GBP/USD Price Analysis: Stays firm after strong US data, bears eye 1.2700

- GBP/USD remains unchanged after ISM Services PMI indicates economic expansion in May.

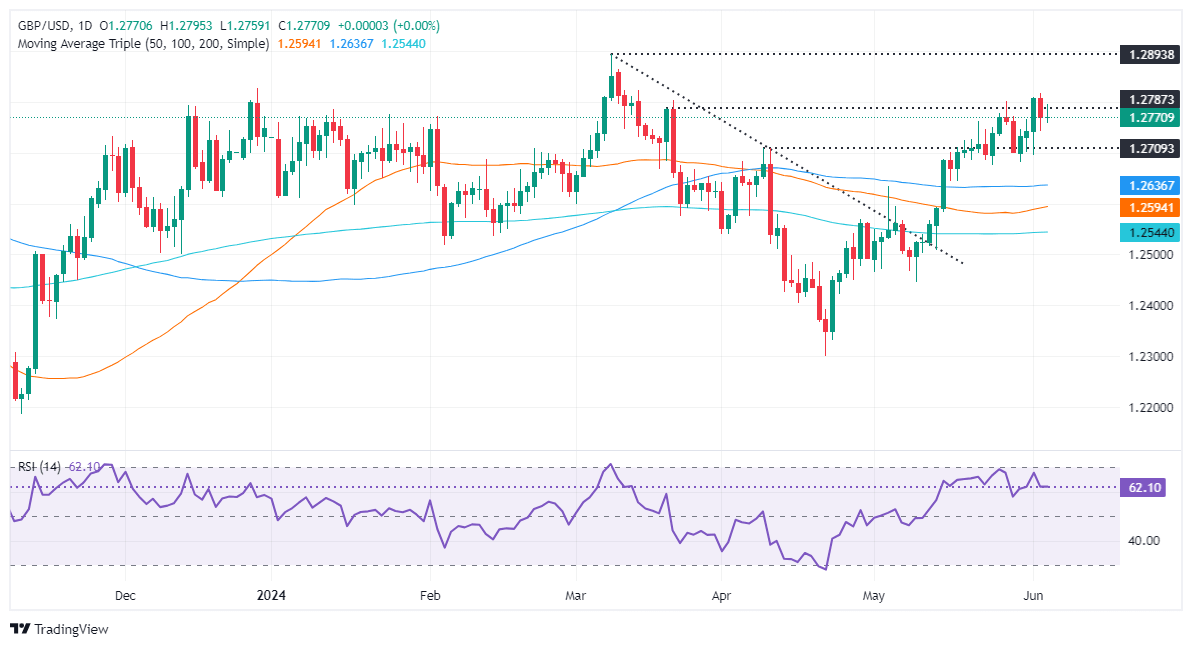

- Technical outlook shows neutral to upward bias, but resistance at 1.2800 limits gains.

- Key levels: Support at 1.2742, 1.2700, and 1.2634; Resistance at 1.2800, YTD high at 1.2893, and 1.2900.

The GBP/USD is virtually unchanged in early trading during the North American session, following the release of the Institute for Supply Management (ISM) Services PMI, which showed the economy remains resilient, expanded in May above estimates and the previous month's reading, contrarily to manufacturing activity. Therefore, the major trades at 1.2768, almost flat.

GBP/USD Price Analysis: Technical outlook

Looking at the daily chart, the GBP/USD is showing a neutral to upward bias. However, the failure to break through the confluence of a three-month-old downslope resistance trendline and the 1.2800 figure has led to a further decline in Cable’s value.

Momentum remains supportive of buyers, as the Relative Strength Index (RSI) shifted almost flat, though in bullish territory, while price action hints at bearish signals.

If sellers push the GBP/USD below yesterday’s low of 1.2742, a drop toward 1.2700 is on the cards. Further losses are seen beneath the June 3 low of 1.2694, like the confluence of the 100-day moving average (DMA) and the May 3 high of 1.2634.

Conversely, if buyers keep the exchange rate within the 1.2740 – 1.2800 range, they could lift the spot prices and challenge the abovementioned confluence, at around the top of the range. Gains lie overhead at the year-to-date (YTD) high of 1.2893, followed by the 1.2900 mark.

GBP/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.