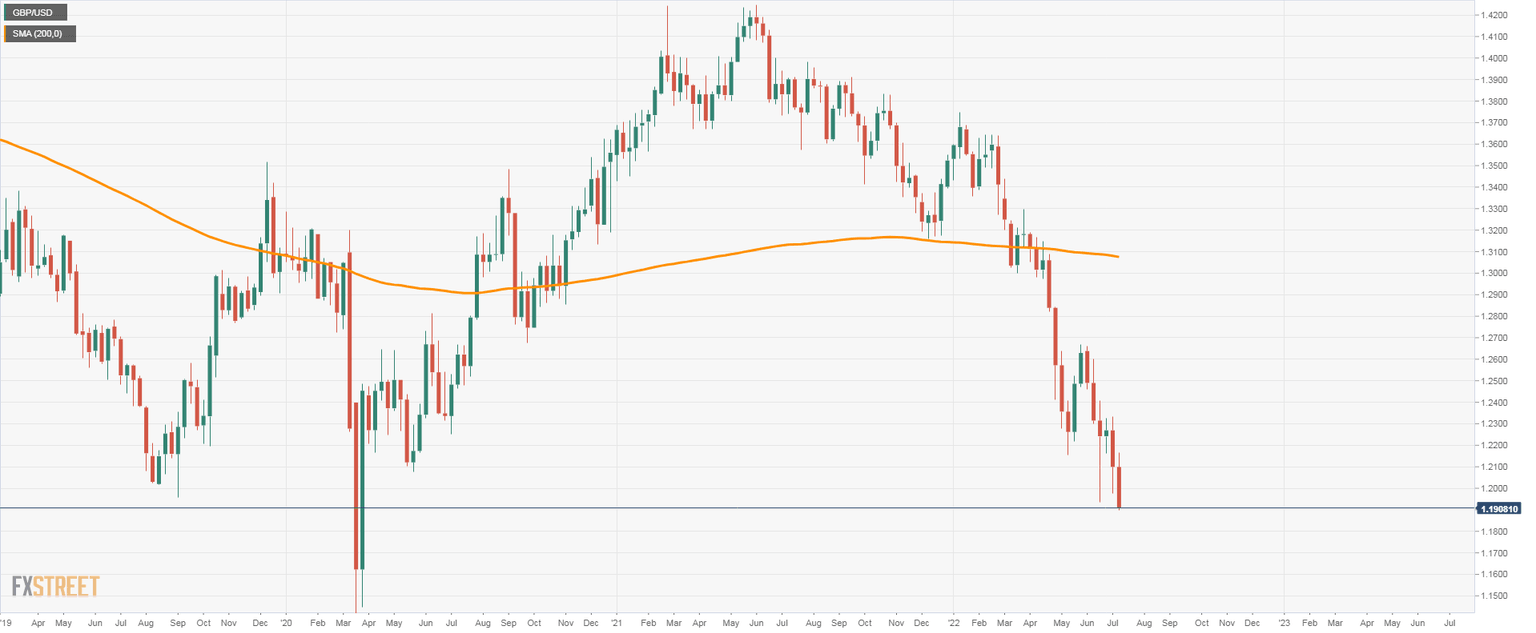

GBP/USD hits lowest since March 2020 under 1.1900 amid risk aversion

- Pound under pressure, among worst performers of the American session.

- GBP/USD heads for the lowest close since March 2020.

- US dollar holds onto significant daily gains as Wall Street tumbles.

Risk aversion continues to weigh on GBP/USD. The pair fell further, reaching at 1.1897, the lowest level since March 2020. It remains under pressure around 1.1900, unable to find support as markets tumble.

Fears about a global recession and a worsening growth outlook in the UK continue to drive the pound lower, in line with many analysts’ forecasts. At the same time, it boosts the demand for the greenback. The DXY is trading at the highest level since 2002, at 106.70, up 1.46% for the day.

Equity prices in Wall Street are falling 1.70% on average. The FTSE 100 dropped almost 3% and the DAX 2.75%. Commodity prices are sinking, with gold down 2% and silver 2.95%. Crude oil collapses, falling by 8.50%.

Adding to concerns, Norway just warned that gas exports to the UK could be shut off this weekend. A strike threatens production in the Scandinavian country.

The pound is among the worst performers of the American session. EUR/GBP has erased daily losses and is back around 0.8600 after falling earlier to 0.8540.

Economic data came in above expectation in the UK and the US. The UK S&P Global Service PMI in June was revised higher from 53.4 to 54.3. In the US, Factory Orders rose by 1.6% in May, surpassing the 0.5% of market consensus. Market participants ignored the numbers. On Wednesday, the FOMC minutes will be released, and on Friday, the Non-farm payroll.

GBP/USD weekly chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.