GBP/USD Price Forecast: Rises above 1.3000 after UK’s budget release

- GBP/USD bounces off ascending channel support, clears 1.3000, and reaches a high of 1.3039 after the UK’s autumn budget release.

- Buyers must clear October 18 peak at 1.3070 to test 1.3100 and the 50-day SMA at 1.3138.

- Key support lies at the October 29 close of 1.3014 and the 100-day SMA at 1.2974, followed by the October low of 1.2936.

The Pound Sterling erased some of its earlier losses, climbing above its opening price against the US Dollar, after the UK Chancellor Rachel Reeves revealed its autumn budget. The GBP/USD trades above 1.3000, virtually unchanged.

According to the Financial Times, the Autumn budget was well received by the markets. Gilt yields are falling, and Cable aimed higher after the new labor Government announced its first budget in 14 years.

GBP/USD Price Forecast: Technical outlook

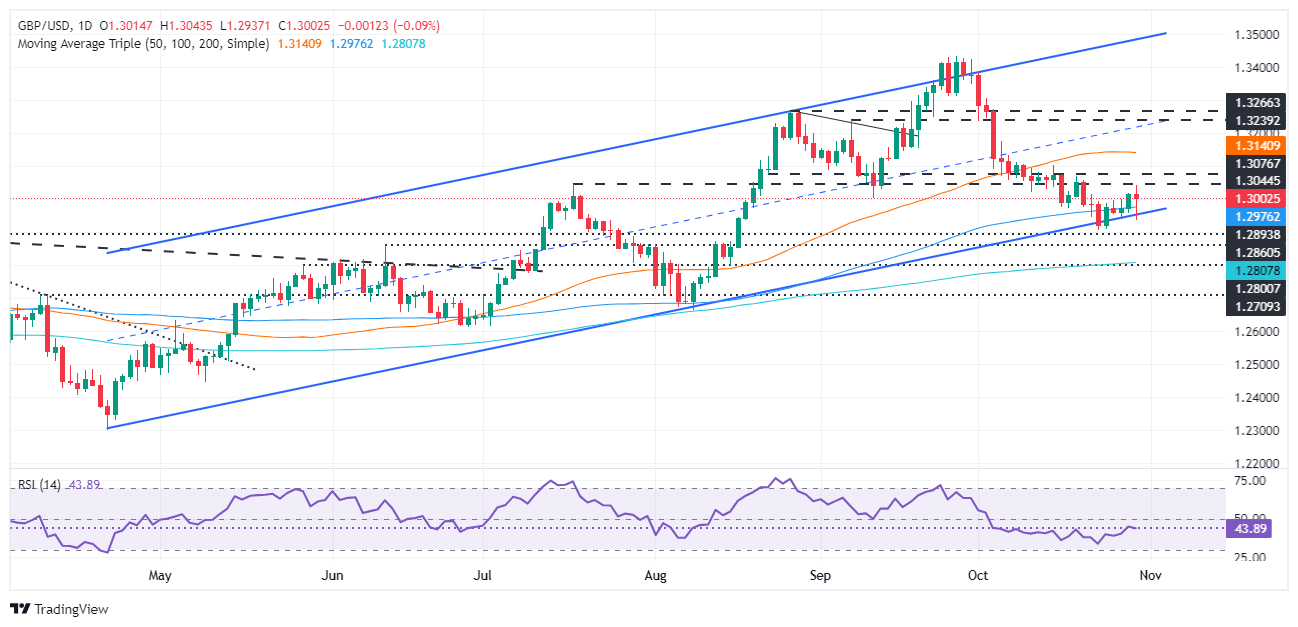

The GBP/USD bounced at the bottom of an ascending channel trendline, extending its gains after Chancellor Reeves, ended her speech. Initially, the pair cleared 1.2970, and pushed higher, clearing the 1.3000 figure hitting a high of 1.3039.

From a technical standpoint, the GPB/USD is not out of the woods, as sellers continued to cap the pair’s advance. Buyers must clear October 18 peak at 1.3070, so they could remain hopeful of testing 1.3100. Once those key resistance levels are taken out, the 50-day Simple Moving Average (SMA) would be up next at 1.3138.

Otherwise, if sellers push the exchange rate below the October 29 daily close of 1.3014, it would expose the 1.3000 psychological level as the next support. A breach of the latter will expose the 100-day SMA at 1.2974, before the GBP/USD tumbles towards October 300 low of 1.2936.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.34% | 0.10% | -0.11% | 0.05% | -0.30% | -0.09% | -0.14% | |

| EUR | 0.34% | 0.44% | 0.23% | 0.39% | 0.03% | 0.24% | 0.20% | |

| GBP | -0.10% | -0.44% | -0.20% | -0.05% | -0.41% | -0.20% | -0.22% | |

| JPY | 0.11% | -0.23% | 0.20% | 0.14% | -0.21% | -0.01% | -0.04% | |

| CAD | -0.05% | -0.39% | 0.05% | -0.14% | -0.36% | -0.15% | -0.17% | |

| AUD | 0.30% | -0.03% | 0.41% | 0.21% | 0.36% | 0.21% | 0.18% | |

| NZD | 0.09% | -0.24% | 0.20% | 0.01% | 0.15% | -0.21% | -0.03% | |

| CHF | 0.14% | -0.20% | 0.22% | 0.04% | 0.17% | -0.18% | 0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.