GBP/USD Price Analysis: Focus on EU Summit and Thursday’s close

- GBP/USD remains capped below 50-DMA ahead of EU Summit.

- The spot awaits a range breakout from a symmetrical triangle.

- Cable to remains at the mercy of Brexit news, USD dynamics.

GBP/USD is battling 1.3000, as the bulls take a breather ahead of the two-day European Union (EU) Summit, starting on Thursday.

The discussion about the EU’s future relationship with the UK will be central to their agenda, particularly after the UK government hinted at its willingness to extend the Brexit negotiations beyond the earlier October 15 deadline set by PM Boris Johnson.

The Times now reports that the UK Chief Brexit Negotiator David Frost has said to have convinced PM Johnson to keep looking for a deal.

Among other developments, Bloomberg reports that the EU seemingly toughened its language on the Brexit matter in its latest Summit draft.

".. EU leaders invite the Commission, in particular, to give timely consideration to unilateral and time-limited contingency measures that are in the EU's interest in case that there is no trade agreement."

Fresh Brexit updates and the sentiment around the US dollar will continue to influence the major in the day ahead.

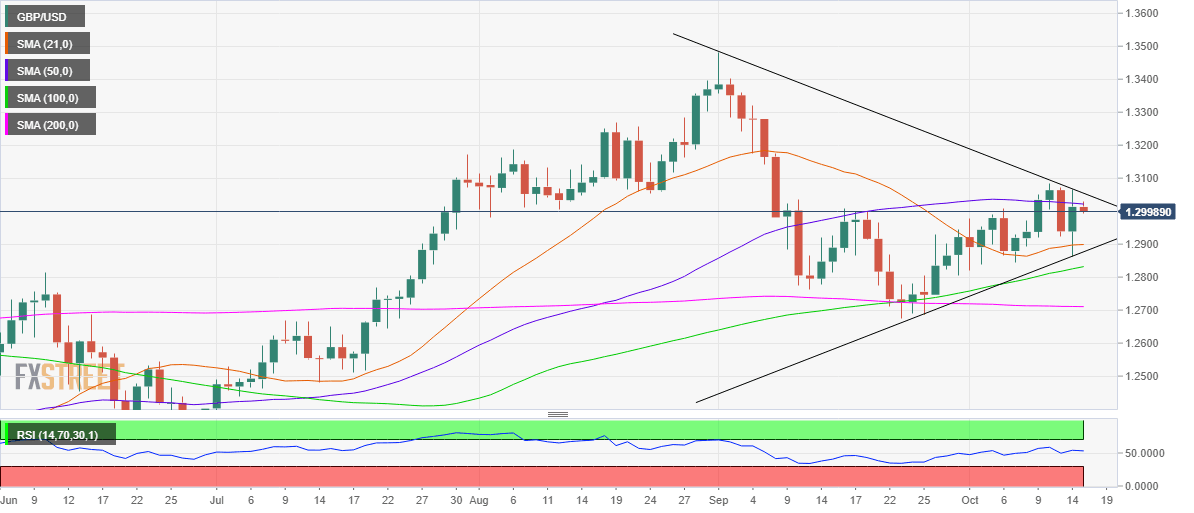

From a technical perspective, the price is holding onto Wednesday’s sharp recovery gains although the 50-daily moving average (DMA) at 1.3021 appears to challenge the bulls’ commitment, at the moment.

A sustained break above the latter could call for a test of the falling trendline resistance at 1.3054. A symmetrical triangle breakout will be confirmed on the daily chart should the cable close above that level on a daily basis.

The 14-day Relative Strength Index (RSI) turns lower but holds well above the midline, still favoring the bulls.

Alternatively, immediate support is seen at the horizontal 21-DMA at 1.2898, below which the rising trendline support at 1.2876 will be put at risk.

The next downside target is aligned at 1.2832, the 100-DMA.

GBP/USD: Daily chart

GBP/USD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.