Crypto Today: XRP, Bitcoin and Ethereum decline as Ripple files response to SEC appeal

- XRP loses over 1.30% as Ripple's executive confirms the filing of an important document in the appeals process in the SEC lawsuit.

- Bitcoin corrects less than 1% and sustains above $67,500.

- Ethereum is down nearly 0.20%, holding above the key support level of $2,500.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades above $67,800 in the American session on Friday. The largest cryptocurrency by market capitalization has traded between $70,080 and $49,000 for nearly three months, since July 29. The crypto token is less than 10% away from its all-time high of $73,777.

- At the time of writing, Ethereum exchanges hands at $2,542, holding above key support of $2,500. Ethereum spot Exchange Traded Funds (ETFs) recorded a $2.3 million net inflow on Thursday, with no clear sign of an increase in institutional demand for Ether.

- XRP trades at $0.5248, losing nearly 1.35% value on the day. Ripple’s Chief Legal Officer (CLO), Stuart Alderoty, assuaged XRP holders’ concerns and confirmed the filing of Form C, a key document that lists legal issues that the firm will address in the appeals process. Find out more about it here: XRP fails to recover even as Ripple files appeal in response to SEC's move

Chart of the day: Pendle (PENDLE)

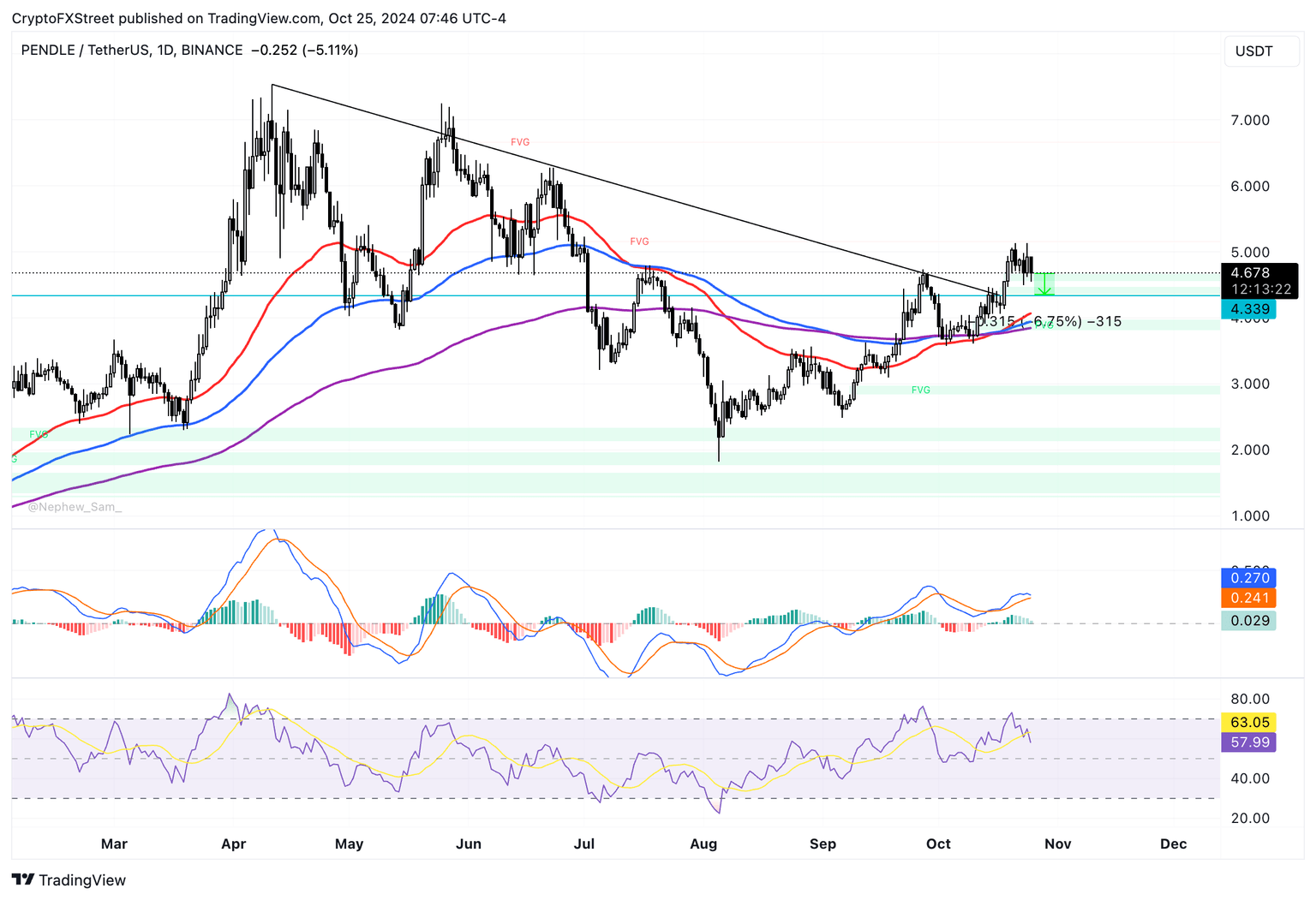

Pendle erases over 5% of its value on the day. The token ranks among cryptocurrencies that yielded the most negative returns for traders on Friday. PENDLE could extend its losses by an additional 7%, down to $4.339, the lower boundary of a Fair Value Gap (FVG) and the October 17 high.

The Moving Average Convergence Divergence (MACD) indicator shows consecutively shorter red histogram bars in the daily chart. This means that the underlying positive momentum on PENDLE is slowly waning.

PENDLE/USDT daily chart

A daily candlestick close at the June 28 high of $5.365 could invalidate the bearish thesis. PENDLE could target the June 26 high of $5.788, nearly 23% gain from the current level.

Market updates

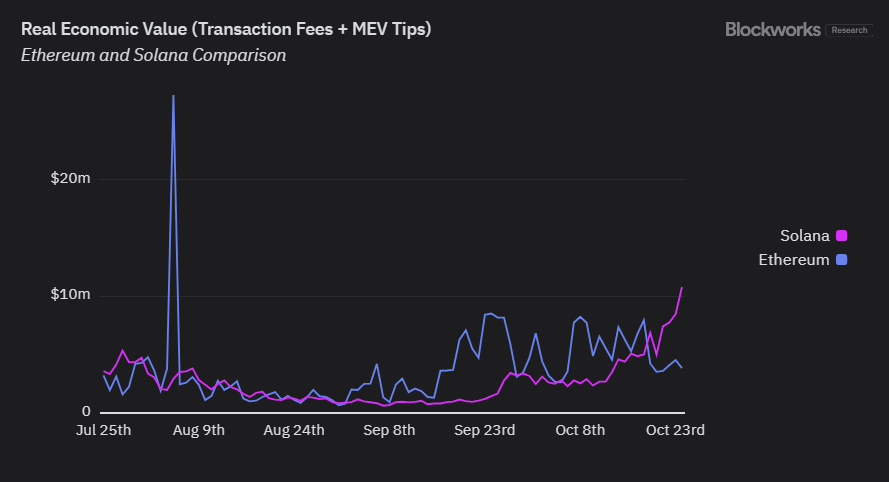

- A Blockworks research dashboard shows that Solana’s network real economic value, calculated as a sum of transaction fees and tips earned by validators, crossed $11 million on Thursday. This marks a new all-time high for the chain and is likely driven by interest in meme coins.

