EUR/USD weakens on broad USD strength, ECB commentary

- EUR/USD declines back to lower 1.0800s ahead of Wednesday’s Fed meeting.

- Speculation is mounting that the Fed could alter how many interest rate cuts it expects to make in 2024.

- Lagarde mentions falling wage inflation, a key metric for the ECB.

EUR/USD declines back to the lower 1.0800s on Wednesday, after several European Central Bank (ECB) speakers, including the President of the ECB Christine Lagarde and the Bank of Ireland Governor and ECB governing council member Gabriel Markhlouf cite lower inflation.

ECB's Lagarde highlighted lower wage inflation, something which at previous meetings she said the ECB would be watching closely before deciding future ECB policy moves.

"Average wage growth in 2024 for all existing wage contracts fell from 4.4% at the time of our January Governing Council meeting to 4.2% at the time of our meeting in March," said Lagarde at the ECB and its Watchers" conference on Wednesday.

Lower inflation increase the probability that the ECB will opt to cut interest rates which would be a negative move for the Euro (EUR) and the EUR/USD pair.

Interest rates, set by central banks, are a key driver of foreign exchange markets. Lower interest rates tend to depreciate a currency by attracting less foreign capital inflows and vice versa for higher interest rates.

EUR/USD could be impacted if Fed changes forecasts

EUR/USD could see volatility as the Federal Reserve (Fed) is scheduled to complete its March policy meeting at 18:00 GMT on Wednesday and while it is not expected to alter interest rates there is a chance it could revise its quarterly forecasts and accompanying statement. This could change the outlook for interest rates and therefore the US Dollar (USD) valuation.

Speculation is mounting that the Fed will revise its economic forecasts in the Summary of Economic Projections (SEP), and the “dot plot”, which reflects the Board of Governors of the Fed’s consensus of the future path of rates.

In the previous SEP, officials forecast three 25 basis points (0.25%) rate cuts in 2024 but some analysts now think there is a material risk that this could be revised down to two 25 bps cuts to reflect inflationary pressures remaining elevated.

“The summary of economic projections will be updated and contains hawkish risks in our assessment with the committee potentially projecting fewer cuts in 2024,” says David Doyle, head of economics at Macquarie, in a note about the Fed meeting.

ECB speakers take the stand

In Europe, a similar debate is going on about when to begin cutting interest rates, with two camps emerging – those who favor waiting until the European Central Bank’s June meeting to decide (the official camp) and a smaller mutineering group who want to keep alive the possibility of an early spring rate cut.

On Tuesday, Vice-President of the European Central Bank (ECB), Luis de Guindos, maintained allegiance with the June camp after he said “we have to wait,” because “services inflation” remains too high.

Wednesday sees a host of ECB talking heads appeared in public

The ECB President Christine Lagarde, ECB Chief Economist Philip Lane and ECB's Gabriel Markhlouf have all already spoken at the "ECB and its Watchers" conference. ECB Executive Board member Isabel Schnabel has also just made a speech in which she said the long-run level of interest rates in Europe may by rising.

Later, the President of the Bundesbank, Joachim Nagel, is scheduled to take the podium at a “Future of European Finance" conference at the ASKO Europa-Stiftung Foundation.

Technical Analysis: EUR/USD falls below key level

EUR/USD has penetrated below the level of the 1.0867 swing lows and in doing so probably reversed the direction of the short-term uptrend. Now the odds slightly favor more losses.

