GBP/USD surges amidst US labor market data, BoE rate hike bets

- GBP/USD skyrockets as US Jobless Claims soar; investors expect Fed pause.

- US Treasury bond yields pressured, USD Index collapsed by 0.73%.

- BoE anticipated rate hike cushions GBP amid sparse economic data.

GBP/USD rallies above 1.2500 as labor market data from the United States (US) keeps investors expecting a pause on the Federal Reserve (Fed) hiking cycle. The lack of economic data to be revealed in the UK, alongside traders betting for Bank of England’s (BoE) additional tightening, underpins the GBP/USD. The GBP/USD trades at 1.2550 after hitting a low of 1.2429.

Sterling rally overrides US Dollar amid US jobless claims spike, Fed’s rate hike pause

The GBP/USD advances aggressively following last week’s Initial Jobless Claims report. The US Department of Labor revealed an increase of 261K unemployment claims, above estimates of 232K, the highest record since October 2021. Continuing Claims dropped 37K to 1.757M in the week ending May 27. The report justifies the Fed’s view of skipping an interest rate increase in June, though next week’s inflation report could shift expectations one day before the decision.

In the fixed-income sphere, US Treasury bond yields are under pressure, with 2s and 10s losing four and eight basis points, respectively, at 4.515%, and 3.716%, a headwind for the greenback. The US Dollar Index, which measures the performance of a basket of six currencies vs. the buck, collapses by 0.73%, at 103.345.

Across the pond, estimates that the Bank of England will continue to lift rates cushioned Pound Sterling (GBP) fall at the beginning of the week. Money market futures estimate the BoE will hike 100 bps towards the year-end. That means the Bank Rate will hit 5.50%.

Upcoming events.

Friday’s economic calendar is absent for both countries, but the next week, it will pick up some steam. On Tuesday, the UK will update the labor market status. Meanwhile, the US Consumer Price Index (CPI) will shed some light and could view by Fed officials, who begin the monetary policy meeting on the same day.

GBP/USD Price Analysis: Technical outlook

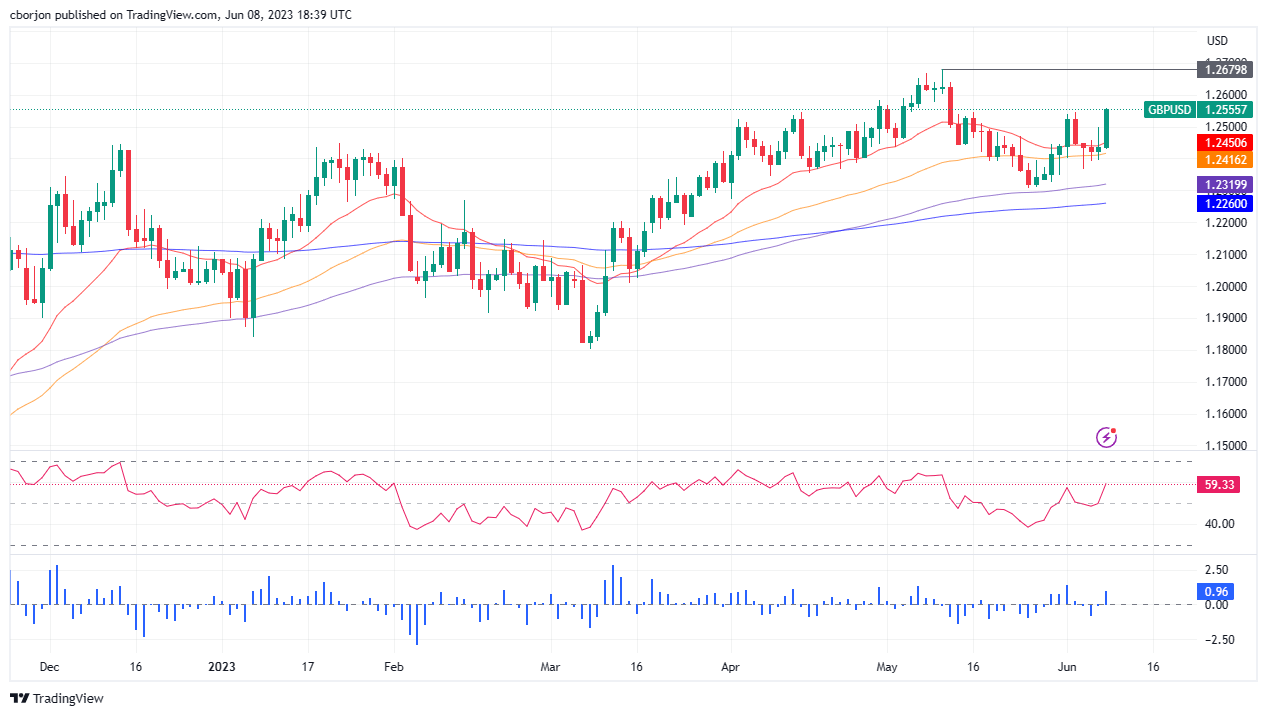

The GBP/USD recovered from its losses and advanced comfortably above 1.2500, with buyers eyeing year-to-date (YTD) highs at around 1.2679. Technical indicators cement the case for an uptrend, with the Relative Strength Index (RSI) reaching new peaks, while the three-day Rate of Change (RoC) depicts buyers gathering momentum. Upside risks lie at the 1.2600 figure, followed by the YTD high, ahead of the 1.2700 mark. On the flip side, the June 7 high-turned support at 1.2499 is the first support, immediately followed by the 20-day Exponential Moving Average (EMA) at 1.2450 before diving to the 50-day EMA at 1.2416.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.