GBP/USD tests the water near 1.24 as key US data looms

- GBP/USD ended Wednesday close to flat, but tested the low side.

- With the Fed’s widely-anticipated rate hold out of the way, markets turn to data prints.

- US Q4 GDP and PCEPI inflation metrics are due on Thursday and Friday, respectively.

GBP/USD spun in a tight circle on Wednesday, briefly dipping into the 1.2400 handle after the Federal Reserve (Fed) kept interest rates on hold. Rate futures markets broadly forecast the lack of movement on interest rates, with the Fed citing no particular reason to rush into further rate cuts. The back half of the trading week will be key US data releases to see if the Fed made the right call.

US fourth-quarter Gross Domestic Product (GDP) growth will be printing on Thursday. Median market forecasts are expecting a step down in annualized GDP growth, expecting a print of 2.6% versus the previous 3.1%. Inflation pressures still remains a concern, and the Q4 GDP Price Index is expected to tick upwards to 2.5% from 1.9%.

Friday’s Core Personal Consumption Expenditures Price Index (PCEPI) will be landing on markets on Friday. The monthly PCEPI figure for December is forecast to tick higher to 0.2% MoM from the previous month’s 01.%, and the annualized figure is expected to stand pat at 2.8% YoY, still frustratingly above the Fed’s 2% annual target and vexing hopes for an uptick in the pace of interest rates.

The Federal Reserve (Fed) held rates steady on Wednesday, as rate futures markets had broadly predicted, and Fed Chair Jerome Powell reiterated the Fed's data-dependent approach to making rate adjustments. Fed Chair Powell noted that the Federal Open Market Committee (FOMC) is closely watching what kind of policies are enacted by US President Donald Trump, but denied that the newly-minted US President has been in contact with the Fed directly.

As an independent federal institution, the White House holds little sway over policy guidance set by the Federal Reserve.Fed Chair Powell noted that the Federal Open Market Committee (FOMC) is closely watching what kind of policies are enacted by US President Donald Trump, but denied that the newly-minted US President has been in contact with the Fed directly. As an independent federal institution, the White House holds little sway over policy guidance set by the Federal Reserve.

Fed Chair Powell also noted that while inflation is still grinding its way toward median target levels, the current economic landscape, plus some concerns over massive trade policies being pursued by US President Trump, means the Fed is in no particular rush to adjust the restrictiveness of policy rates. Rate markets have trimmed their bets of Fed rate cuts in 2025. According to the CME's FedWatch Tool, rate futures markets are pricing in no moves on the fed funds rate until June at the earliest.