Real economic value of Solana

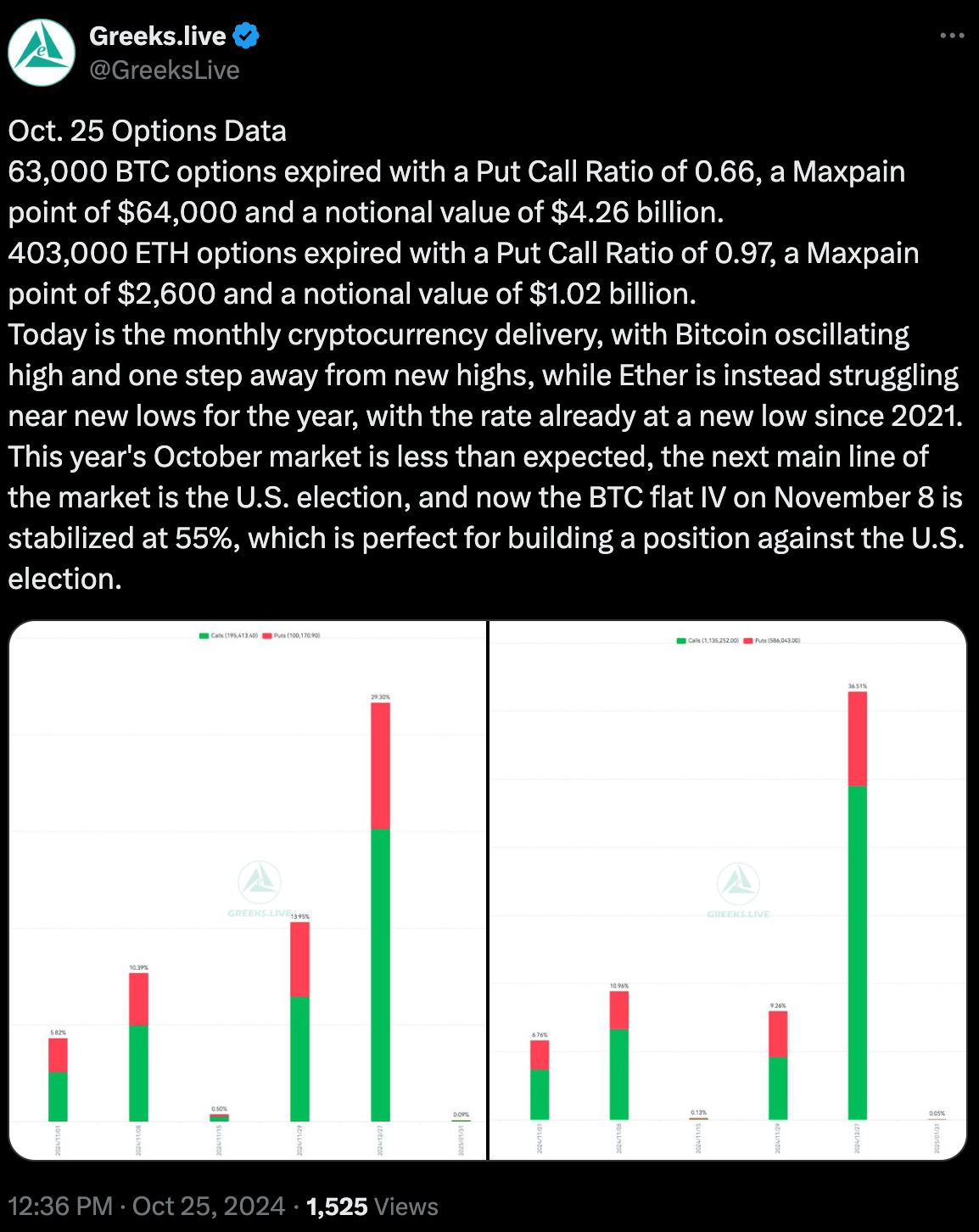

- Bitcoin options worth $4.26 billion expire on Friday. BTC hovers around $68,000 ahead of the options expiry.

Bitcoin options expiry

- CoinGecko’s study shows that among the existing blockchains, Cosmos has the highest yield, offering up to 18.50% with approximately 248.8 million ATOM tokens staked.

Industry updates

- US Securities & Exchange Commission (SEC) Commissioner Mark Uyeda compared the regulator’s crypto approach to other countries in the Indo-Pacific region. When comparing the different agency’s approach to crypto and fintech, Uyeda said at the AIMA APAC Annual Forum in Hong Kong on Wednesday that the US continues to grapple with unclear regulatory frameworks for digital assets, while countries like Japan, Singapore, Hong Kong, and Australia have taken a leadership role in fostering innovation.

- WazirX, an Indian cryptocurrency exchange that suffered an exploit earlier this year, published a new proof of reserves report.

Proof of Reserves is now live

— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) October 25, 2024

In line with our commitment to transparency, you can now verify wallet addresses and review asset balances through our Proof of Reserves.

Click here https://t.co/Aivwy4nYCP

Note: A Proof of Reserves dashboard with dynamically updated data… pic.twitter.com/0yrg9zvrQT

- Crypto Intelligence tracker Arkham Intelligence states that $20.7 million worth of funds appear to have been stolen from US government wallets.

: $.

— Arkham (@ArkhamIntel) October 24, 2024

$20M in USDC, USDT, aUSDC and ETH has been suspiciously moved from a USG-linked address 0xc9E6E51C7dA9FF1198fdC5b3369EfeDA9b19C34c to… pic.twitter.com/UXn1atE1Wx

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.