GBP/USD Price Analysis: Inside the woods ahead of FOMC minutes

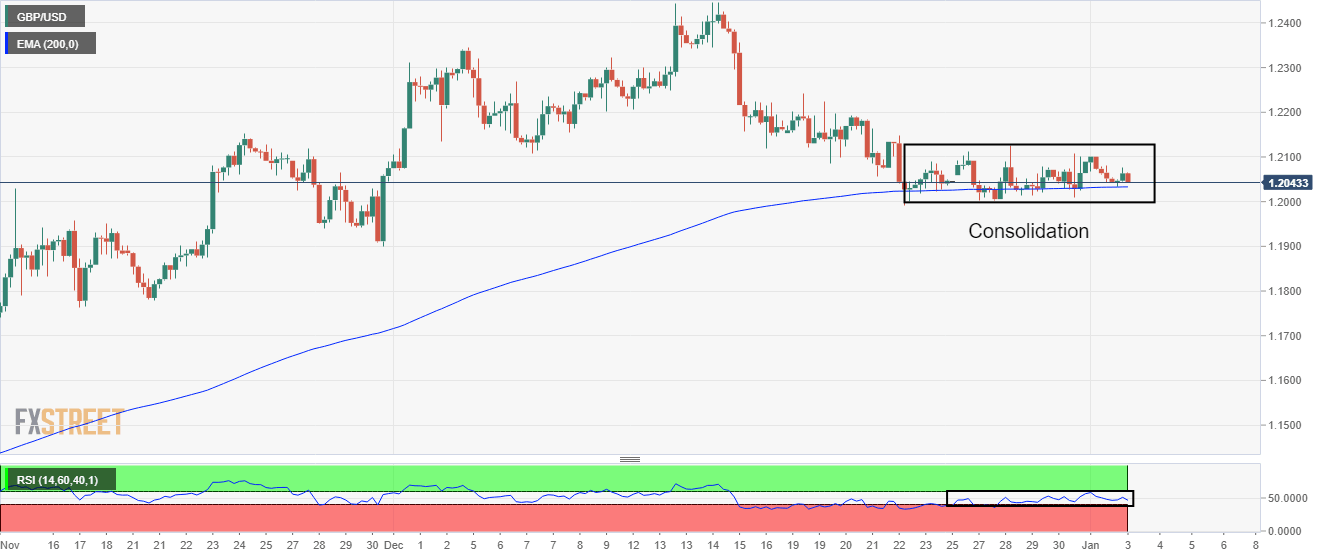

- GBP/USD is oscillating in a 1.2000-1.2126 range for the past 10 trading sessions.

- The 200-EMA around 1.2027 is acting as a major cushion for the Cable.

- A 40.00-60.00 range oscillation by the RSI (14) indicates an absence of a potential trigger.

The GBP/USD pair has delivered an upside break of the consolidation formed in a narrow range of 1.2040-1.2046 in the Asian session. The Cable asset has climbed above 1.2060 but is still likely to remain inside the woods as the market mood is still quiet.

It is difficult to ascertain the risk profile at the current juncture as the trading activity is still low. Meanwhile, S&P500 futures have initiated the week on a bearish note, portraying caution ahead of the release of the Federal Open Market Committee (FOMC) minutes this week.

On a four-hour scale, the Cable asset is tightly holding the cushion from the 200-period Exponential Moving Average (EMA) around 1.2027. As the 200-EMA has turned flat, a rangebound performance is likely to persist ahead till the absence of a potential trigger. For the past 10 trading sessions, the Cable is oscillating in a range of 1.2000-1.2126.

The Relative Strength Index (RSI) (14) is continuously oscillating in a 40.00-60.00 range, which indicates volatility contraction, which will be followed by a breakout in the same.

Should the Cable break above December 26 high at 1.2126, Pound Sterling bulls will drive the major towards the round-level resistance at 1.2200. A breach of the latter will drive the pair towards December 12 high around 1.2300.

Alternatively, a break below the psychological support of 1.2000 will drag the Cable towards November 18 high around 1.1950 followed by November 30 low at 1.1900.

GBP/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.