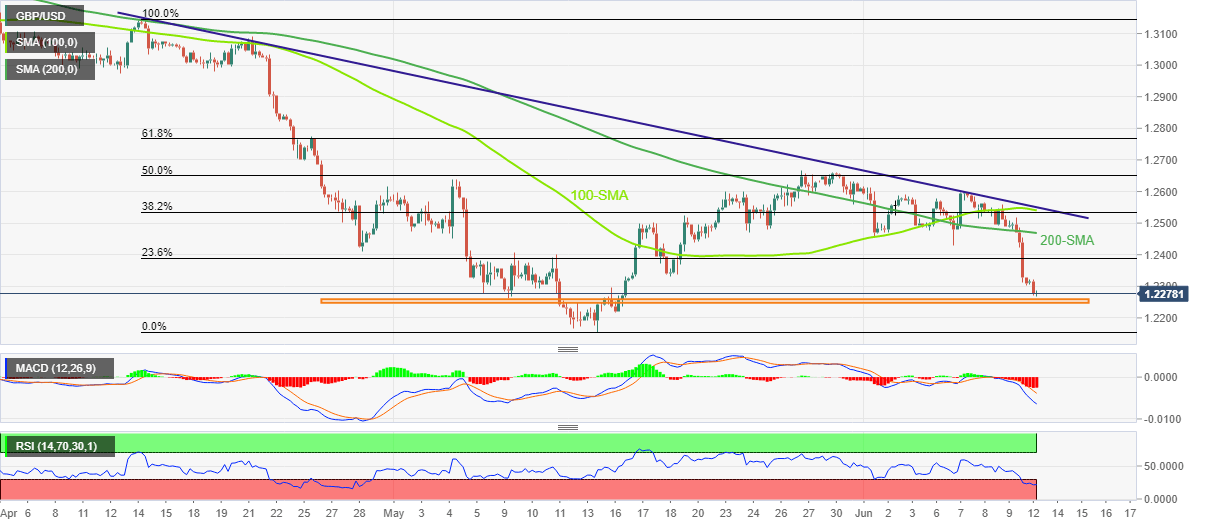

GBP/USD Price Analysis: Drops to fresh monthly low, focus on 1.2260-50 support area

- GBP/USD drops for the fourth consecutive day, takes offer to refresh monthly bottom.

- Sustained break of the key SMAs, bearish MACD signals favor bears ahead of the UK’s monthly data dump.

- Five-week-old horizontal support zone restricts immediate downside amid oversold RSI.

GBP/USD bears keep reins for the fourth consecutive day while refreshing the one-month low during Monday’s mid-Asian session. In doing so, the cable pair takes offers to 1.2270 as it renews the multi-day low by the press time.

However, oversold RSI (14) can join multiple levels marked since May 09 to challenge the pair’s further downside around 1.2260-50.

Failing to do so can quickly fetch the quote towards the yearly low of 1.2155 before directing the GBP/USD bears towards the 1.2000 psychological magnet.

On the contrary, 200-SMA and 100-SMA can challenge the corrective pullback around 1.2468 and 1.2540 in that order.

Also challenging the short-term upside moves of the GBP/USD prices is a descending trend line resistance from mid-April, around 1.2550 by the press time.

To sum up, GBP/USD remains on the bear’s radar ahead of the monthly data dump, as well as monetary policy meetings of the Fed and the Bank of England (BOE). However, the immediate downside has multiple challenges and hence a corrective pullback can’t be ruled out.

GBP/USD: Four-hour chart

Trend: Limited weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.