First Majestic Silver (AG) Stock Price and Forecast: Should I buy AG now?

- AG shares benefit as the Reddit-fueled army reportedly looks to silver.

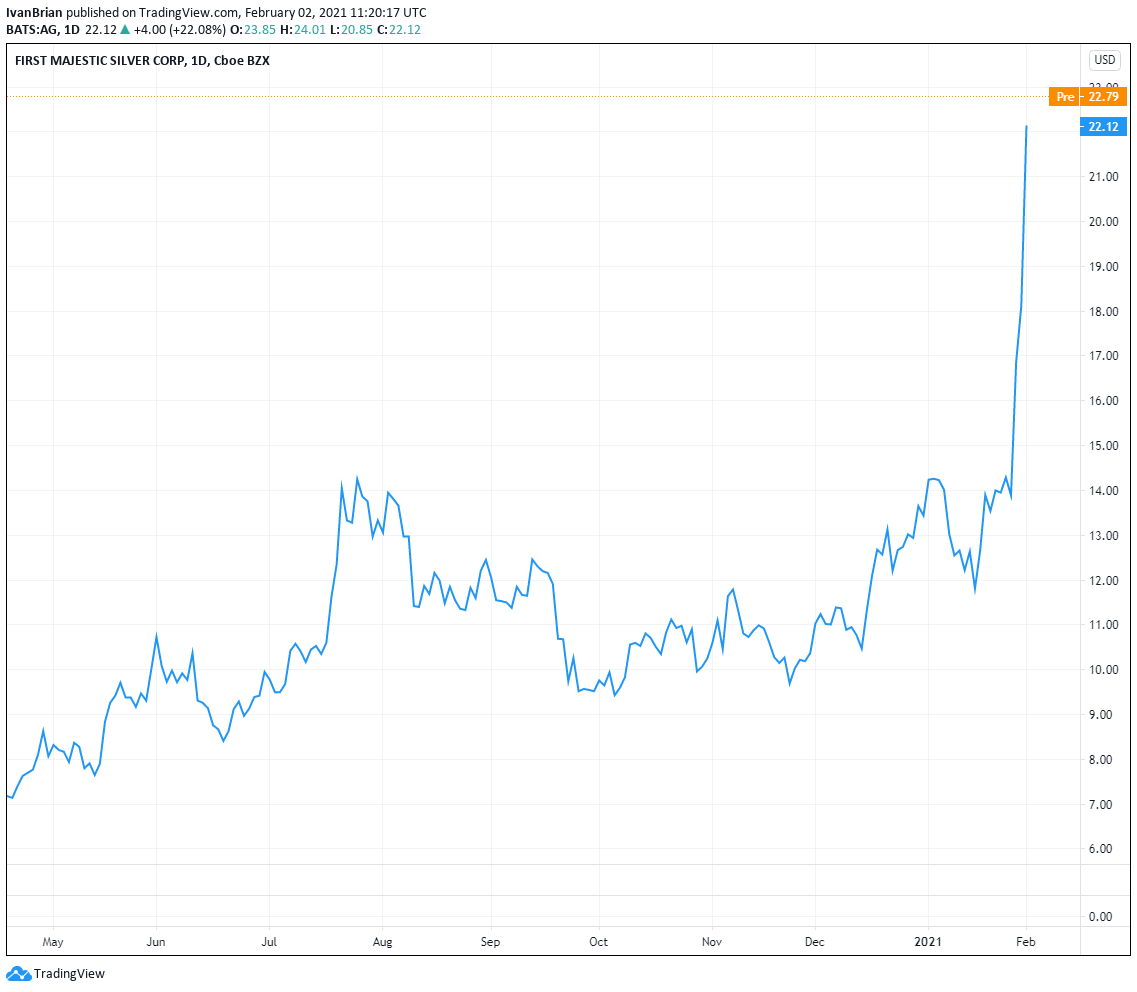

- Shares in First Majestic Silver (AG) are up nearly 60% in the last week.

- Silver prices have rallied 20% in the last week.

First Majestic Silver (AG) is a miner of precious metals and as the name suggests, primarily silver! 65% of AG’s revenue comes from silver with the balance coming from aluminium. So the performance of AG is largely determined by the price of silver. And silver has been on a charge lately, rising by over 20% to trade above $30, before falling back somewhat.

Another retail target

The reason for this charge has been the army of Reddit-fueled retail traders supposedly turning their attention to silver. However many members of the /wallstreetbets Reddit community dispute this saying they are staying with Gamestop (GME) and AMC.

Another short squeeze?

Either way silver has been on a charge and mining stocks have benefited. The FTSE100 is heavily weighted to mining stocks and was pulled along for the ride yesterday. To add to the factors helping push First Majestic Silver (AG) higher is the fact that AG has a healthy short interest, of over 23%. This has also drawn attention given the short-squeeze moves witnessed across a range of stocks in 2021.

Strong update, results due on Thursday

First Majestic (AG) released a positive update on January 20 with silver production higher than previously guided at 11.6 million ounces. Q4 earnings for AG are due to be released on February 4, 2021.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.