GBP/USD recovers from 1.1940 as US Dollar refreshes day’s low, Fed Powell’s speech eyed

- GBP/USD has sensed responsive buying action around 1.1940 as risk aversion loses luster.

- The speech from Jerome Powell is expected to be less hawkish on interest rate guidance.

- The Bank of England is expected to advance its interest rates to 4.25% in Q1CY2023.

- GBP/USD has gained strength after testing the 200-EMA around 1.1960.

GBP/USD has sensed a decent buying interest after testing Tuesday’s low of around 1.1940 in the Asian session. The Cable is looking to extend its recovery towards the psychological resistance of 1.2000 as the risk appetite theme has waned now. China’s COVID protest-inspired volatility is fading away as Chinese marshals have restricted the general public at their shelters.

The US Dollar Index (DXY) has refreshed its day’s low at 105.70 as an improvement in investors’ risk appetite has trimmed safe-haven’s appeal. The US Dollar has lost its traction ahead of the speech from Federal Reserve (Fed) chair Jerome Powell. S&P500 futures have turned green after a weak start in early Tokyo as investors are returning to the risk-sensitive assets.

The 10-year US Treasury yields have dropped below 3.73% after hitting a high of 3.75% as investors are expecting a ‘less-hawkish’ stance on interest rate guidance by Fed chair Jerome Powell.

Fed Powell may sound ‘less-hawkish’ on interest rate guidance

The street is expecting that a good October inflation report could compel Fed chair Jerome Powell to sound ‘less-hawkish’ on interest rate guidance for December monetary policy meeting. The headline United States Consumer Price Index (CPI) has slipped to 7.7% from a recent high of 9.1%. Therefore, the Federal Reserve (Fed) could look for an option of decelerating the current pace of the interest rate hike as it might support assessing the performance of efforts yet made by policymakers and reducing financial risks.

As the inflation rate is extremely far from the targeted rate of 2%, consideration of a halt in the rate hike regime is not in the picture.

Other United States economic catalysts that will bring volatility to Cable

Investors are expecting fireworks in Cable in Wednesday’s New York session as the United States economy will report multiple triggers. Right from the US Automatic Data Processing (ADP) Employment, Gross Domestic Product (GDP), and core Personal Consumption Expenditure (PCE) to Fed’s Beige Book, investors might keep juggling in bullish and bearish positions.

According to the estimates, the annualized GDP and core PCE for the third quarter are expected to remain stable at 2.6% and 4.5% respectively. A slowdown in both catalysts would cement a downside shift in the rate hike extent for December’s interest rate decision.

On the labor market front, the consensus says an addition of 200k jobs in November vs. the prior release of 239k.

Meanwhile, Fed’s Beige Book will provide the regional status of consumer spending, employment, and the extent of economic activities.

Bank of England to raise interest rates to 4.25% by Q1CY2023

The inflation rate in the United Kingdom has not displayed signs of a meaningful slowdown yet, therefore, the Bank of England (BOE) cannot halt its policy-tightening process. Analysts at JP Morgan believe that the Bank of England will raise the bank rate to 4.25% by the first quarter of next year. They further added that the UK economy will contract by 0.6% in CY2023 due to tighter monetary and fiscal policy and economic damage from the pandemic and Brexit.

On Tuesday, Bank of England Governor Andrew Bailey testified at the Lords Economic Affairs Committee, citing that "There has been no discussion with the government on the pace and timing of BoE asset sales." He believes that the “UK labor market has turned out to be much more constrained than we thought, different to other countries."

GBP/USD technical outlook

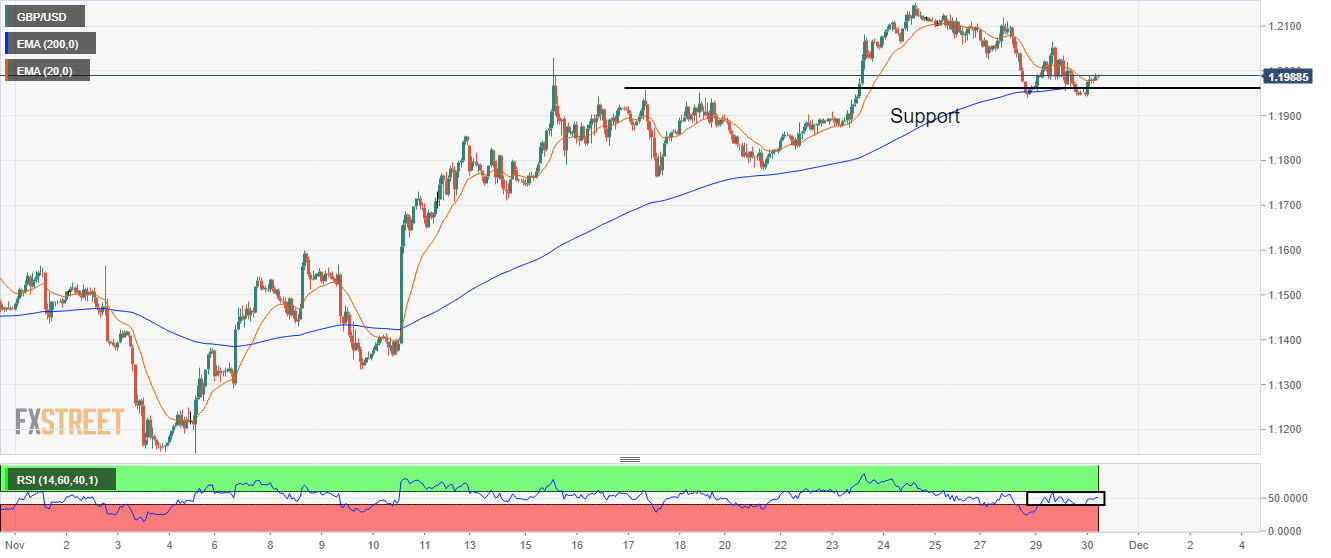

GBP/USD has witnessed a responsive buying action after testing the horizontal support plotted from November 17 high of around 1.1940. The 200-period Exponential Moving Average (EMA) at 1.1960 has acted as major support for the Cable. The Pound bulls have also pushed the Cable above the 20-EMA at 1.1980, which indicates that the short-term trend is bullish now.

Meanwhile, the Relative Strength Index (RSI) (14) has pushed itself into the 40.00-60.00 range, which indicates a consolidation ahead.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.