EUR/USD strengthens amid consistent improvement in Eurozone’s PMI

- EUR/USD finds cushion near 1.0800 amid improvement in the Eurozone’s economic outlook.

- The ECB is set to start reducing interest rates from the June meeting.

- The US Dollar drops even though traders pare back Fed rate-cut bets.

EUR/USD seems well-supported above the round-level support of 1.0800 in Friday’s New York session. The strength in the major currency pair is majorly driven by strong Eurozone preliminary Purchasing Managers Index (PMI) data for May. The strong Composite PMI has improved the Eurozone’s economic outlook, but the likelihood of the European Central Bank (ECB) lowering interest rates in the short term remains firm.

S&P Global reported on Thursday that the Composite PMI jumped to 52.3, beating the consensus of 52.0 and the former release of 51.7. The PMI data rose for the third consecutive month even though the ECB is maintaining a restrictive policy framework.

Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank (HCOB) – which also publishes the PMI data in collaboration with S&P Global – said: “This time, there is also some good news for the ECB as the rates of inflation for input and output prices in the services sector have softened compared to the month before. This will be supportive of the apparent stance of the ECB to cut rates at the meeting on June 6. However, the better inflation outlook will most probably not be enough for the central bank to announce that further rate cuts will follow suit.”

Meanwhile, deepening uncertainty over whether the ECB would reduce interest rates in the July meeting too is keeping the Euro firm. In Friday's European session, ECB board member Isabel Schnabel advised that the centreal bank should be cautious over lowering interest rates quickly. Schnabel agreed that there is a noticeable decline in price pressures but some elements such as domestic and service inflation are still persistent.

Daily digest market movers: EUR/USD rises further as US Dollar falls sharply

- EUR/USD holds the crucial support of 1.0800 as the US Dollar declines despite upbeat data from the United States and deepening uncertainty about when the Federal Reserve (Fed) will start reducing interest rates. The early PMI print by S&P Global for May showed that the Composite PMI also beat expectations in the US, exceeding the prior reading due to robust growth in both manufacturing and service activities.

- The US preliminary PMI numbers suggested that business activity rose at the fastest pace in just over two years after two months of slower growth, indicating that the economy is on track to post solid Gross Domestic Product (GDP) gain in the second quarter. Strong US PMI data has weakened market speculation that the Fed will start reducing interest rates from the September meeting.

- The CME FedWatch tool shows that the probability for rate cuts from their current levels in September has been reduced to 53% from 64% recorded a week ago. Meanwhile, hawkish guidance on interest rates by Fed policymakers has also weighed on rate-cut bets for September.

- On Thursday, Atlanta Fed Bank President Raphael Bostic said the central bank may need to wait for the rate-cut consideration amid upside risks to inflation despite a slowdown in price pressures in April’s Consumer Price Index (CPI) report, Reuters reported. In a virtual class session with Stanford University business school students, Bostic said prices of a few goods are increasing at a faster pace than what is required to bring inflation down to the 2% target. Bostic added that a strong job market gives him comfort in maintaining a restrictive stance on interest rates.

- Meanwhile, the US Census Bureau has posted stronger-than-expected Durable Goods Orders data for April. The agency reported that Durable Goods Orders surprisingly rose by 0.7% while investors expected them to decline by 0.8%. The Durable Goods Orders data is a leading indicator of the core Consumer Price Index (CPI), and higher demand for durable goods suggests a stubborn inflation outlook.

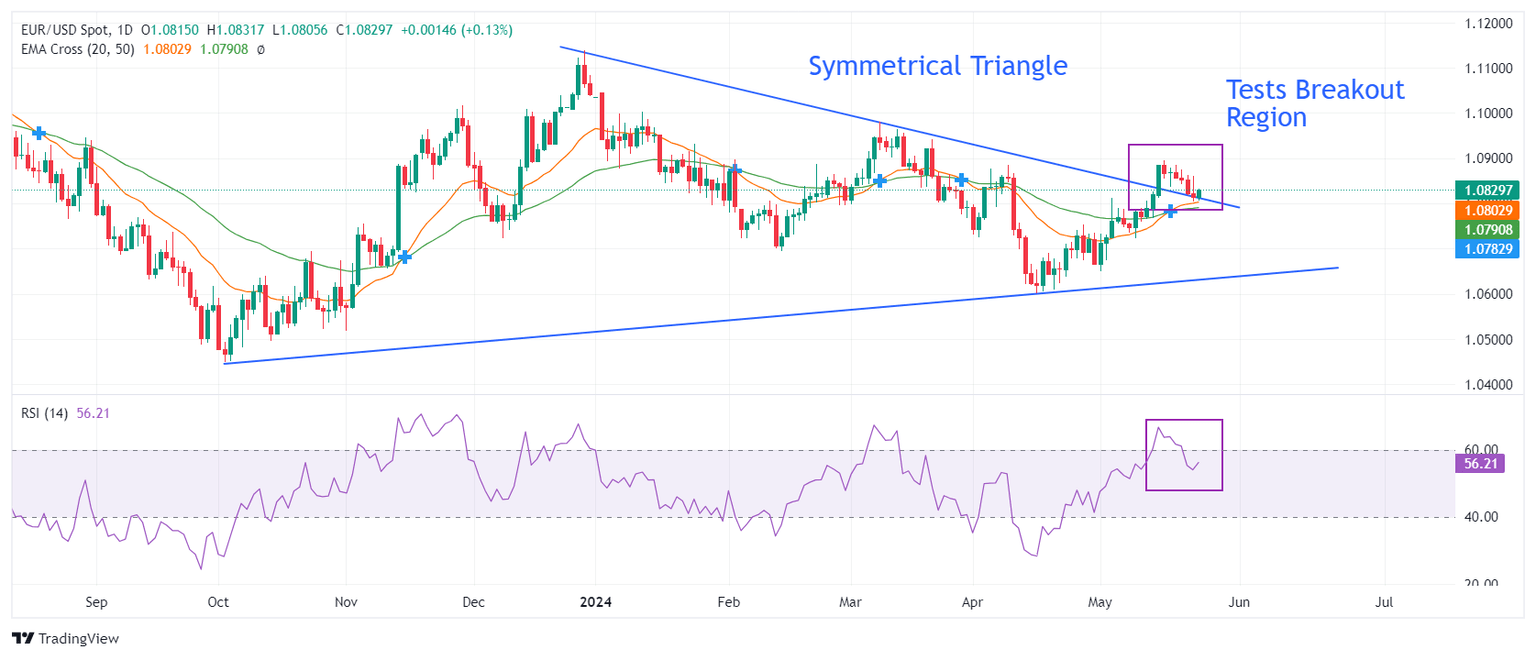

Technical Analysis: EUR/USD jumps to 1.0850

EUR/USD finds buying interest near the breakout region of the Symmetrical Triangle formed on the daily time frame around 1.0800. The near-term outlook of the shared currency pair remains firm as the 20-day and 50-day Exponential Moving Averages (EMAs) have delivered a bullish crossover around 1.0780.

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00, suggesting that the momentum, which was leaned toward the upside has faded for now.

The major currency pair is expected to recapture a two-month high around 1.0900. A decisive break above this level would drive the asset towards March 21 high around 1.0950 and the psychological resistance of 1.1000. However, a downside move below the 200-day EMA at 1.0800 could push it further down.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.