EUR/USD recovery fizzles out just above 1.05

- EUR/USD gave back nearly half of a percent on Wednesday.

- A muted release calendar to bolster the Euro in the midweek.

- Fiber traders waiting for Friday’s PMI business activity prints.

EUR/USD bulls frayed at their ends during the midweek hump session, giving back nearly half of a percent and keeping Fiber price action hamstrung just north of the 1.0500 major handle. Thursday is a quiet showing on the economic calendar for both the Euro and the Greenback, leaving markets to sit and twiddle their thumbs until Friday’s Purchasing Managers Index (PMI) figures get released at the tail-end of the trading week.

European Central Bank (ECB) President Christine Lagarde will be making an appearance on Friday at the 34th annual European Banking Conference in Frankfurt. The ECB head is expected to hit familiar notes while discussing the state of EU monetary policy and how it impacts the banking sector, though traders will be keeping an ear out for any tidbits about the possible direction the ECB is leaning as it pertains to rate cuts in the near term.

European HCOB Purchasing Managers Index (PMI) survey results will drop on markets while ECB President Lagarde is delivering prepared notes. Pan-EU business activity survey figures are expected to hold flat in November, with the Composite PMI headliner forecast to print at a steady 50.0

The key data print this week will be S&P Purchasing Managers Index (PMI) survey results, which are due on Friday. Markets are anticipating a slight increase in Manufacturing PMI figures, expected to rise to 48.8 from the previous 48.5, while the Services component is expected to rise by a similar amount, to 55.3 from 55.0.

