GBP/USD grapples with the low side after CPI upswing fails to spark a bid

- GBP/USD roiled on Wednesday before settling 0.2% lower.

- Despite an upbeat UK CPI inflation print, Cable knocked lower.

- Thin Thursday economic calendar gives way to global PMI prints.

GBP/USD struggled to find a direction on Wednesday, testing the bounds of the 1.2700 handle before facing a downside rejection and ending the midweek market session a fifth of a percent lower than it started. Despite an above-forecast print in UK Consumer Price Index (CPI) inflation figures, the Pound Sterling still waffled as the Bank of England (BoE) looks set to write off another rate cut in 2024 as the UK grapples with still-sticky inflation.

UK CPI came in broadly higher than markets expected, with headline UK CPI inflation rising to 2.3% YoY, over and above the forecast 2.2% and bouncing from the previous period’s print of 1.7%. Meanwhile, core CPI inflation rose to 3.3% on an annualized basis while investors were expecting a slight downtick to 3.1% from the previous 3.2%. With UK inflation still sparking fears of sticky price growth, the BoE is less likely to deliver another rate cut in 2024 despite a lopsided economy.

Thursday’s economic calendar is a thin showing, leaving Cable traders to sit on their hands until Friday’s doubleheader showing of Purchasing Managers Index (PMI) activity survey results due from both the UK and the US to wrap up the trading week. UK PMI figures are broadly expected to hold steady at previous figures, with the Manufacturing PMI component forecast to hold at 49.9 and the Services PMI component expected to print flat at 51.8.

The key data print this week will be S&P Purchasing Managers Index (PMI) survey results, which are due on Friday. Markets are anticipating a slight increase in Manufacturing PMI figures, expected to rise to 48.8 from the previous 48.5, while the Services component is expected to rise by a similar amount, to 55.3 from 55.0.

