GBP/USD holds steady amid soft US inflation, ahead of Fed and BoE’s decision

- GBP/USD stable in mid-North American session post US data, with soft inflation boosting rate cut expectations.

- US PCE Index shows steady headline inflation at 2.6%; core rate drops to 2.9%, hinting at possible May Fed rate cut.

- Focus shifts to upcoming central bank decisions; Fed likely to hold rates, BoE expected to maintain Bank Rate.

The GBP/USD was virtually unchanged in the mid-North American session on Friday after data from the United States (US) was released. A softer inflation reading was cheered by investors, who remained confident the Federal Reserve (Fed) would cut rates in May. Despite that, the major remains flat, hovering around 1.2700, set to finish the week with minuscule gains.

GBP/USD hovers around its opening price following soft US PCE data; traders eye central bank decisions

The US Personal Consumption Expenditures (PCE) Price Index was revealed by the US Department of Commerce suggesting that inflation continues its downtrend. Headline inflation rose by 2.6%, unchanged compared to November’s and expected figures, while the underlying measures dropped from 3.2% to 2.9%. Although the data could allow a rate cut by the Fed, investors estimate the first one would be in May, according to the Chicago Board of Trade (CBOT). Money market traders expect Fed Chair Jerome Powell and Co. to lower rates to 4% by the year’s end.

Given the fundamental backdrop, GBP/USD traders eye the next week’s monetary policy decisions by both central banks. The Fed is expected to keep rates unchanged on January 31, though market participants will be eyeing Powell’s press conference.

Across the pond, the Bank of England (BoE) is foreseen to keep the Bank Rate at 5.25%, although with a unanimous vote, than the previous 6-3 split by February 1. Investors are eyeing the release of economic projections and the BoE’s press conference.

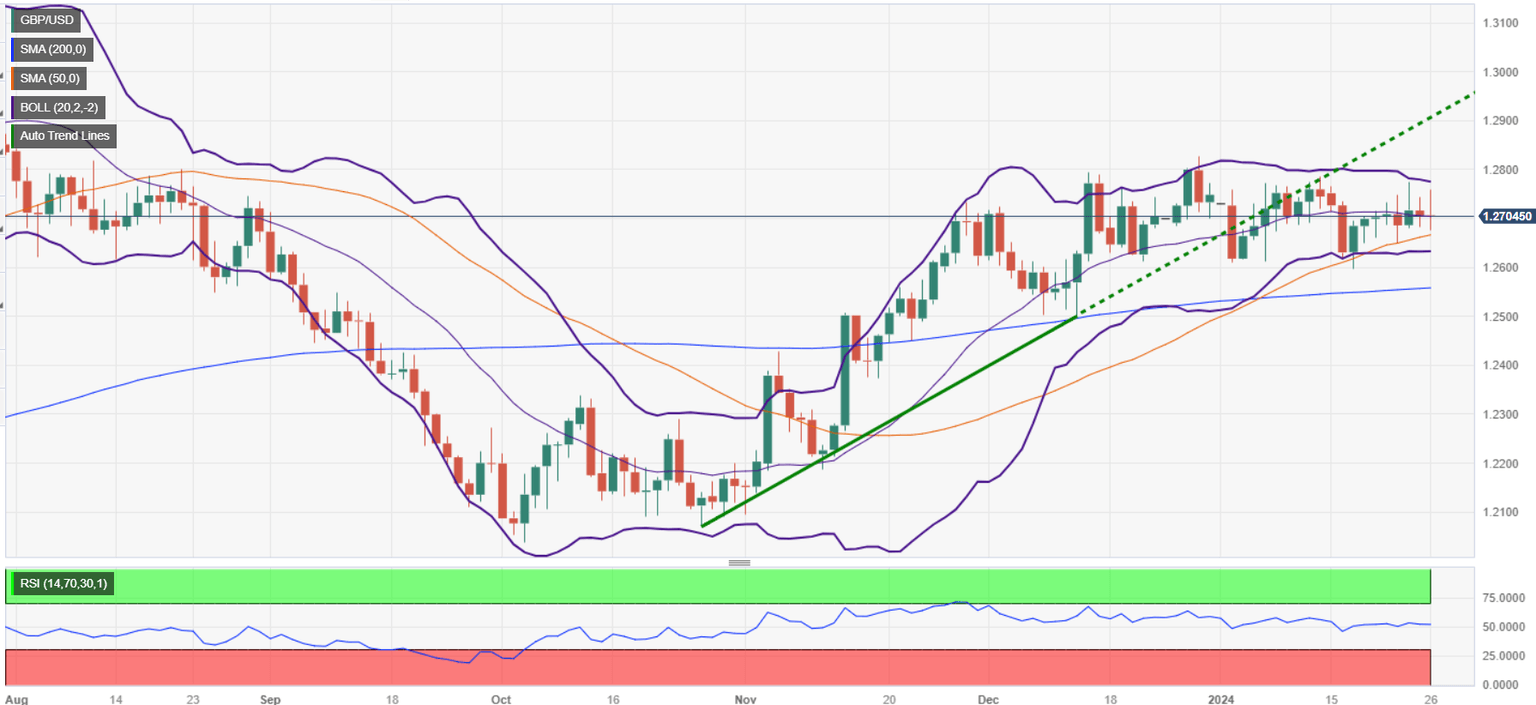

GBP/USD Price Analysis: Technical outlook

From a technical standpoint, the GBP/USD remains neutrally biased, thought at the brisk of tilting to the downside, as price action closes into the 50-day moving average (DMA), the first support level at 1.2654. if sellers break below the 1.2700 figure and the latter, further downside is seen. The next demand zone would be the January 5 low of 1.2611 and the 1.2600 figure. On the upside, the pairJanuary first resistance would be the January 24 cycle high at 1.2774, before testing 1.2800.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.