GBP/JPY Price Forecast: Jumps to multi-week top, reclaims 191.00 amid notable JPY weakness

- GBP/JPY turns positive for the fifth straight day and climbs to a nearly three-week top.

- BoJ Governor Ueda’s cautious remarks weigh on the JPY and lend support to the cross.

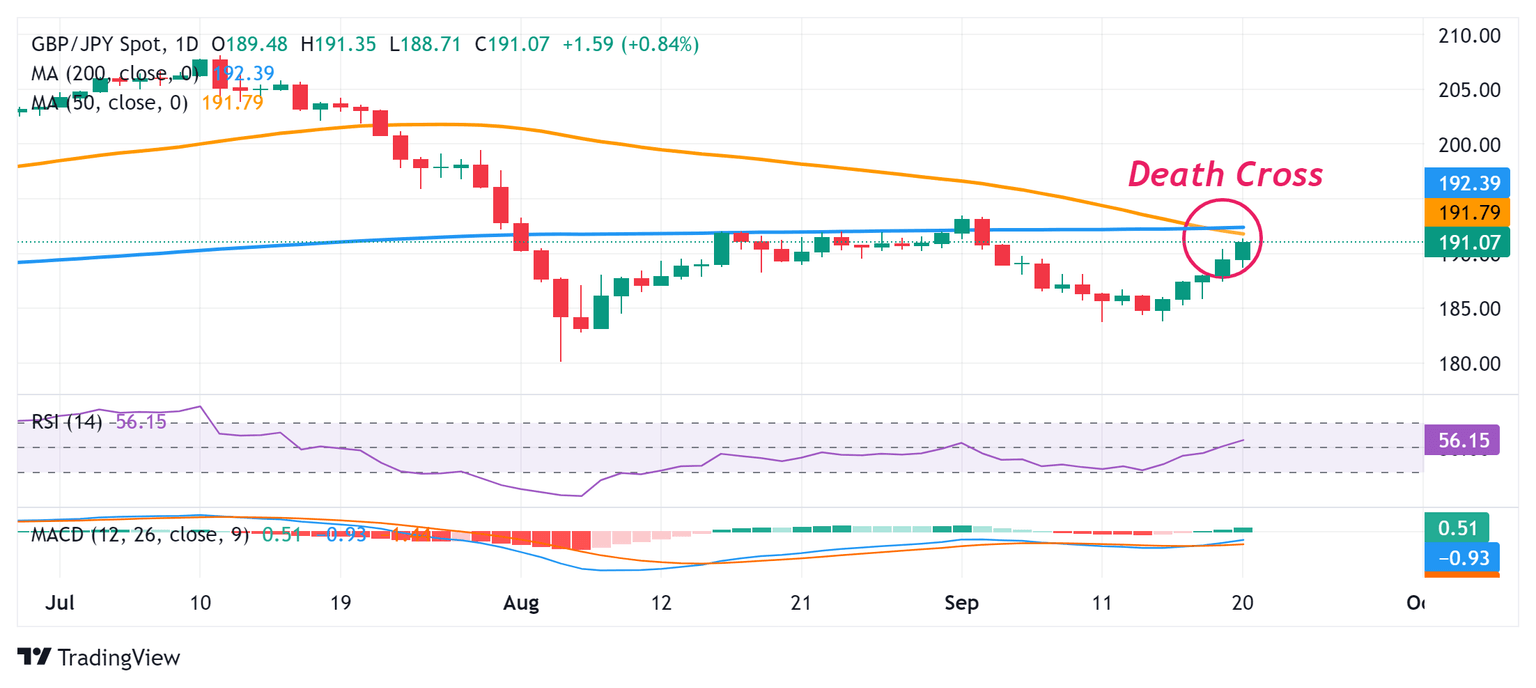

- The formation of a ‘Death Cross’ on the daily chart warrants caution for bullish traders.

The GBP/JPY cross turns positive for the fifth successive day following an intraday dip to the 188.70 area and jumps to a nearly three-week top during the first half of the European session on Friday. Spot prices reclaim the 191.00 mark in the last hour amid the emergence of some selling around the Japanese Yen (JPY), triggered by the Bank of Japan (BoJ) Governor Kazuo Ueda's less hawkish remarks during the post-meeting press conference.

In fact, Ueda noted that uncertainties surrounding Japan's economy, and prices remain high and that risks of inflation overshoot have diminished to some extent in the wake of the recent FX moves. This, along with the underlying bullish sentiment across the global financial markets, undermines the safe-haven JPY. Meanwhile, the British Pound (GBP) draws support from the Bank of England's (BoE) decision on Thursday to keep rates unchanged and run down its stock of government bonds by another £100 billion over the coming 12 months. This, in turn, provides an additional boost to the GBP/JPY cross and contributes to the move up.

From a technical perspective, oscillators on the daily chart have been gaining positive traction and support prospects for a further appreciating move. That said, the 50-day Simple Moving Average (SMA) has fallen below the 200-day SMA, forming the 'Death Cross' pattern on the daily chart and warranting some caution for bullish traders. Hence, any subsequent move up might confront stiff resistance near the 50-day SMA, currently near the 191.75 region. This is followed by the 192.00 mark, above which the GBP/JPY cross could climb further, though is likely to remain capped near the 200-day SMA barrier near the 192.35-192.40 region.

On the flip side, the 190.40-190.35 zone now seems to protect the immediate downside ahead of the 190.00 psychological mark and the 189.45 horizontal support. Some follow-through selling could drag the GBP/JPY cross towards the 189.00 mark en route to the daily swing low, around the 188.70-188.65 region. Failure to defend the said support levels will suggest that this week's goodish rebound from the vicinity of the monthly low has run its course and pave the way for deeper losses. Spot prices might then accelerate the fall towards the 188.00 round figure before eventually dropping to the 187.35 support zone and the 187.00 mark.

GBP/JPY daily chart

Economic Indicator

BoJ Press Conference

The Bank of Japan (BoJ) holds a press conference at the end of each one of its eight scheduled policy meetings. At the press conference the Governor of the BoJ communicates with media representatives and investors regarding monetary policy. The Governor talks about the factors that affect the most recent interest rate decision, the overall economic outlook, inflation, and clues regarding future monetary policy. Hawkish comments tend to boost the Japanese Yen (JPY), while a dovish message tends to weaken it.

Read more.Last release: Fri Sep 20, 2024 06:00

Frequency: Irregular

Actual: -

Consensus: -

Previous: -

Source: Bank of Japan

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.