GBP/USD hits YTD high amid USD weakness, cautiously eyes 1.3000 amid BoE speculations

- GBP/USD bounces to a new YTD high as US Treasury bond yields tumble amid mixed US jobs report.

- Despite talks of further rate hikes by Fed officials, the USD falters; GBP/USD traders now eye the BoE stance.

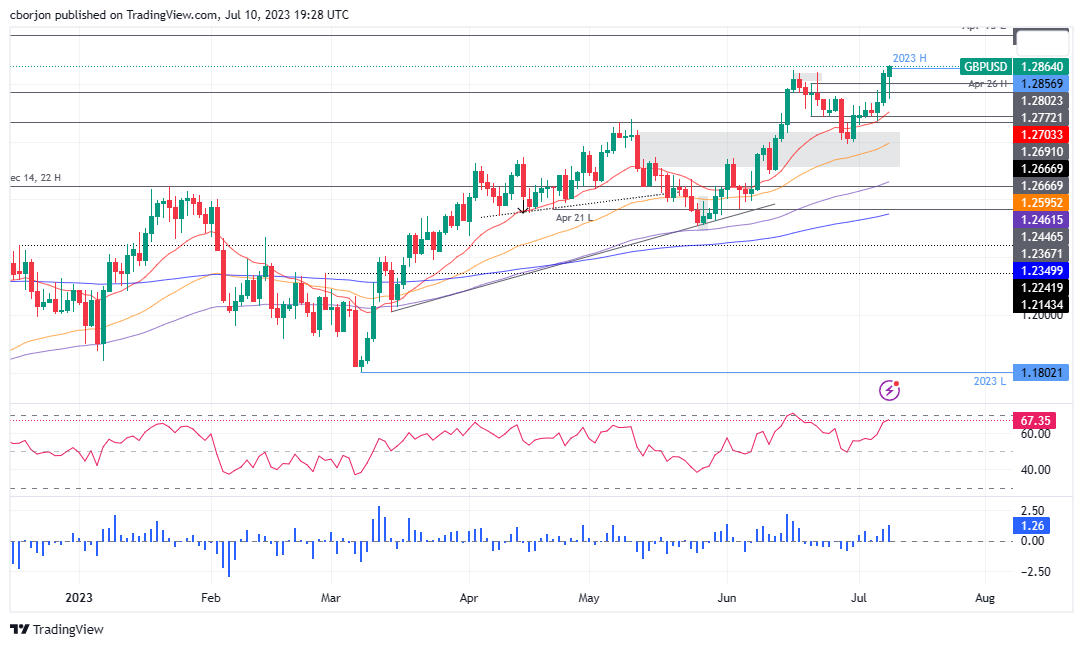

- GBP/USD challenges 1.2850/1.2900 resistance, with a potential downturn to 1.2800 if this area remains unconquered.

GBP/USD climbs to a new year-to-date (YTD) high at 1.2867, amid overall US Dollar (USD) weakness, after the major printed a daily low of 1.2750. The GBP/USD exchanges hands at 1.2864, gains 0.21%, helped by falling US Treasury bond yields, even though US Federal Reserve (Fed) speakers suggested further rate hikes needed.

GBP/USD propelled by plummeting US bond yields; future hinges on BoE’s potential aggressive tightening

Of late, Wall Street showed an improvement in market sentiment as US Treasury bond yields tumble. Last Friday’s jobs report in the United States (US) was mixed. Although the headline jobs report showed that Nonfarm Payrolls for June added 209K jobs above forecasts, other employment figures still portray a tight labor market. Average Hourly Earnings (AHE) jumped 0.2% to 4.4% YoY compared to May, while the Unemployment Rate at 3.6% YoY flashed that hiring improved.

That said, money market futures had priced in a 92.4% chance for a 25 basis points (bps) rate hike by the Fed at the 25-26 July meeting, as shown by the CME FedWatch Tool.

Despite that, the greenback is plunging, dragged by the fall of US bond yields, with the 10-year benchmark rate losing six bps, down to 4.008%. The US Dollar Index (DXY), a measure of the buck’s performance vs. a basket of six currencies, slumps 0.30% and sits at 101.963, at four-week lows.

In the meantime, the central bank bonanza continued ahead of the Fed’s blackout period to begin on Friday. The Fed’s Vice-Chair for Supervision, Michael Barr, stated the Fed still has “a bit of work to do” on rates. At the same time, Cleveland Fed President Loretta Mester commented that the economy is still robust while saying, “When the economy reopened, labor demand well outpaced labor supply, putting upward pressure on wages and price inflation.” She stated, “More hikes are needed to bring inflation back down to target.”

Recently, the San Francisco Fed Preside Mary Daly said that a couple of rate hikes are needed and that inflation risks outpaced growth ones, diminishing the chances of overtightening. On the dovish front, Atlanta’s Fed President Raphael Bostic has emerged as the new dove in town, saying that inflation could return to the Fed’s 2% target without further rate increases.

On the UK front, the Bank of England (BoE) Governor Andrew Bailey stated the central bank needs to see the labor market cooling down as the BoE struggles to tackle stickier inflation levels in the UK economy. BoE expectations for further tightening on Monday see the Bank Rate peaking between the 6.25%-6.50% range in early 2024, the highest level in 25 years.

The upcoming UK jobs report on July 11 is likely to see the unemployment rate stand at 3.8%, while Average Earnings are estimated to rise close to 7%, a sign that would increase the odds for aggressive tightening by the BoE. Even though it should be viewed as positive for Sterling (GBP), increased chances of a recession could boost the appetite for the greenback. Therefore, further GBP/USD downside could be expected in the medium term.

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains neutral to upward biased, but price action suggests the 1.2850/1.2900 barrier is proving to be strong resistance to surpass. GBP/USD buyers must reclaim that area, so they could threaten to break the 1.3000 figure. Otherwise, if GBP/USD struggles again at current exchange rates, the GBP/USD could dive past 1.2800 and edge toward the 20-day Exponential Moving Average (EMA) at 1.2702. Once cleared, the next support emerges at the confluence of the June 29 swing low and the 50-day EMA, both at around the 1.2590/95 area.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.