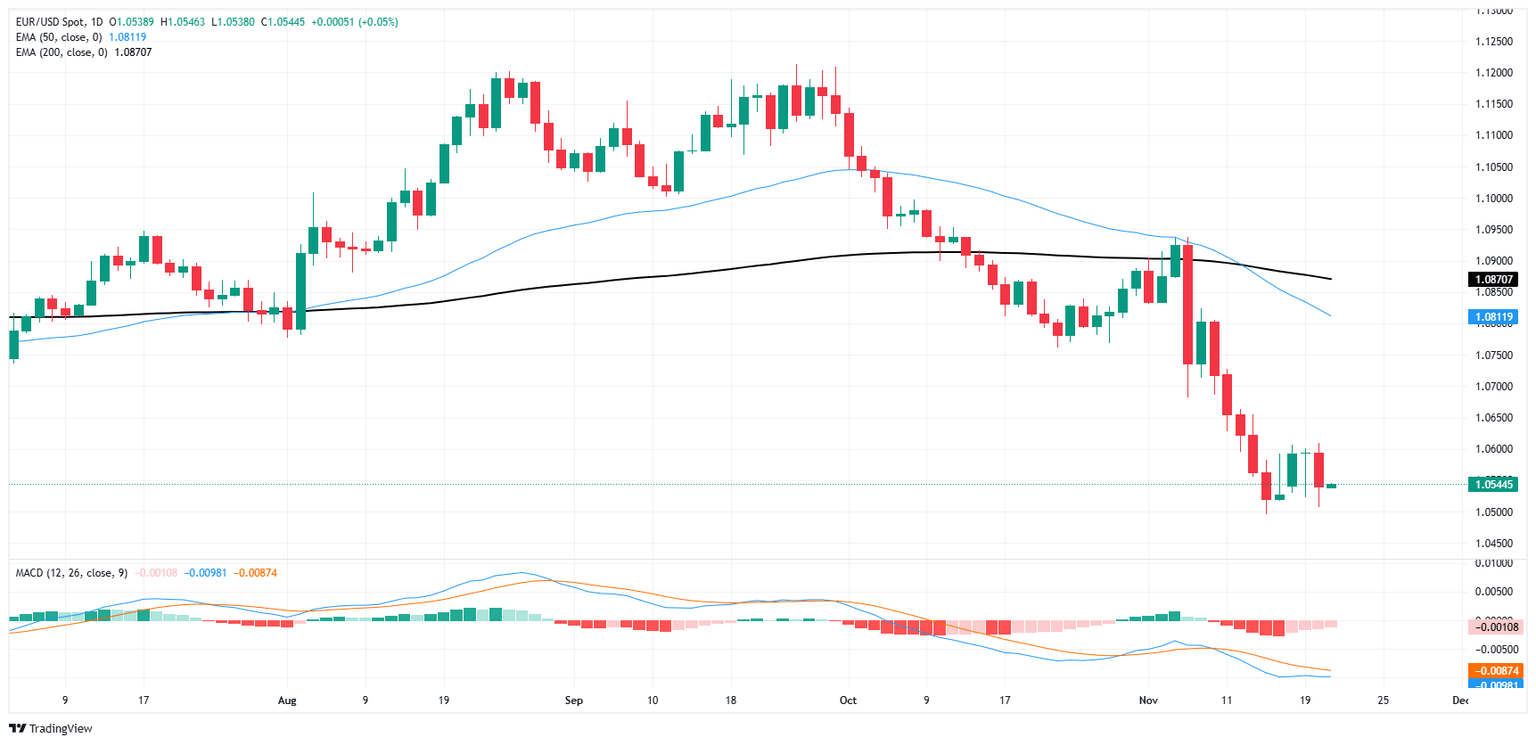

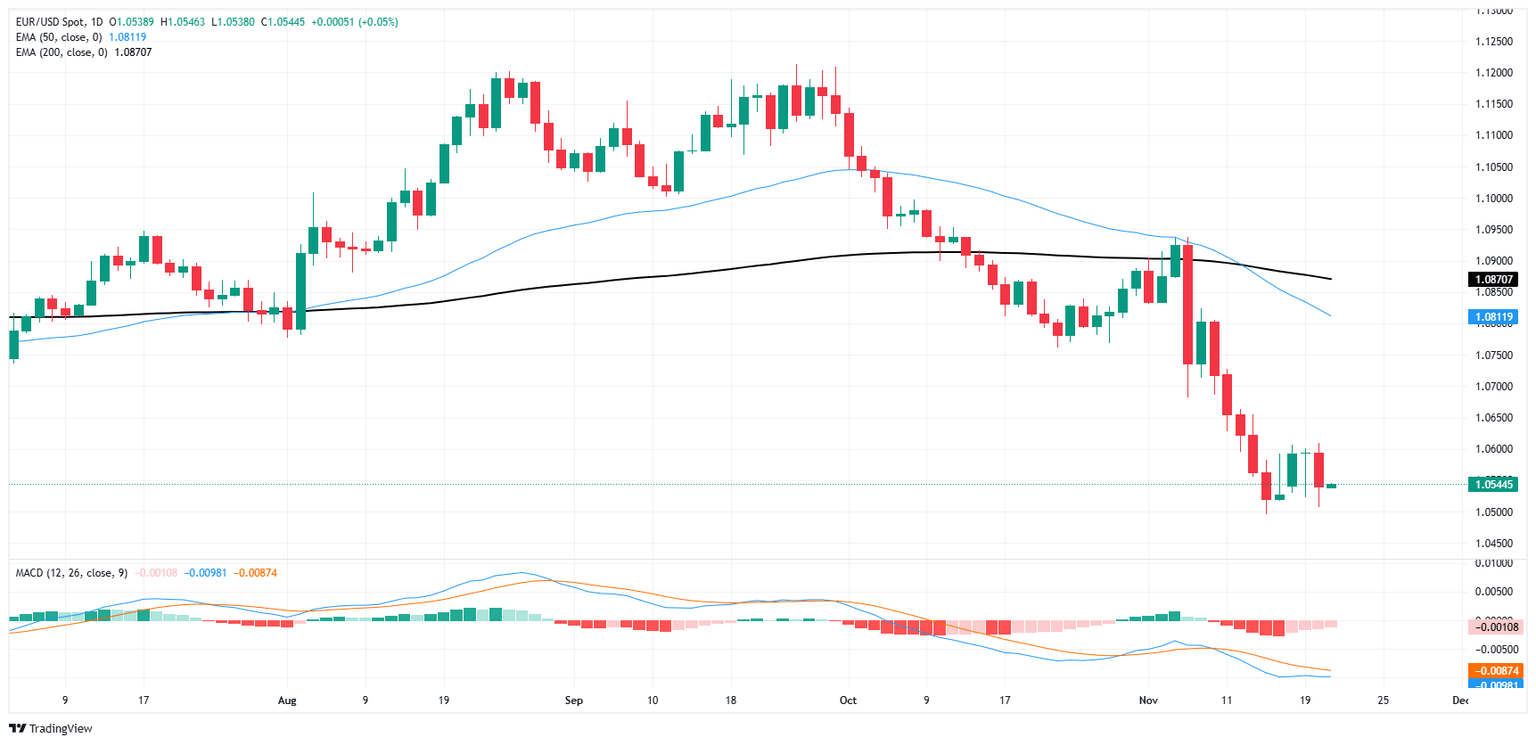

EUR/USD price forecast

EUR/USD is trapped near its lowest bids in over a year after tapping a 54-week low last Wednesday. A near-term bullish recovery sputtered out almost as quickly as it began, with bidders running into the much near 1.0600 and failing to capture higher ground.

Fiber is down around 6% from September’s peaks above 1.1200, and the Euro’s technical picture has changed significantly in a short amount of time. EUR/USD is still trapped on the south end of the 50-day Exponential Moving Average (EMA), which is accelerating into the low side and poised to pass through 1.0800 in short order.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.