GBP/JPY sets new 16-year high for a fourth straight day

- GBP/JPY continues to climb to fresh highs as Yen extends backslide.

- Floundering JPY draws out more direct warnings from Japanese officials.

- Market flows unlikely to change as rate differential remains wide.

GBP/JPY set a fresh 16-year high on Wednesday, marking the fourth consecutive day the Guppy has reached a new peak as the Japanese Yen continues to tumble. Increasingly stern alerts from Japanese policymakers regarding the pace of the Yen’s decline has produced very little results as investors await actual policy changes from the Bank of Japan (BoJ) and the Japanese Ministry of Finance (MoF).

Currency chief Masato Kanda, Japan’s Vice Finance Minister noted early Wednesday that he has “serious concern about the recent rapid weakening of the yen”, within Kanda continuing that he and the MoF are closely monitoring market trends with a high sense of urgency”. Kanda ended with saying that “we will take necessary actions against any excessive movements.”

GBP/JPY briefly softened to 202.40 before Guppy traders promptly responded by pushing the pair to a fresh 16-year high at 203.15.

The back half of the trading week kicks off a raft of impactful data for Japan and the UK, with Japanese Retail Trade figures due early Thursday. The Bank of England (BoE) will release its latest Financial Stability Report later in the day, leaving Yen pairs to pivot to face down the latest Japanese Tokyo Consum Price Index (CPI) inflation figures due early Friday. The UK’s first-quarter Gross Domestic Product (GDP) will be revised to round out the trading week.

