GBP/USD slumps as Trump’s tariff talk overpowers US PCE data

- GBP/USD falls 0.16% to 1.2398, continuing its decline as Trump threatens tariffs on Canada and Mexico.

- US inflation aligns with expectations, Core PCE Index rises 0.2% MoM; Fed's rhetoric supports dollar strength.

- US Dollar Index (DXY) climbs 0.20%, reflecting gains against major currencies, including the Pound.

The Pound Sterling extended its losses for the second consecutive day as US President Donald Trump tariffs rhetoric sent ripples across the financial markets. Therefore, the Greenback remains bid, as economic data takes the backseat. The GBP/USD trades at 1.2398, down 0.16%.

GBP/USD dips amid heightened US trade tension, persistent UK economic concerns.

On Thursday, Trump reiterated that he will impose tariffs on Mexico and Canada, which lent a lifeline to the US Dollar, which was posting losses before ending the day in the green. Most G10 Forex currencies, depreciated, including Sterling.

Worries about an economic slowdown in the UK kept the GBP pressured amid concerns on the budget presented by chancellor Rachel Reeves.

In the meantime, inflation in the United States (USD) rose in December. The Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) preferred inflation gauge increased by 0.2% MoM as expected, up from November 0.1%. On an annual basis, the underlying PCE remained unchanged at 2.8% as projected.

Fed speakers are also providing some support for the US Dollar, as Governor Michelle Bowman said that inflation risks are tilted to the upside. At the time of writing, Chicago’s Fed President Austan Goolsbee added that he liked December’s inflation report, stating that he’s comfortable that inflation is on the path to 2% target.

The data maintained the “status quo.” US equities continued to trend higher, and the buck gained some traction, as the GBP/USD dropped from around 1.2430 to 1.2408.

The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, is rising 0.20% up at 108.41. The US 10-year Treasury bond yield drops one and a half basis points to 4.50%, after the data.

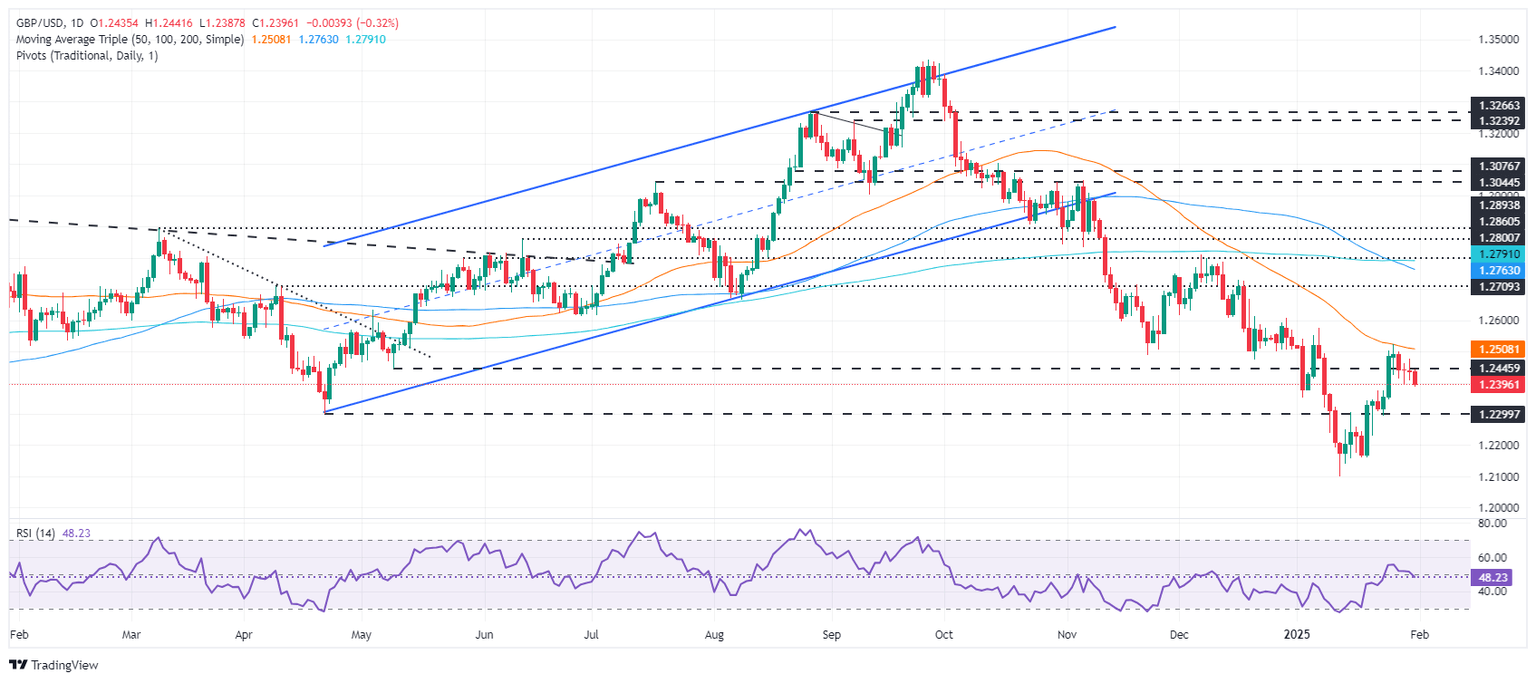

GBP/USD Price Forecast: Technical outlook

Given the backdrop, the GBP/USD bias remains downwards. Following the pair’s clash at the 50-day Simple Moving Average (SMA) near 1.2500, it has trended lower, extending its fall beneath 1.2400. If Sterling weakens further, the next support would be intermediate support at January’s 23 low of 1.2292, before challenging January 17 swing low of 1.2159.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.39% | 0.29% | 0.25% | 0.19% | -0.11% | -0.11% | 0.02% | |

| EUR | -0.39% | -0.10% | -0.16% | -0.20% | -0.49% | -0.50% | -0.36% | |

| GBP | -0.29% | 0.10% | -0.08% | -0.09% | -0.39% | -0.39% | -0.26% | |

| JPY | -0.25% | 0.16% | 0.08% | -0.04% | -0.33% | -0.34% | -0.20% | |

| CAD | -0.19% | 0.20% | 0.09% | 0.04% | -0.31% | -0.30% | -0.16% | |

| AUD | 0.11% | 0.49% | 0.39% | 0.33% | 0.31% | -0.01% | 0.14% | |

| NZD | 0.11% | 0.50% | 0.39% | 0.34% | 0.30% | 0.00% | 0.14% | |

| CHF | -0.02% | 0.36% | 0.26% | 0.20% | 0.16% | -0.14% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.