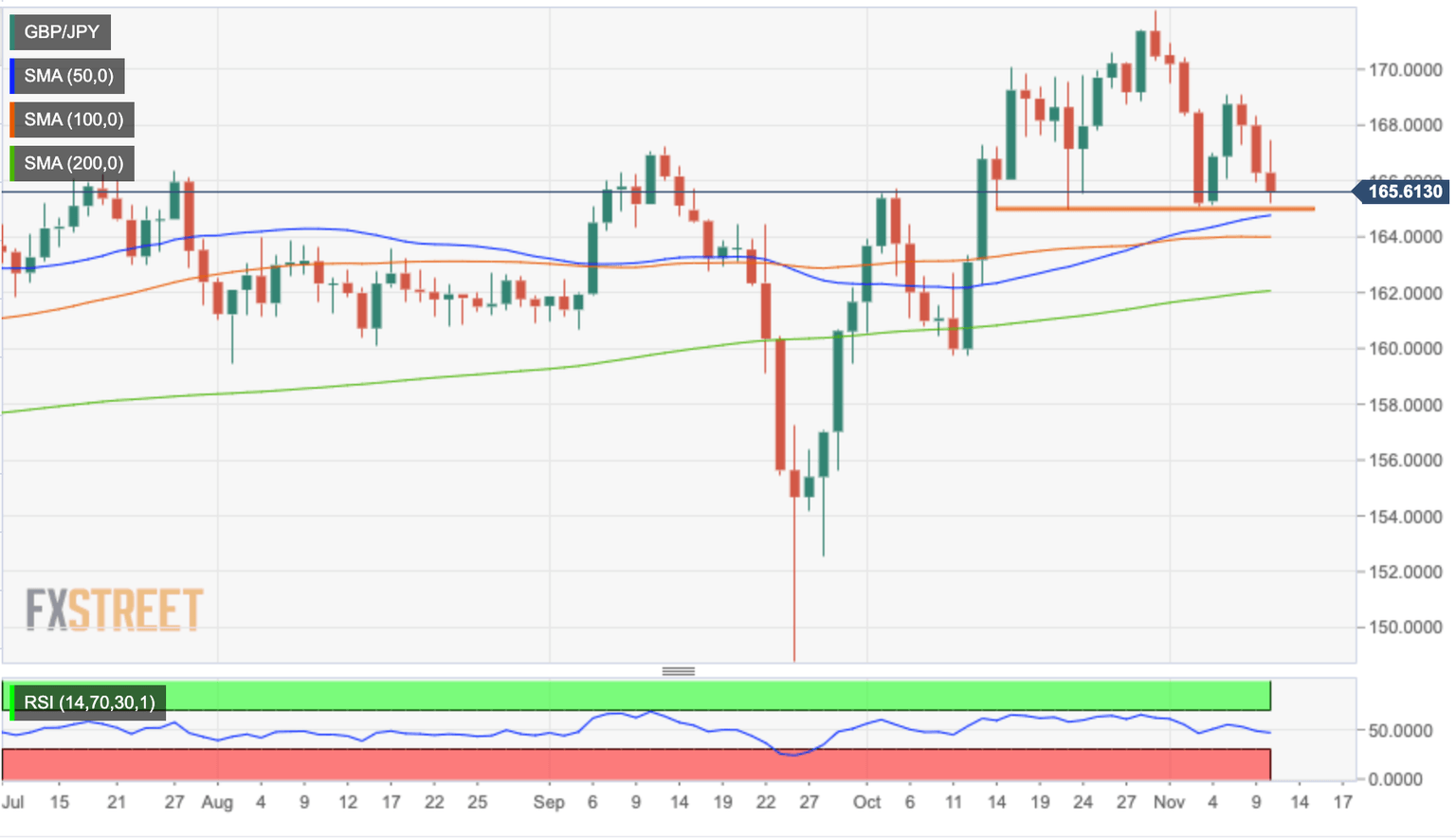

The Pound headed south against the Japanese Yen for the third consecutive day on Thursday, extending its reversal from Monday’s high at 169.05 to test the neckline of a Head & Shoulders pattern at 165.00.

The Yen surged after US CPI data

The mild recovery attempt seen during the Asian and early European sessions lacked follow-through above 167.00, and the pair dropped sharply during the early US trading session, with the Japanese Yen skyrocketing after the release of US inflation data.

Yen strength has pulled the pair to test an important support level at 165.00, where the October 14 and 21 and November 3 and 4 lows meet the 50-day SMA.

Hourly charts show the pair close to overbought levels, which might favor some consolidation before further movement takes place.

A confirmation below 165.00 would increase negative pressure and send the pair to test the 100-day SMA, now at 164/05 area, and the 200-day SMA, at 162.10 before aiming for October’s low at 159.80.

On the flip side, the pair should breach intra-day resistance at 167.50 to ease negative pressure, and extend towards November 6 and 7 high at 167.11, which closes the path to the 170.00 psychological level.

GBP/JPY daily chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.