EUR/USD tests 1.0900 heading into the Friday closing bell

- The EUR/USD is drifting higher in Friday trading, clipping into 1.0900.

- Markets are tilting risk-on as investors re-up on bets that the Fed is done with rate hikes.

- Investors to dig into the Fed's Meeting Minutes due next Tuesday.

The EUR/USD clipped into the 1.0900 handle late Friday to round out a trading week that saw an early rally into the 1.0880 region after catching a lift from the week's opening bids near 1.0680.

Forex Today: Worst week since July for the Dollar

US inflation figures softened noticeably this week, driving market sentiment back into the top end and sending the US Dollar (USD) lower across the board as risk-on bets piled into the Euro (EUR). The EUR/USD has been pinned into the top side as traders take a break from ongoing Federal Reserve (Fed) great hike concerns.

Markets rally as investors herald the end of Fed rate hikes

As growth and inflation figures ease in the US, money markets are pricing in a 100% chance of a rate hold from the Fed in December. With the Fed switching from an aggressive "higher for longer" stance to a more dovish "wait and see" approach to their regular rhetoric, investors are eating up any opportunity for risk appetite as US data continues to show inflation easing.

European finalized Harmonized Index of Consumer Prices (HICP) printed as expected early Friday, with October's month-on-month showing a 0.1% increase and the annualized number coming in at 2.9%.

European inflation is slowly easing back towards the 2% target band set by the European Central Bank (ECB), and forward-looking upside potential for the Euro may be capped now that the ECB looks well and done on rate hikes.

US housing data is helping to bolster risk sentiment for Friday

US Building Permits in October increased from 1.471 million (revised down from 1.475 million) to 1.487 million, beating the forecast decline to 1.45 million. October Housing Starts also beat the street, adding 1.372 million residential units compared to September's 1.346 million (also revised down from 1.458 million), beating the 1.35 million expected.

EUR/USD Technical Outlook

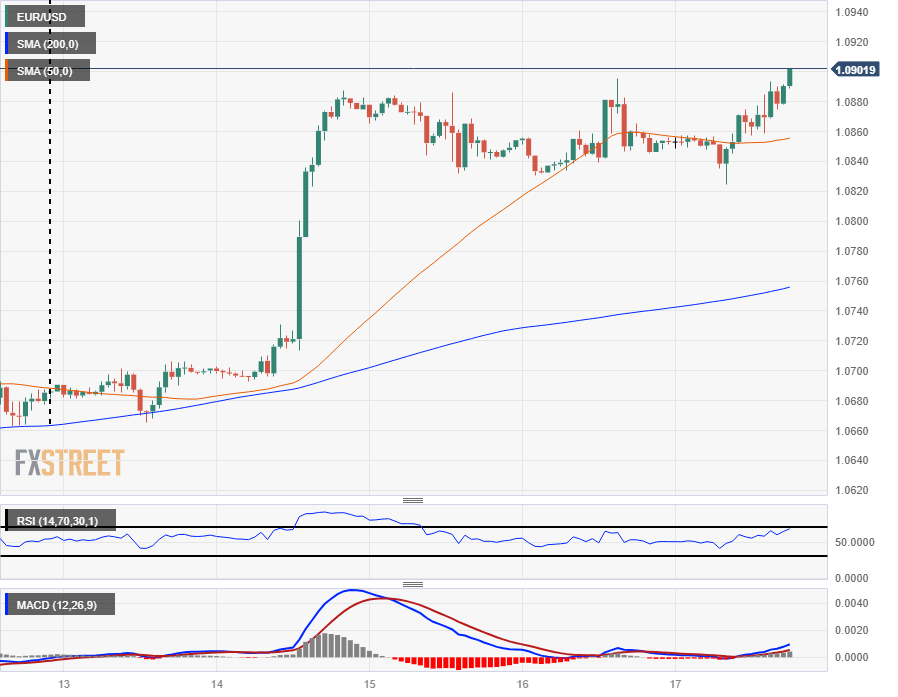

The EUR/USD's Friday risk-on rally sees the pair testing chart territory at the 1.0900 handle, pushing into fresh highs for the week ahead of the closing bell.

The Euro is up 2.2% against the US Dollar from the week's lows near 1.0665.

The EUR/USD caught a bounce from the 200-hour Simple Moving Average (SMA) last week, and the pair is testing into its highest bids since late August.

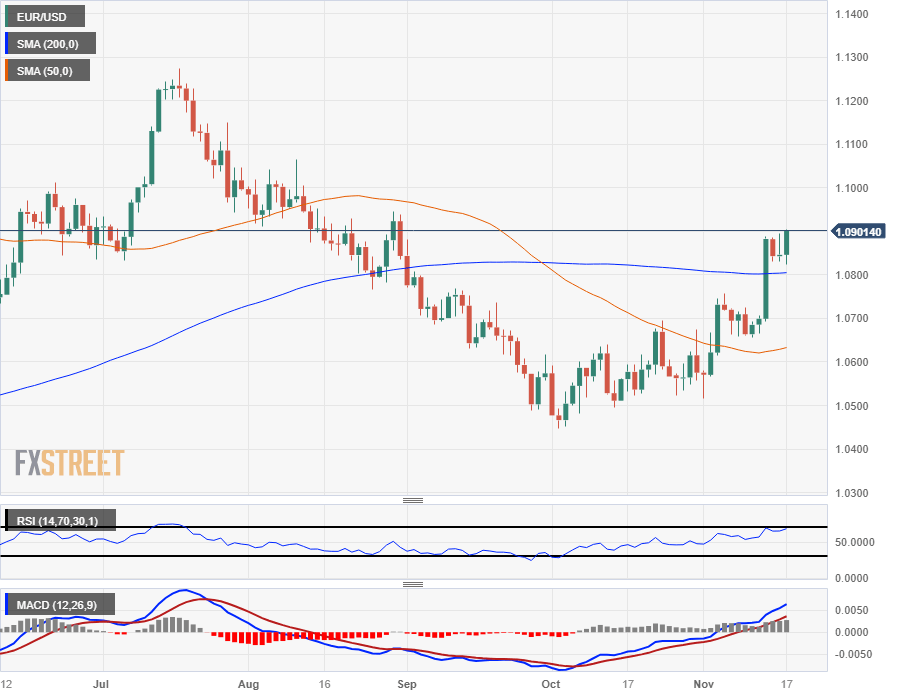

This week's rally above the 1.0800 handle sees the EUR/USD cracking the 200-day SMA and leaning into the bullish side for Friday, with the 50-day SMA rotating into a bullish stance just north of 1.0600 as the moving average struggles to keep up with the Euro's top side push.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.