GBP/USD drops after mixed UK retail sales, risk aversion

- GBP/USD falls 0.48% to 1.2376, influenced by rising geopolitical risks and statements from major central banks.

- Bank of England's Deputy Governor comments on inflation risks fail to support Sterling as it hits new lows.

- Mixed economic data from the UK with stagnant retail sales in March, contrasting with modest annual growth.

The Pound Sterling tumbles against the US Dollar during the mid-North American session after a volatile trading day due to an escalation of the Israel-Iran conflict. Major central bank speakers led by the Bank of England (BoE) and the Federal Reserve (Fed), continued to set the tone for the financial markets. The GBP/USD trades at 1.2376, down 0.48%.

GBP/USD slides as Israel-Iran conflict escalates

According to Reuters, there were explosions over an Iranian city on Friday, in what sources described as an Israel attack. However, Iranian authorities downtoned the event and stated they had no plans for retaliation. As a consequence, the GBP/USD tumbled toward 1.2388, a new five-month low, before recovering some ground.

Words from the BoE’s Deputy Governor Dave Ramsden failed to underpin Cable, which refreshed five-month lows at 1.2372. Ramsden said he would consider the implications of Forex for inflation, adding that the bank would do what makes sense in terms of the BoE’s mandate. He added the disinflation process would be bumpy, but risks are tilted to the downside.

In addition, Chicago’s Fed President Austan Goolsbee adopted a neutral stance, slightly boosting the Greenback. He commented that progress on inflation has stalled, suggesting that a pause would allow incoming data to provide insight into the disinflation process.

British Retail Sales showed signs of stagnation during the European session in March compared to February’s reading. Analysts were expecting sales to grow 0.3% MoM, which came at 0%, while core sales tumbled from 0.3% to -0.3%. On an annual basis, the Office for National Statistics (ONS) revealed that sales rose by 0.8%, which is up from a drop of -0.3% in February.

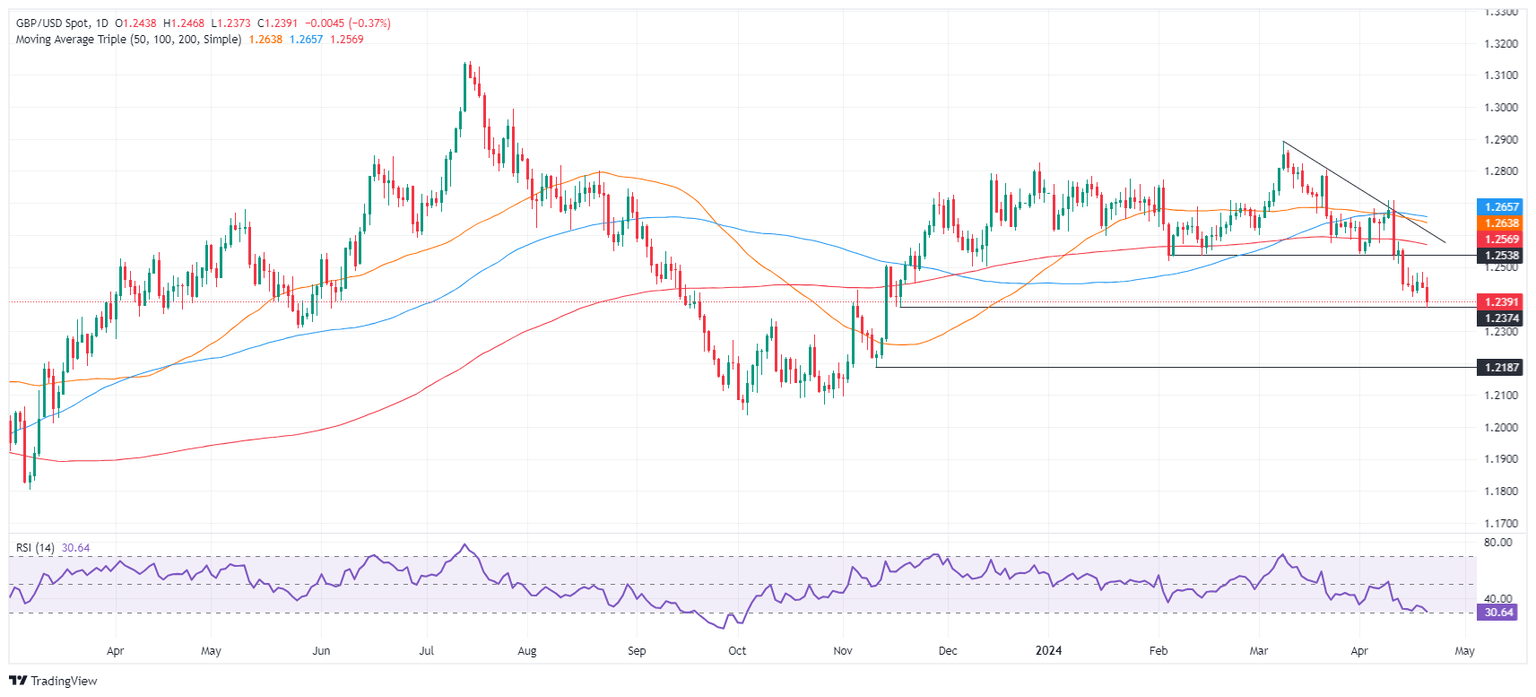

GBP/USD Price Analysis: Technical outlook

After breaching below 1.2400, the GBP/USD could resume its ongoing downtrend. Unless buyers regain the 1.2400 mark, sellers are in charge. The first support would be the November 17 low of 1.2373, followed by the November 10 low of 1.2187. On the other hand, if buyers reclaim 1.24000, the next key resistance area would be the April 18 high at 1.2484, ahead of 1.2500.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.