GBP/USD hovers around 1.2430s, unchanged amidst improved US debt talks, ahead of the UK’s CPI data

- GBP/USD holds steady, buoyed by positive US debt ceiling discussions but weighed down by hawkish Federal Reserve comments.

- The US Dollar Index remains flat, preventing further GBP/USD gains.

- Money market futures show a high probability of a Bank of England rate hike at the next meeting, potentially offering further support to GBP.

GBP/USD trades flat in the mid-North American session on Monday, following hawkish remarks by US Federal Reserve officials, which weighed on the Pound Sterling (GBP). Nevertheless, a risk-on impulse spurred by improvements in discussions about raising the debt ceiling in the United States (US) was a headwind for the US Dollar (USD). At the time of writing, the GBP/USD is trading at 1.2437.

Uncertainty about US debt-ceiling discussions dissipates, underpins the GBP/USD pair

GBP/USD is still pressured by market sentiment. Discussions about the US debt ceiling showed some improvement, according to US House Speaker Kevin McCarthy, adding that a deal could be struck tonight or tomorrow. Although an agreement was not reached, he emphasized, “We can make it happen by the debt deadline.”

Another reason that keeps the GBP/USD from appreciating further is that Fed speakers continued with their hawkish rhetoric, with St. Louis Fed President James Bullard eyeing two more rate hikes. Nevertheless, there is a split among officials, with some leaning toward the dovish side like Atlanta’s Fed President Raphael Bostic backing a pause on the Fed’s tightening cycle.

In the meantime, the US Dollar Index (DXY), a gauge that measures the buck’s value vs. a basket of six currencies, is almost flat at 103.190, putting a lid on GBP/USD gains.

Across the Atlantic, an absent UK economic docket keeps traders leaning on Tuesday’s S&P Global PMIs on its final reading for May, alongside inflation figures, on Wednesday. Any hints that the Consumer Price Index (CPI) in April exceeded estimates and the prior’s month reading could open the door for further tightening.

Money market futures predict an 81% chance that the Bank of England (BoE) will raise rates by 25 bps at its next meeting. The BoE has lifted rates 11 times since December 2021 as it scrambles to tame sticky inflation.

GBP/USD Price Analysis: Technical outlook

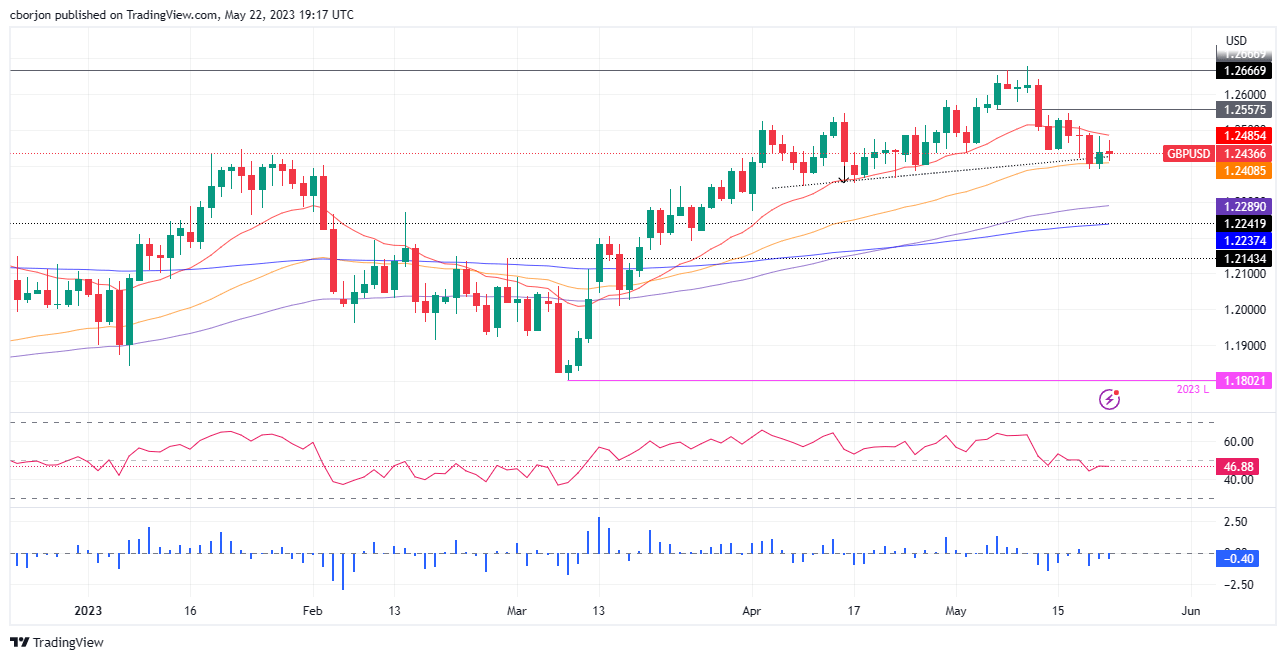

The GBP/USD is still upward biased, though trapped within the boundaries of the 20 and 50-day Exponential Moving Averages (EMAs), each at 1.2485 and 1.2409, respectively. Although price action suggests further upside is expected, the Relative Strength Index (RSI) indicator pushes below the 50-midline. That warrants sellers are gathering momentum, while the 3-day Rate of Change (RoC), shows that sellers are moving in.

Upside risks lie above the 20-day EMA at 1.2485, followed by the 1.2500 figure. On the flip side, the GBP/USD first support would be the 50-day EMA before cracking the 1.2400 mark.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.