GBP/USD prolongs its agony and breaks below 1.2600 amid weak US ADP data

- GBP/USD sees three-day decline, dropping below 1.2700, shedding over 1% during the week.

- US data reveals disappointing ADP Employment Change and widening trade deficit, pressuring GBP/USD.

- Despite weak indicators, US Dollar Index rises 0.22% to 104.19, while BoE Governor Bailey signals potential UK rate cuts amid financial pressures.

GBP/USD trips down and extended its losses to three consecutive days; after diving below the 1.2700 figure, the Pound Sterling (GBP) had shed more than 1% of its value, during the week. At the time of writing, the major is trading at 1.2555, down 0.28% after hitting a daily high of 1.2613.

Pound Sterling faces headwinds amid higher interest rates set by the BoE

Investors' sentiment remains depressed as portrayed by Wall Street. The November ADP Employment Change report revealed private hiring increased by 103K, falling short of the forecasted 130K and the previous month's 106K. later, the US Commerce Department, showed October's US trade deficit widened more than anticipated, reaching $-64.3 billion, exceeding the forecast of $-64.2 billion and trailing September's $-61.2 billion.

Despite this weak data, the US Dollar Index (DXY), tracking the dollar against six other currencies, is up 0.22% at 104.19, while US Treasury bond yields fall.

Across the Atlantic, the Bank of England (BoE) Governor Andrew Bailey stressed that UK banks are well positioned to support borrowers, after the BoE released its Financial Stability Report (FSR). Bailey acknowledged that businesses are pressured by higher rates, while households finances remain stretched. Even though BoE’s members had remained hawkish, expectation for rate cuts had begun to gain some steam, with market participants expecting three 25 bps rate cuts by the end of 2024.

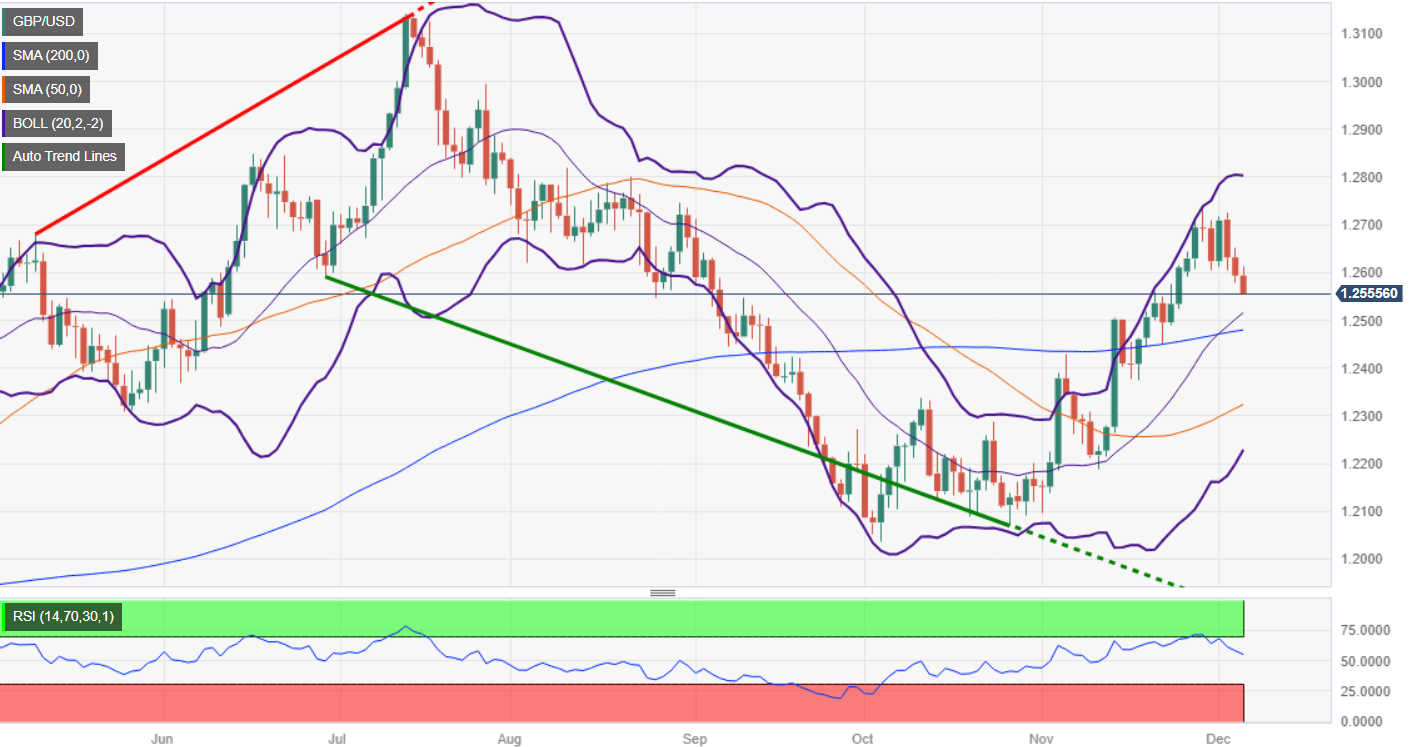

GBP/USD Price Analysis: Technical outlook

The daily chart portrays the pair's failure to decisively break the 1.2700 resistance level, exacerbating the GBP/USD’s fall toward current exchange rates. Therefore, sellers are in charge, and if they break support below 1.2550, that could pave the way toward the 12500 mark. Further downside is expected at the 200-day moving average (DMA) At 1.2478.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.