GBP/JPY technical outlook

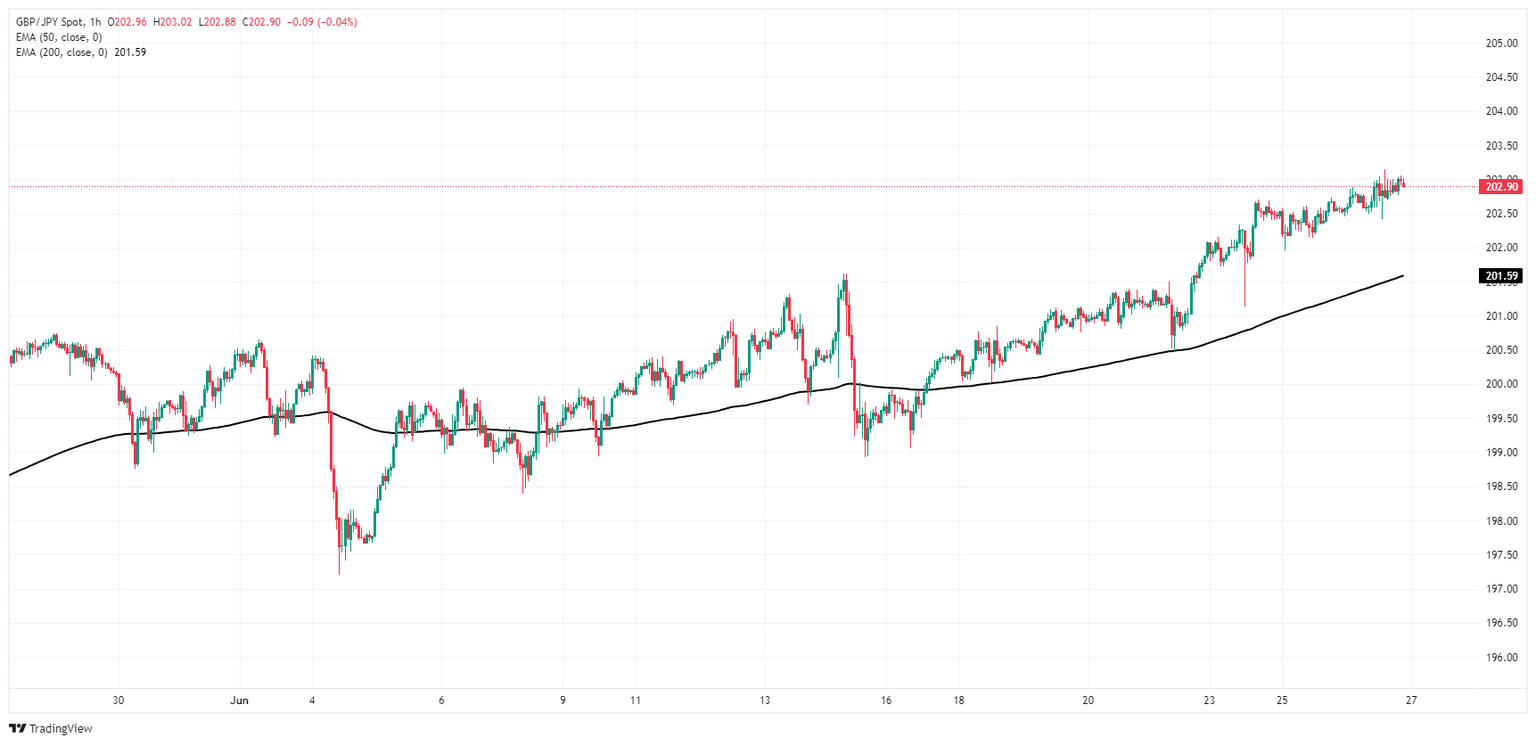

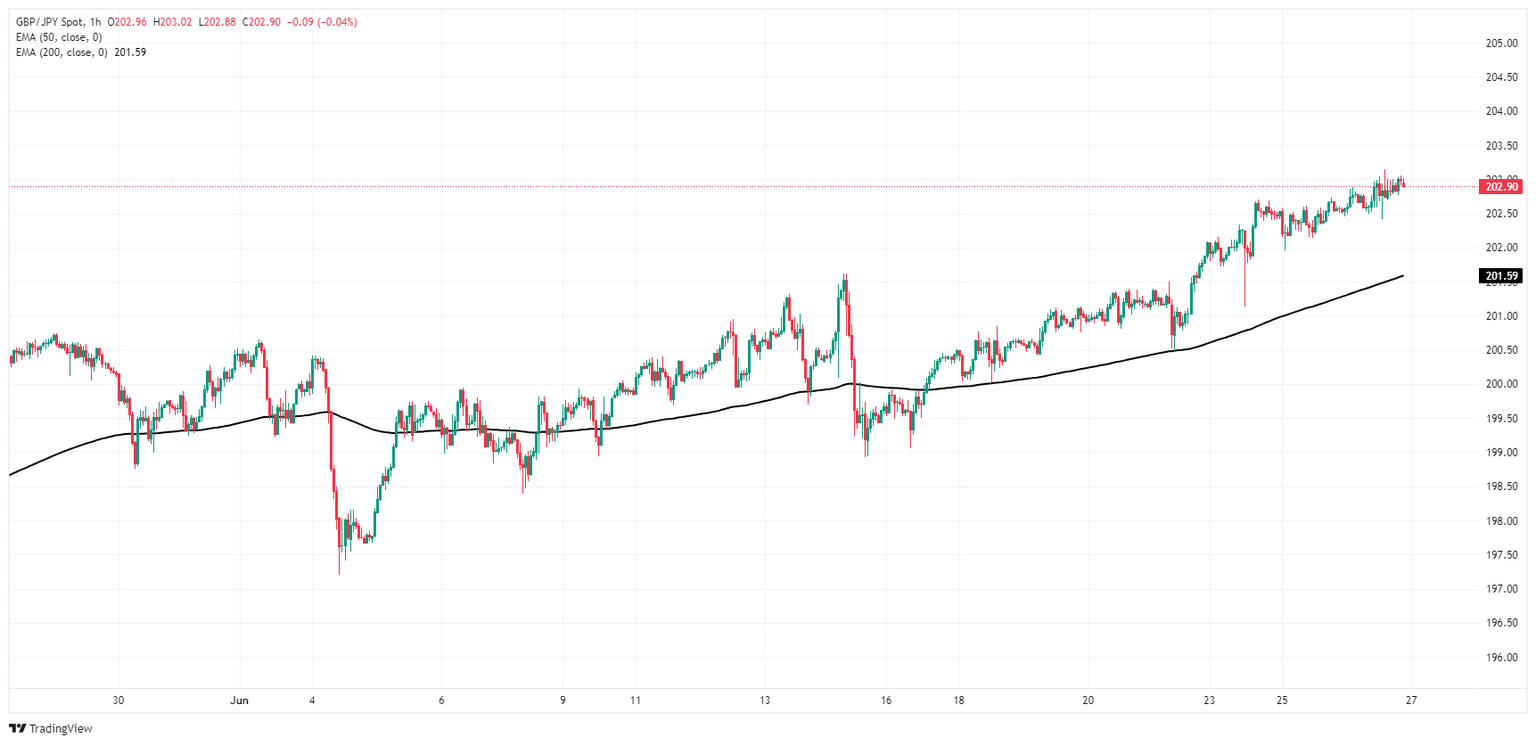

A steady grind into the high side leaves GBP/JPY with little meaningful technical resistance levels. The pair has risen 2% from the last swing low into 198.90, trading steadily north of the 200-hour Exponential Moving Average (EMA) rising into 201.60.

