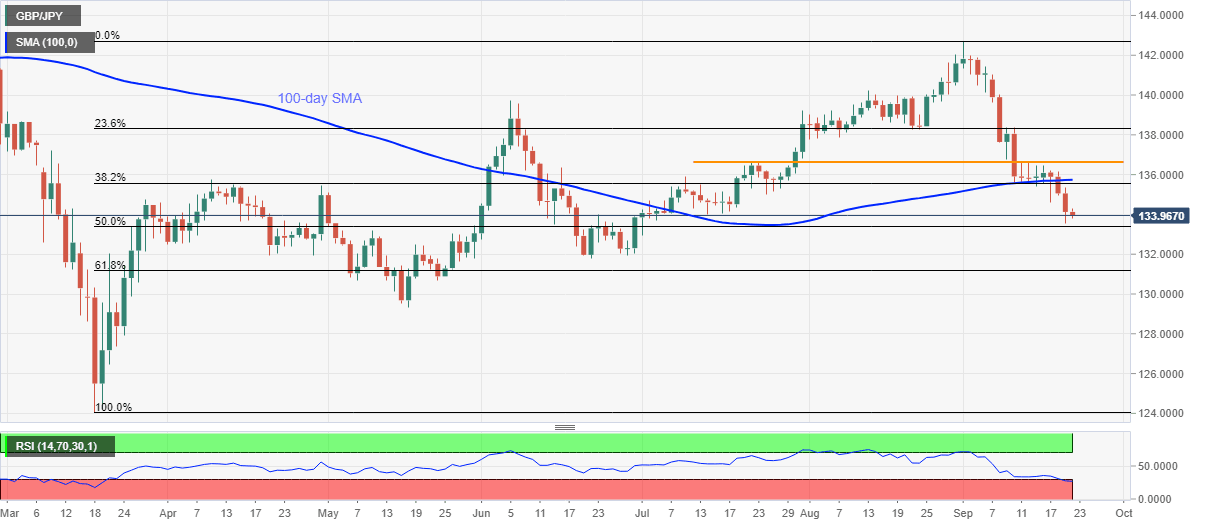

GBP/JPY Price Analysis: Bears slow down near 50% Fibonacci retracement amid oversold RSI

- GBP/JPY stays heavy for fourth consecutive day, nears lowest levels since July 01.

- The key Fibonacci retracement may offer intermediate moves but buyers are less likely to enter below 100-day SMA.

- June low is on the bears’ radars below the immediate stop beyond 133.00.

GBP/JPY stays mildly offered while declining to 133.98 during the pre-UK opening on Tuesday. In doing so, the pair sellers catch a breather around the lowest since early July amid the oversold RSI conditions.

Other than the aforementioned momentum indicator, the 50% Fibonacci retracement of March-September upside by GBP/JPY also probes the bears around 133.35.

As a result, the quote’s further weakness is limited beyond the key Fibonacci retracement support, a break of which will recall June month’s low of 131.76 back to the chart.

On the contrary, July 24 low near 135 may restrict the pair’s short-term pullback. Though, any buyers are likely to remain cautious unless witnessing a break of 100-day SMA, at 135.73 now.

Given the pair’s ability to cross 100-day SMA on a daily closing, multiple upside barriers around 136.60/65 can question the GBP/JPY buyers as portrayed by a short-term horizontal line.

GBP/JPY daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.