GBP/USD mildly up after PCE figures from the US meet expectations

- The US PCE Price Index, rose to 2.5% YoY and 0.3% MoM in February, in line with market expectations.

- The core PCE also met expectations.

- With inflation indicators in sight, investors will eye next week's employment data, as its influence can potentially postpone any rate cut decision.

In Friday's session, GBP/USD is being traded around 1.2640, registering a variation of 0.14% as investors digest the US February Personal Consumption Expenditures (PCE) figures.

Inflation in the US increased slightly to 2.5% annually in February, as per the PCE Price Index, which the Fed prefers for tracking inflation. This was a minor rise from January's 2.4% and met expectations. The index rose by 0.3% from the previous month, a tad lower than the 0.4% forecast. Core PCE, excluding food and energy, also rose by 2.8% annually, aligning with predictions, and showed a 0.3% monthly increase. With January's core PCE figures revised up, ongoing inflation may lead the Federal Reserve (Fed) to maintain higher interest rates. Upcoming employment data will be key for future policy decisions, potentially affecting the timing and extent of rate cuts.

In line with that, hot employment data may push Fed policymakers to delay cuts beyond June and post just two instead of the three forecasted cuts for 2024 which could eventually benefit the US Dollar.

GBP/USD technical analysis

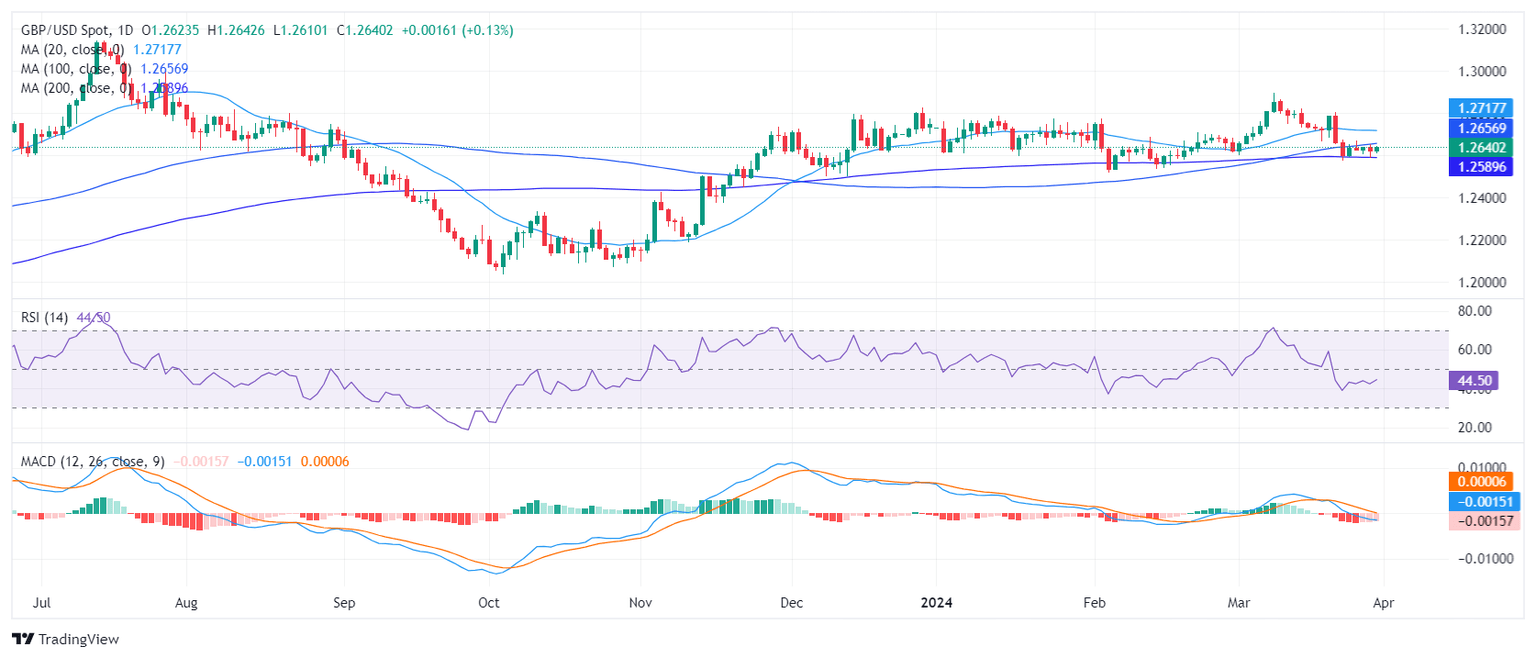

On the daily chart, the Relative Strength Index (RSI) for the GBP/USD pair is lingering in the negative territory, currently reading at 44. The prevalence of the RSI within the negative area indicates stronger selling momentum. Meanwhile, the flat red histogram of the Moving Average Convergence Divergence (MACD) implies fading bearish momentum but also serves as a caution to bulls.

On a larger scale, the pair is also below the 20 and 100-day Simple Moving Averages (SMAs), but above the 200-day SMA. This suggests that despite the current conditions, the bulls continue to exhibit strength in the overall trend.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.