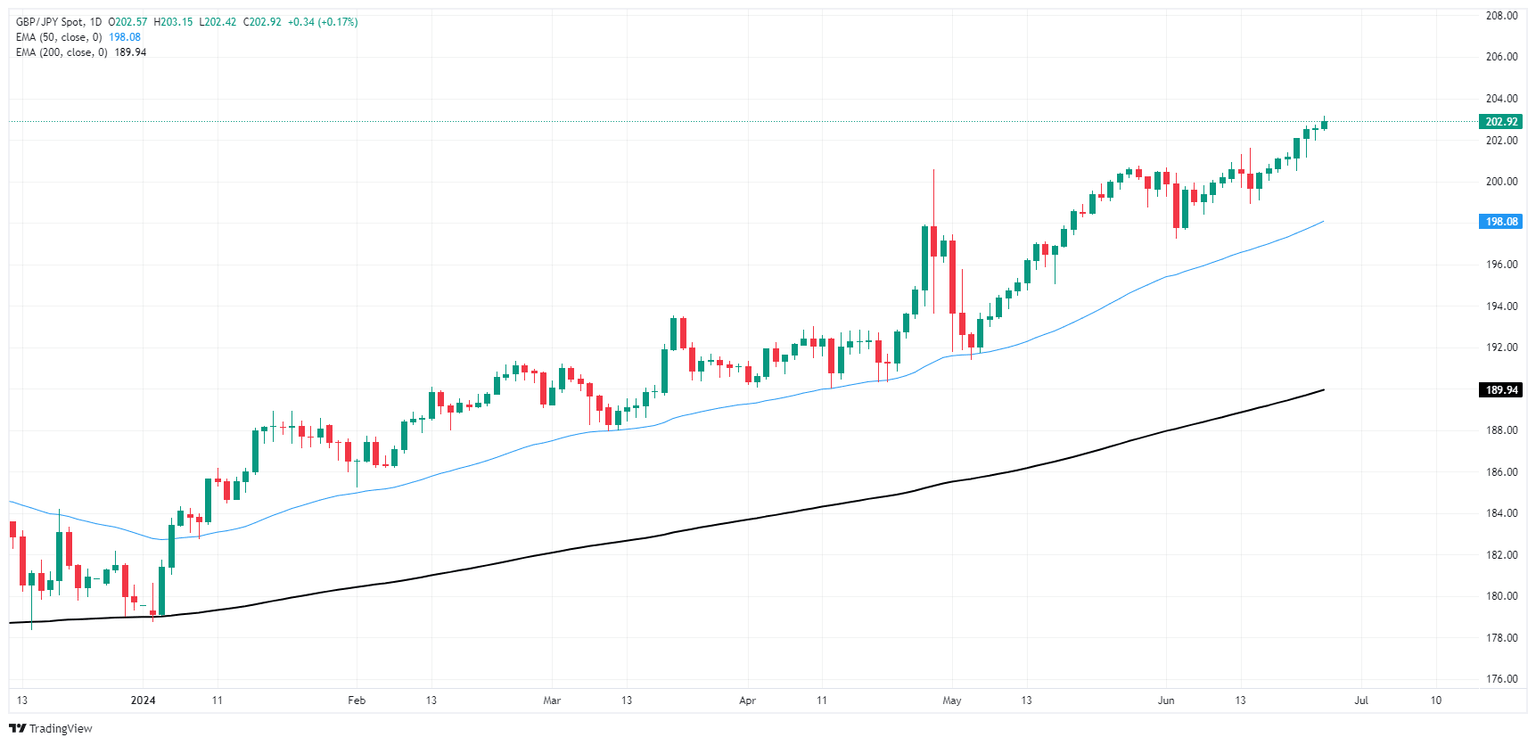

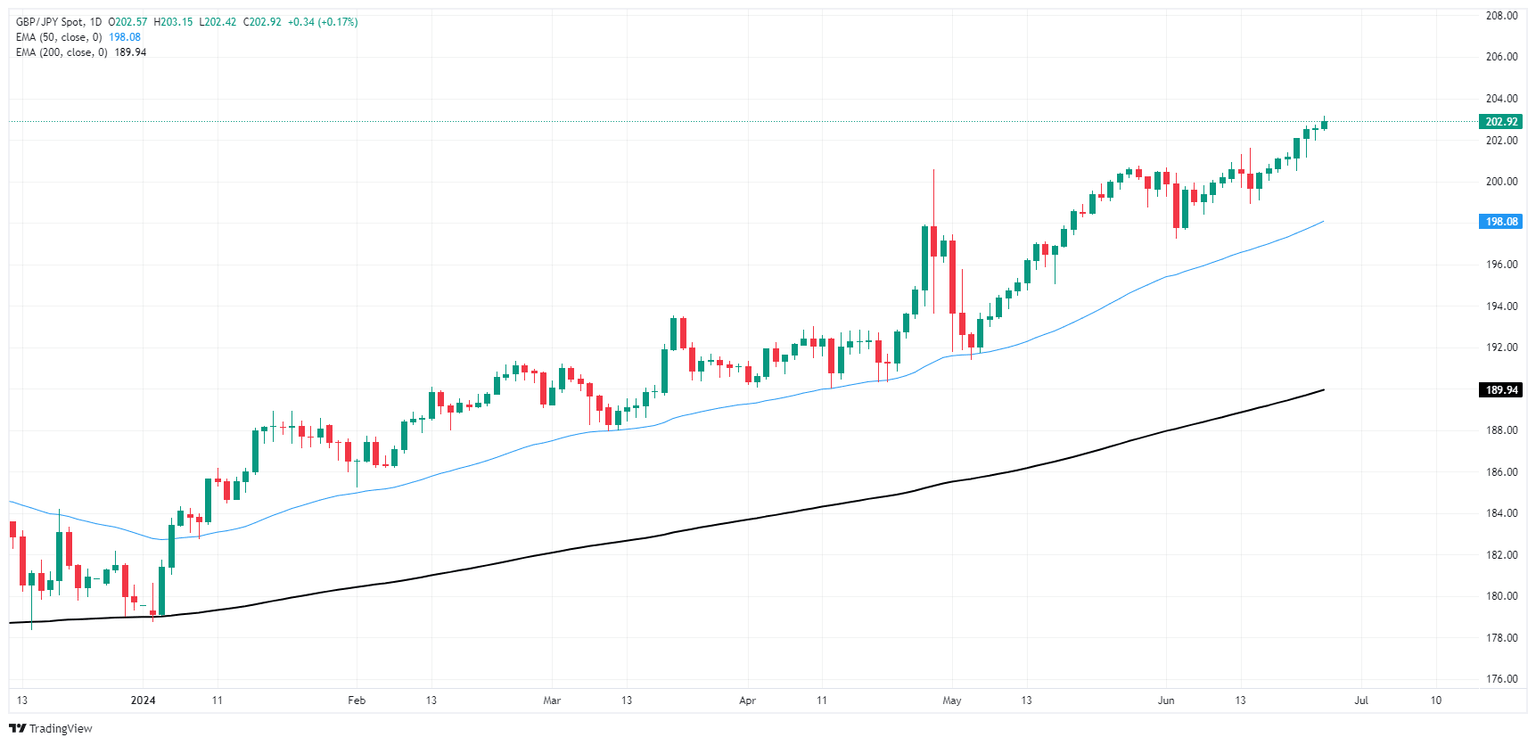

Daily candlesticks have churned out an eighth consecutive gain as the Guppy continues its march towards 204.00. The pair is up 13% in 2024, and has closed in the green for six straight months.

GBP/JY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.