GBP/USD Price Analysis: Oscillates above 1.2500 as US PMI contraction vs. solid Employment divides Fed

- GBP/USD is juggling in a narrow range above 1.2500 ahead of the US NFP data.

- Fed policymakers are divided over contracting US Manufacturing PMI vs. tight labor market conditions.

- GBP/USD is gathering strength for a breakout above the 61.8% Fibo retracement at 1.2539.

The GBP/USD pair is oscillating after a stalwart rally above the psychological resistance of 1.2500 in the early Tokyo session. The Cable has turned sideways as investors are confused that whether Federal Reserve (Fed) policymakers will focus on consistently contracting United States ISM Manufacturing PMI or tight labor market conditions while designing the monetary policy for June month.

On Thursday, the US ISM reported a seventh straight contraction in US factory activity due to higher interest rates while the Automatic Data Processing (ADP) agency reported an addition of 278K fresh payrolls against the consensus of 170K.

The US Dollar Index (DXY) showed a vertical fall after surrendering the crucial support of 104.00 and has now extended its downside below 103.60, at the time of writing.

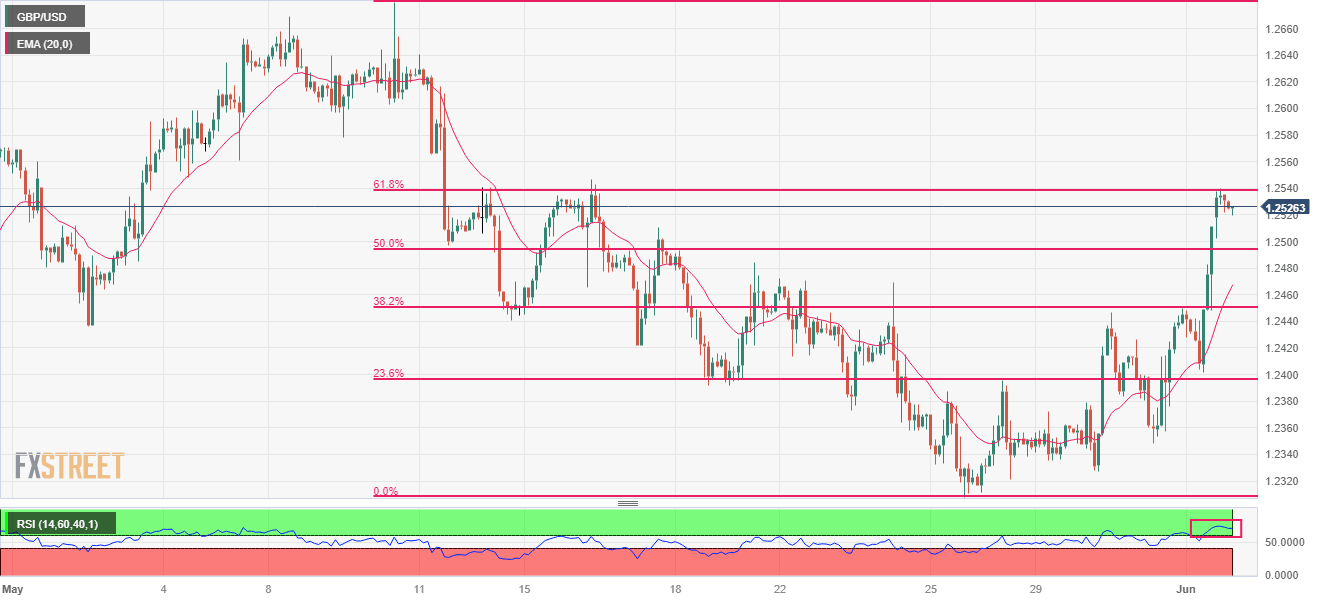

GBP/USD is gathering strength for a breakout above the 61.8% Fibonacci retracement (plotted from May 10 high at 1.2680 to May 25 low at 1.2308) at 1.2539 on a two-hour scale.

Upward-sloping 20-period Exponential Moving Average (EMA) at 1.2468 indicates that the short-term trend is extremely bullish.

Also, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which signals the bullish momentum has already been triggered.

For further upside, a confident break above May 16 high at 1.2547 will drive the Cable toward May 10 low at 1.2603 followed by May 10 high at 1.2680.

On the flip side, a breakdown below May 12 low at 1.2440 will drag the asset toward a 23.6% Fibo retracement near 1.2400 and May 31 low at 1.2348.

GBP/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.