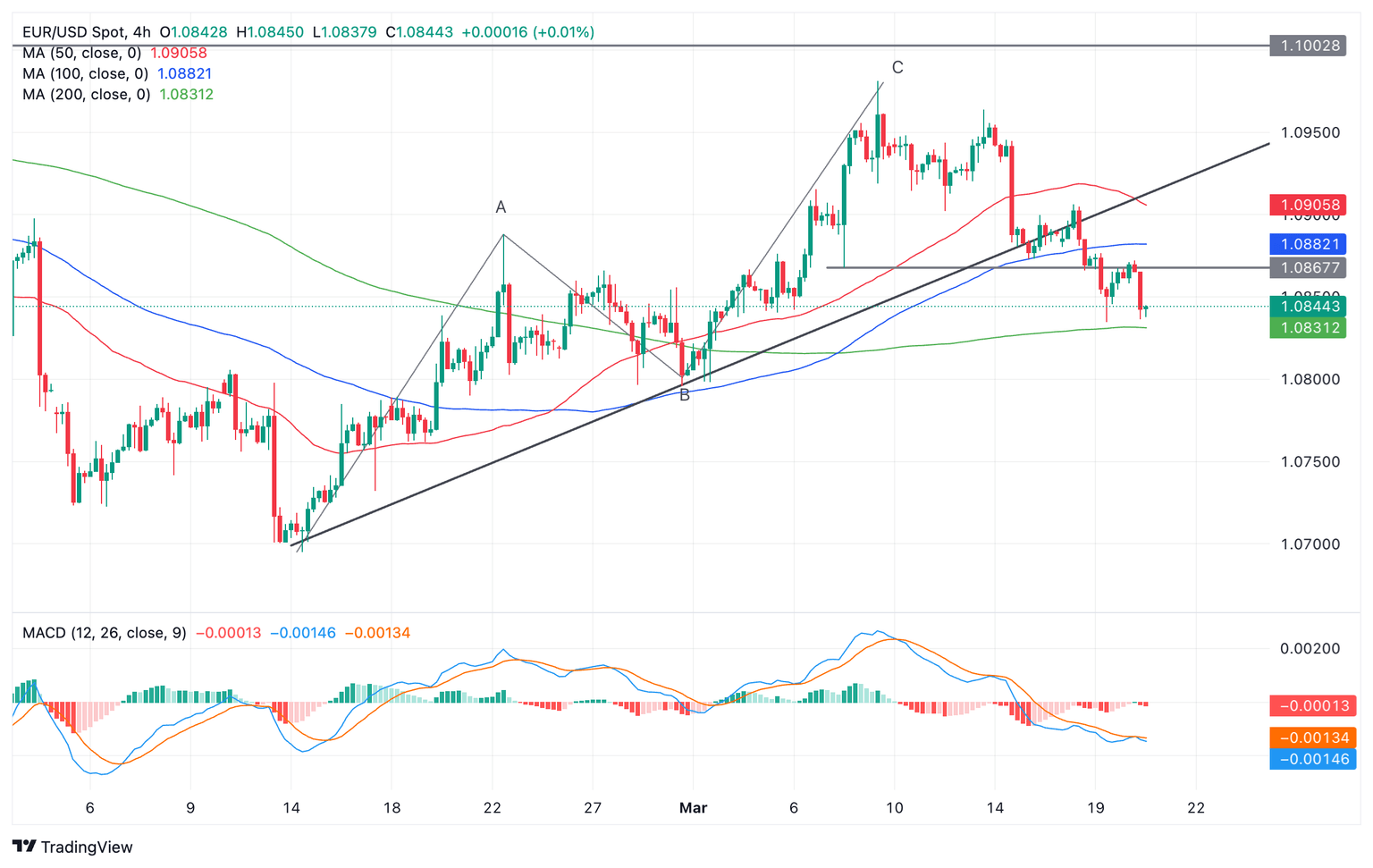

Euro versus US Dollar: 4-hour chart

Subject to fundamentals, the price will probably continue to fall to the next key support level at roughly 1.0800 – the lows of wave B of the Measured Move that unfolded in February and early March.

Tuesday’s sell-off fell to a low of 1.0835 before recovering and thereby forming a bullish Japanese hammer reversal candlestick pattern on the 4-hour chart. This was followed by a little move higher, however, since then upside has petered out and the pair has fallen back down.

