Euro climbs to multi-day peaks past 1.0900 as Dollar debilitates further

- The Euro keeps the optimism well and sound vs. the US Dollar.

- Stocks in Europe en route to a mixed close on Wednesday.

- EUR/USD advances further north of the 1.0900 mark.

- The USD Index (DXY) accelerates the decline and challenges 103.00.

- US yields lose their shine post-US data releases.

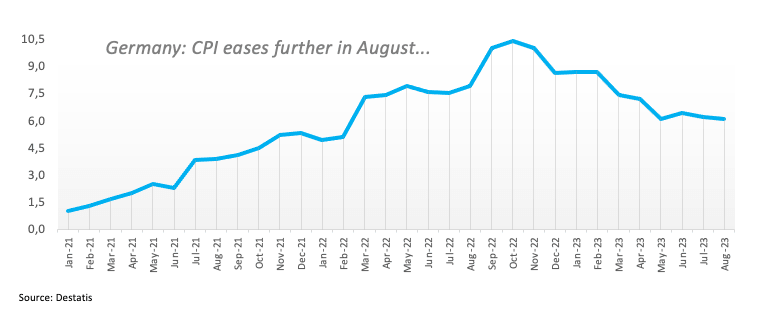

- Inflation in Germany is seen at 6.1% in the year to August.

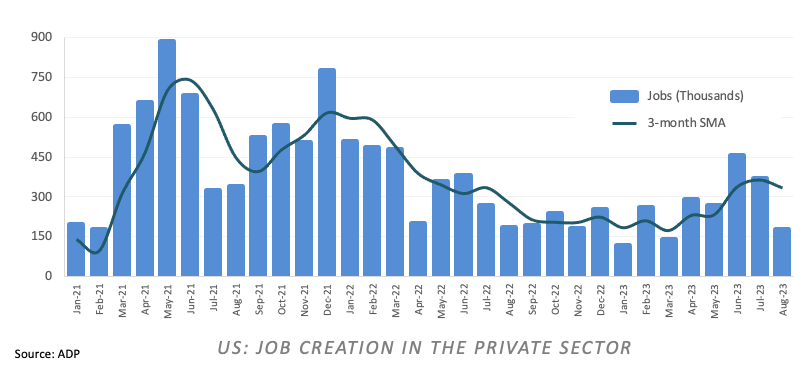

- US ADP report missed estimates at 177K jobs during last month.

The Euro (EUR) gathers extra pace vs. the US Dollar (USD), motivating EUR/USD to not only surpass the 1.0900 barrier but also advance to multi-day highs past 1.0930 as the European trading session draws to a close on Wednesday.

On the flip side, the Greenback succumbs to the persistent selling pressure and adds to Tuesday's data-led sharp pullback, relegating the USD Index (DXY) to print new multi-session lows and challenges the key support 103.00 ini the wake of the opening bell in Wall Street. The dollar's negative price action, in the meantime, comes in tandem with further decline in US yields, particularly in the short end and the belly of the curve.

In the meantime, the Federal Reserve’s (Fed) tighter-for-longer approach now appears somewhat dented in response to recent data releases, which also pour cold water over expectations of a 25 bps rate hike at the November 1 gathering.

By contrast, there is no news around the European Central Bank (ECB) regarding its potential decision on rates once the summer season is over.

Data-wise in the region, flash inflation figures in Spain see the CPI rising 2.6% in the year to August, while Consumer Confidence in Italy receded a tad to 106.5 and eased to -16 when it comes to the broader euro area. In Germany, flash inflation figures now see the CPI rising at an annualized 6.1% for the current month.

In the US, the ADP report showed the private sector added 177K jobs in August (vs. 195K expected), while another estimate of the Q2 GDP Growth Rate expects the economy to have expanded 2.1% YoY and flash Goods Trade Balance predicts the deficit to have widened to $91.18B in July. Finally, Pending Home Sales will close the calendar.

Daily digest market movers: Euro paves the way for extra gains

- The EUR extends the weekly uptrend vs. the USD.

- German and US bond yields reverse the earlier upside traction.

- Market participants will now shift their focus to the ADP results.

- JOLTs Job Openings dropped to the lowest level since March 2021 in July.

- The Fed's tighter-for-longer narrative seems to be losing momentum.

- Investors see the Fed on hold for the remainder of the year.

- Further stimulus measures are likely to be taken by the PBoC in the near term.

- BoJ’s Tamura favoured the current loose monetary conditions.

Technical Analysis: Euro now looks at 1.0970

EUR/USD’s weekly recovery faltered just ahead of the 1.0900 figure on Tuesday. The current upside momentum could leave further room for extra gains in the short term.

In case bulls push harder, EUR/USD is expected to face a minor resistance level at the weekly high of 1.0930 (August 22), which also appears reinforced by the provisional 100-day SMA. Further up comes the interim 55-day SMA at 1.0967, prior to the psychological 1.1000 barrier and the August top at 1.1064 (August 10). Once the latter is cleared, spot could challenge the weekly peak at 1.1149 (July 27). If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 (July 18). Further up comes the 2022 high at 1.1495 (February 10), which is closely followed by the round level of 1.1500.

The resumption of the downward bias could motivate the pair to revisit the August low of 1.0765 (August 25) ahead of the May low of 1.0635 (May 31) and the March low of 1.0516 (March 15). The loss of this level could prompt a test of the 2023 low at 1.0481 (January 6) to re-emerge on the horizon.

Furthermore, sustained losses are likely in EUR/USD once the 200-day SMA (1.0810) is breached in a convincing fashion.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.