GBP/JPY Price Analysis: Trims intraday gains above 150.00 post BOJ

- GBP/JPY eases from short-term rising wedge resistance.

- BOJ leaves key rates, bond yield target unchanged but sounds worried over the economic outlook.

- Bearish chart formation, downbeat MACD keep sellers hopeful.

Alike other Japanese yen (JPY) pairs, GBP/JPY also stepped back following the Bank of Japan’s (BOJ) monetary policy decision on early Tuesday.

Although the BOJ left the key rate at -0.25% and the 10-year Japanese Governor Bond (JGB) yield towards 0.0%, fears of losing economic momentum due to the coronavirus (COVID-19) seemed to have put a bid under the safe-haven JPY.

Read: BOJ Quarterly Report: There is big uncertainty on outlook

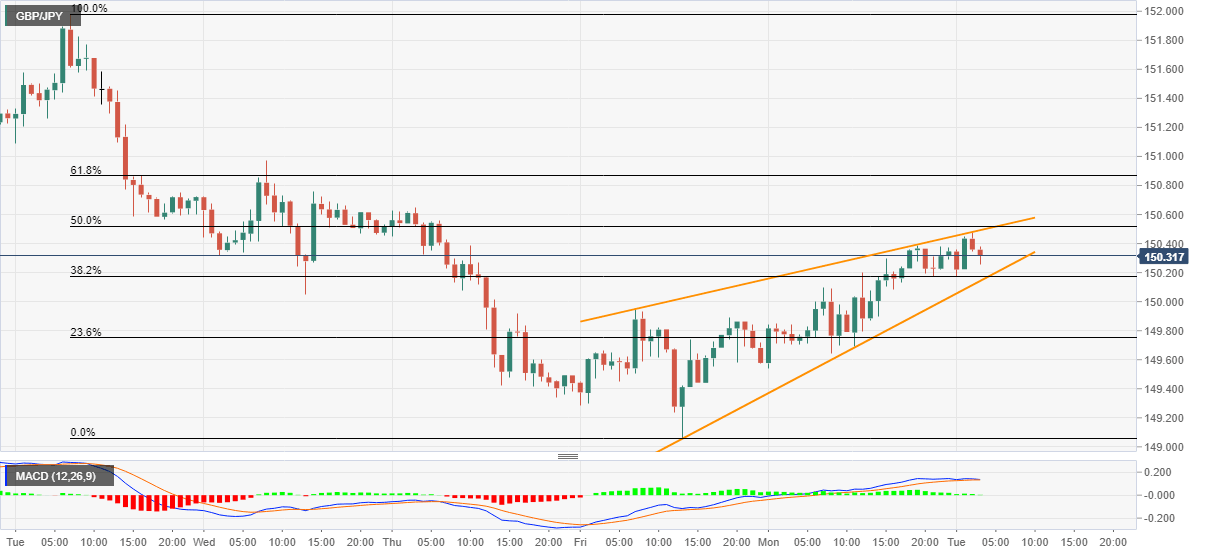

Technically, GBP/JPY recovery from Friday portrays a short-term rising wedge bearish chart pattern on the hourly play.

Given the recently weaker MACD signals, a downside break of 150.15 immediate support line may not hesitate to test the monthly low, marked last week, around 149.00. However, the 150.00 threshold can offer an intermediate halt during the fall.

Meanwhile, an upside break of 150.50 defies the bearish chart pattern but 50% and 61.8% Fibonacci retracement levels of April 20–23 declines, respectively around 150.55 and 150.85, may test the GBP/JPY buyers afterward.

GBP/JPY hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.