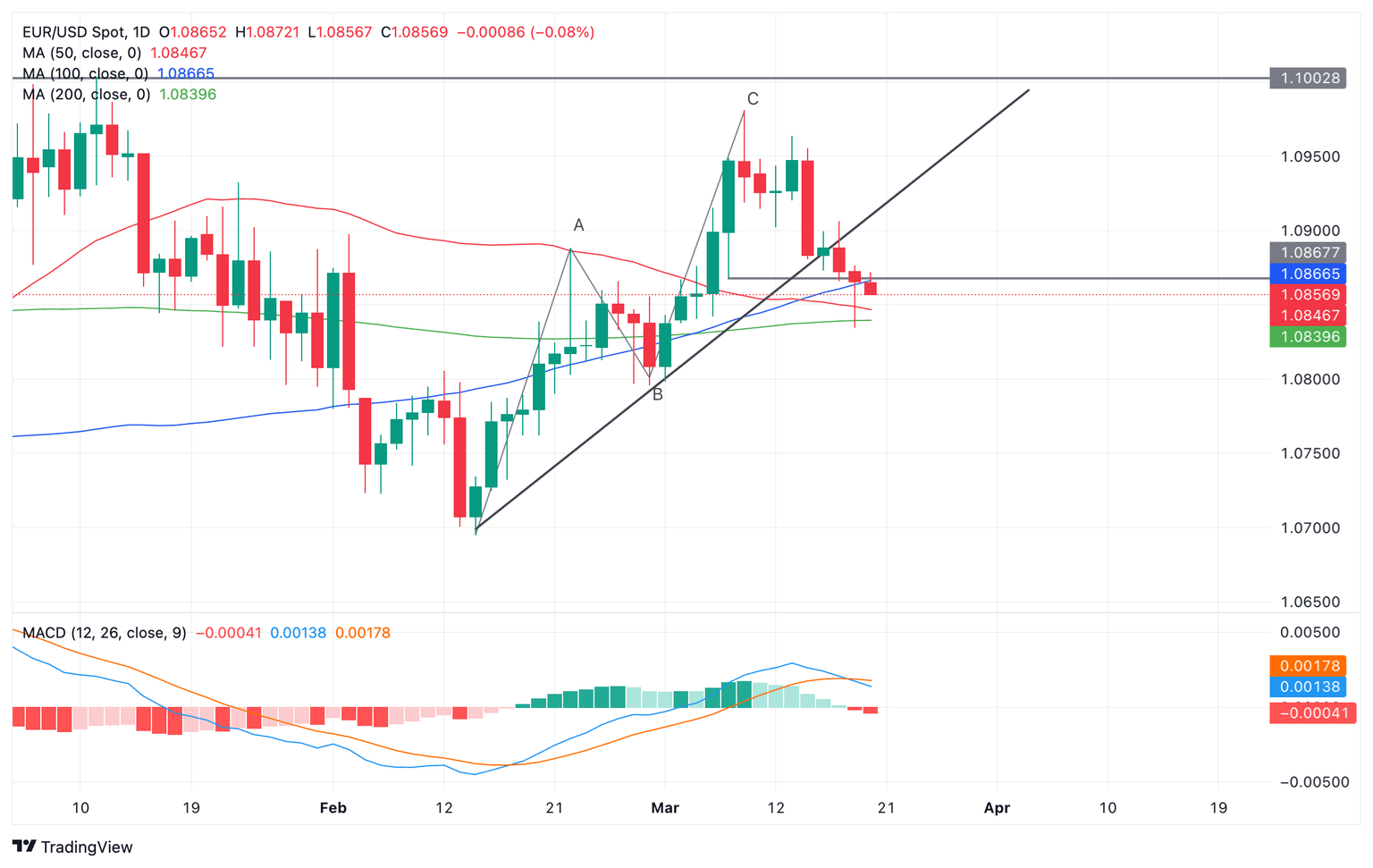

The daily chart below is showing the Moving Average Convergence/ Divergence (MACD) momentum indicator crossing over the signal line, giving a bearish sell signal, and adding further evidence to a change of trend.

However, it is also flagging up some key barriers to progress lower in the form of dynamic support from the red 50-day and then the green 200-day Simple Moving Averages (SMA).

Euro versus US Dollar: Daily chart

On Tuesday price penetrated the 50-day SMA situated at 1.0848 but was repulsed by the 200-day SMA at 1.0839, it has since fallen back down and is retesting the 200-day again. A break below the SMA and Tuesday's lows would provide bearish confirmation of further downside.

Alternatively, for a bullish recovery to be confirmed Wednesday needs to end on a bullish note as a green candlestick. If that is the case, EUR/USD is likely to continue its recovery higher.

(This story was corrected on March 20 at 12:40 GMT to say 'Tuesday's sell-off to a low of 1.0835' rather than Thursday's sell-off.)

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.