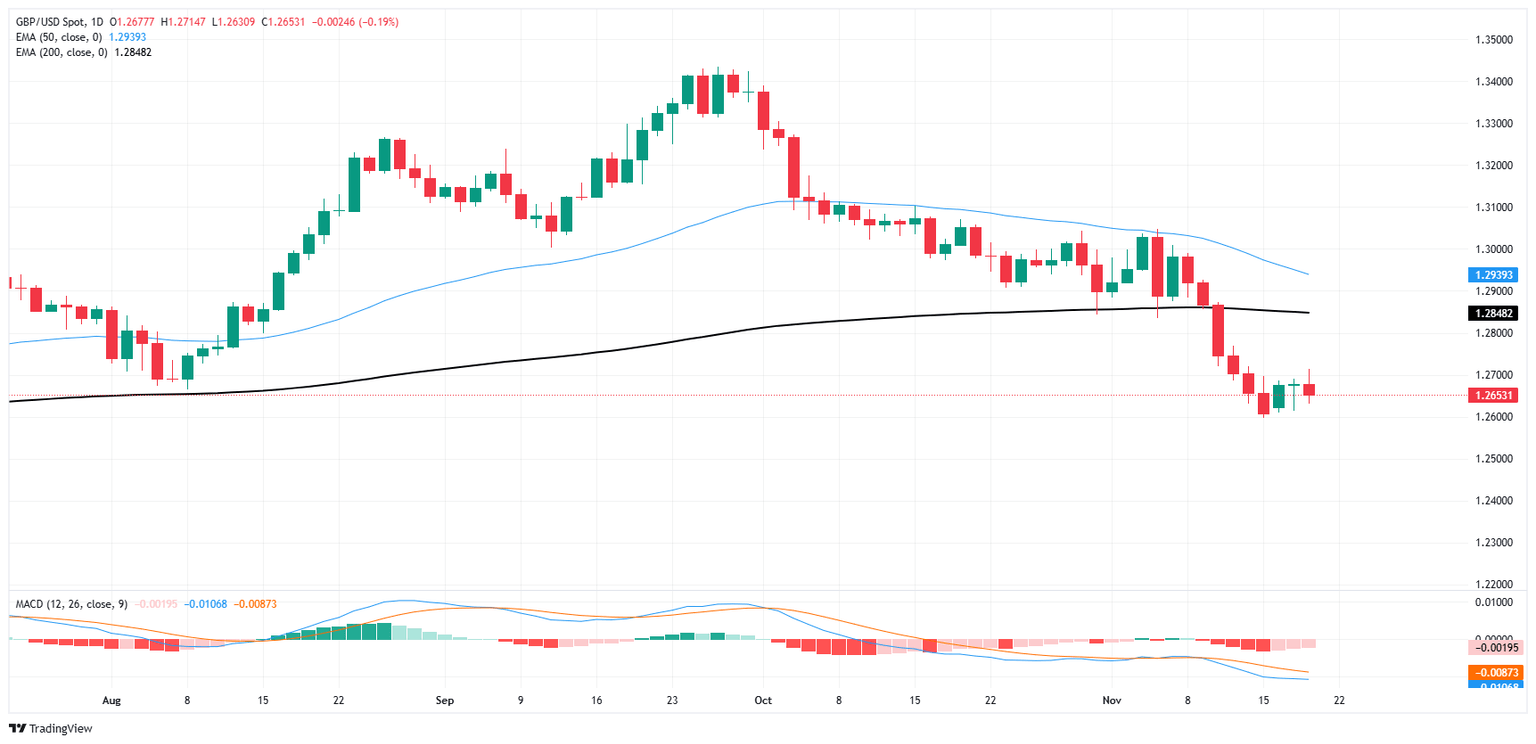

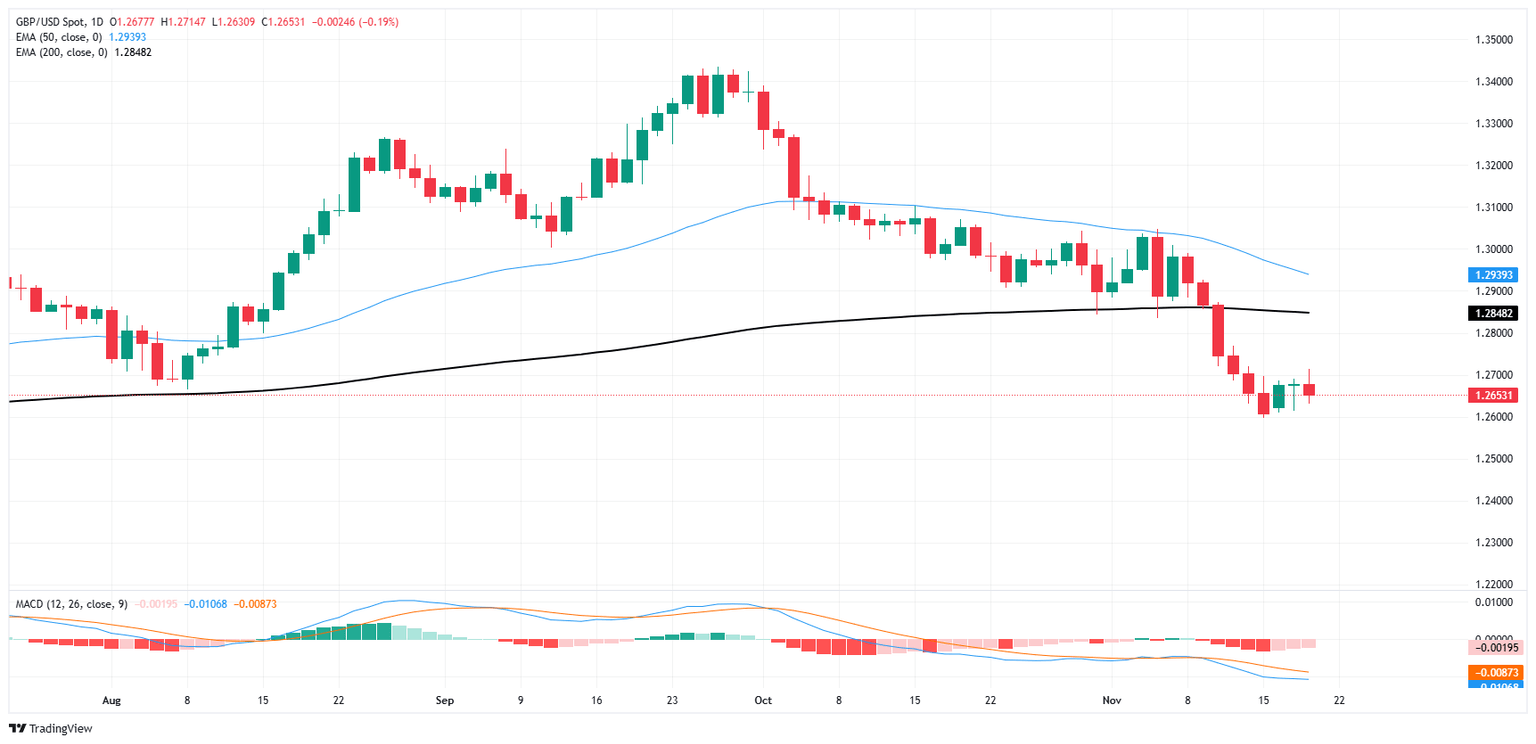

GBP/USD price forecast

GBP/USD failed to extend into a bullish recovery this week after a flubbed pullback from 27-month lows near the 1.2600 handle. Technical action priced in a floor and looked set to kick off a bullish recovery run, but high side bids are fizzling out after running into friction near 1.2700.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.