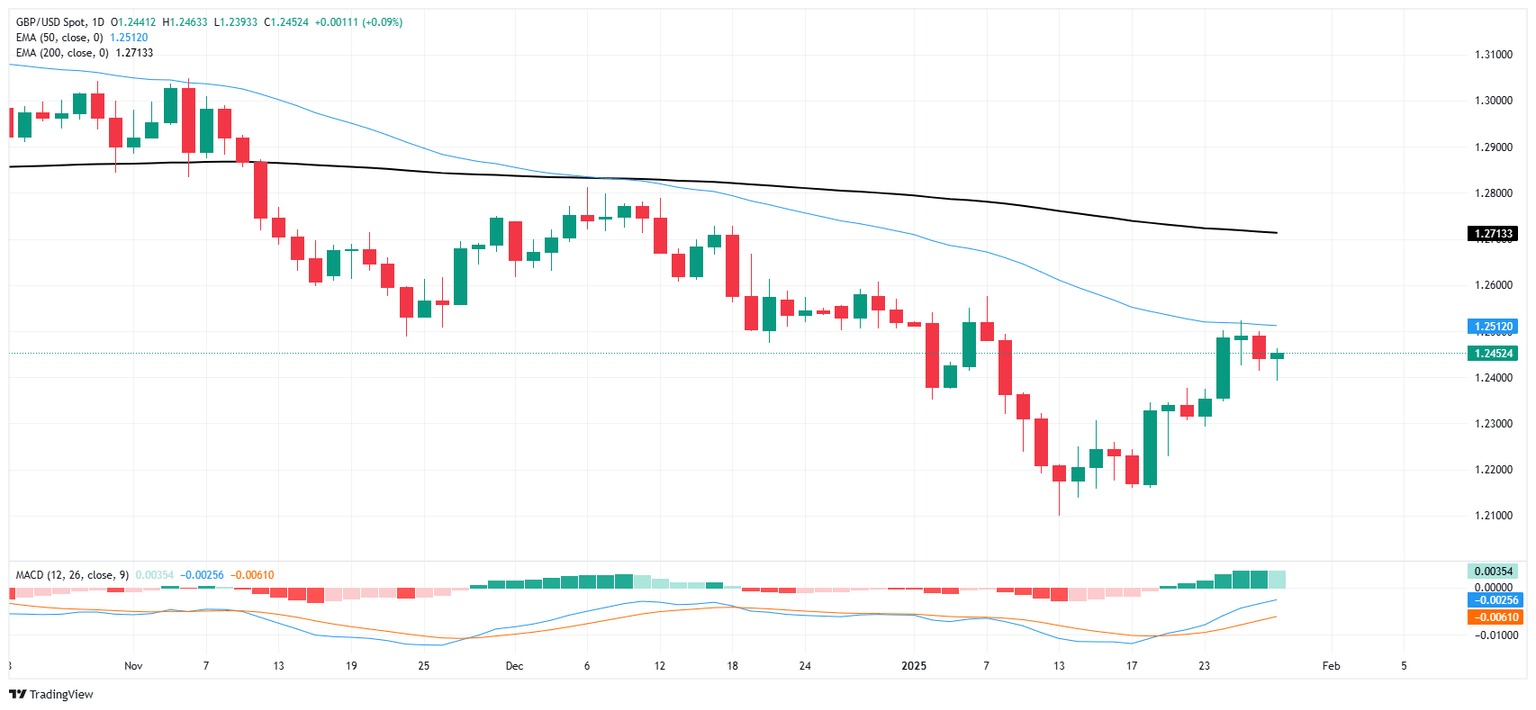

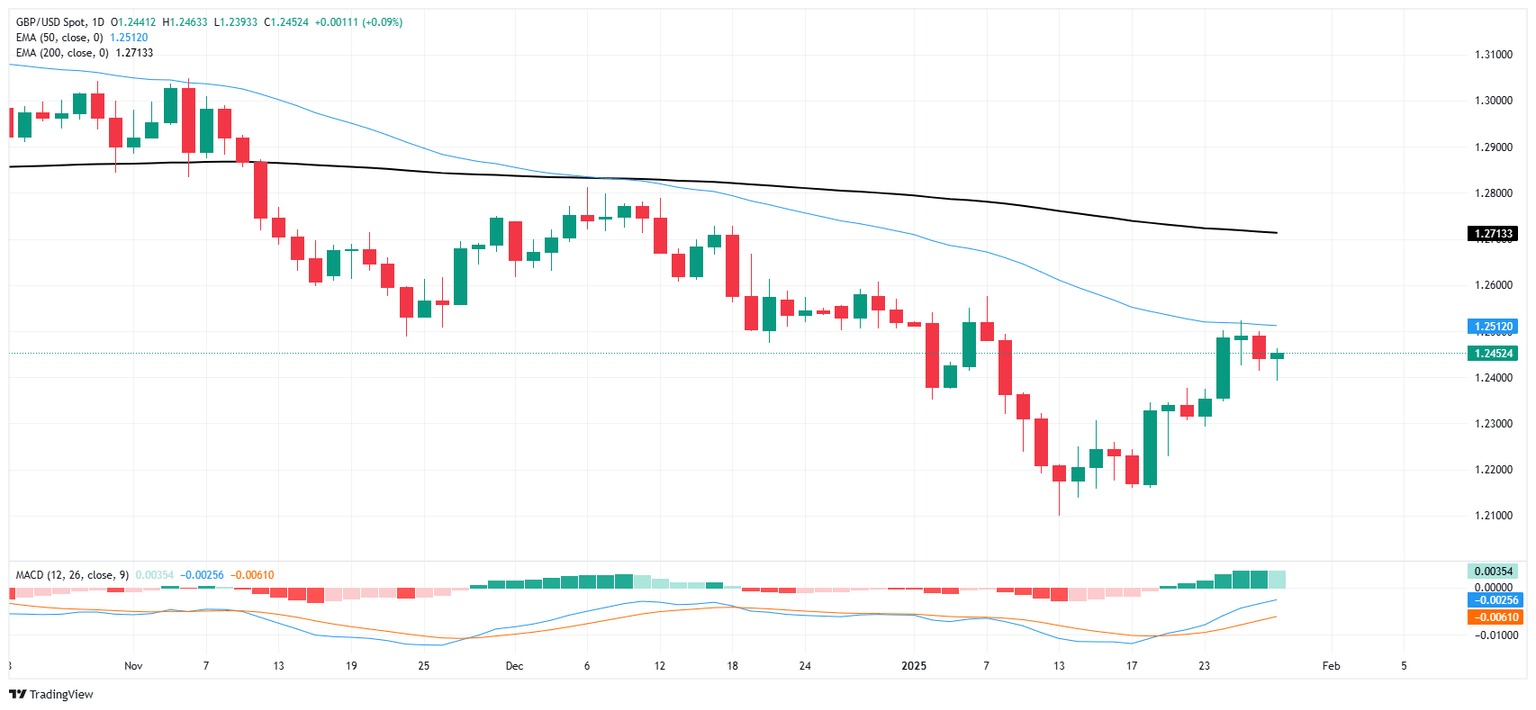

GBP/USD price forecast

GBP/USD continues to grind through chart paper in the most frustrating position possible, drifting just south of the 50-day Exponential Moving Average (EMA) near 1.2500 but unable to sink decisively below 1.2400. A bullish technical correction appears to have run out of gas, but a meaningful downturn remains off of the cards for now.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.