EUR/USD Price Analysis: Up up up it goes

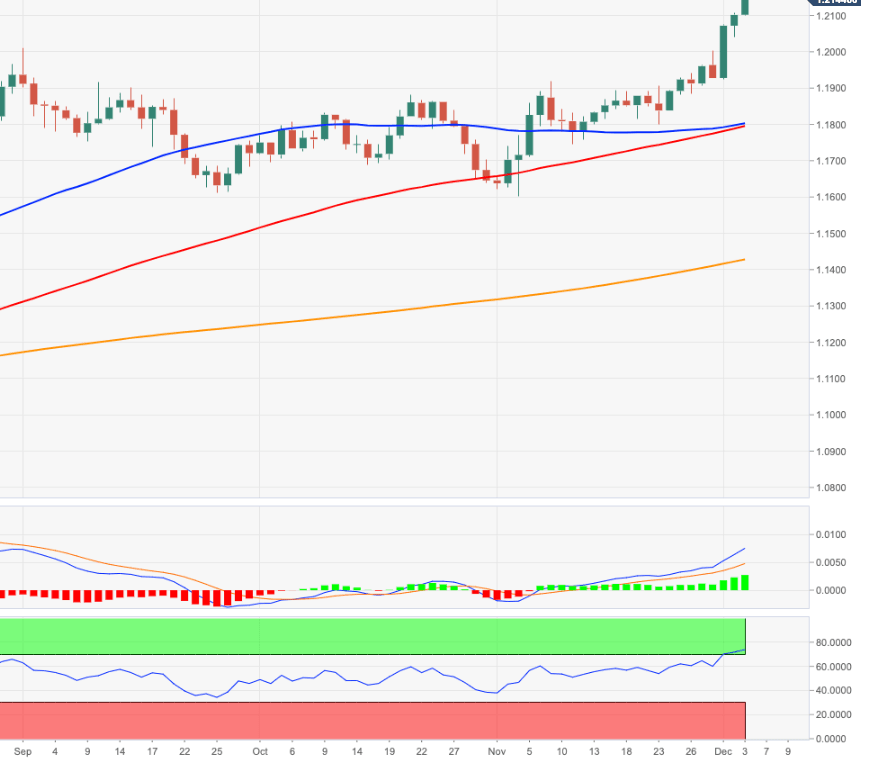

- EUR/USD pushes higher and quickly surpasses the 1.21 mark.

- Immediate, interim hurdles are located at 1.2413 and 1.2476.

EUR/USD remains bid and extends the rally further north of the 1.21 yardstick on Thursday, levels last traded back in April 2018.

The positive stance in EUR/USD remains unchanged and allows for the continuation of the uptrend in the near-term at least. That said, next on the upside come in 1.2413 (April 2018 high) ahead of 1.2476 (March 2018 high). Further north emerges the more relevant barrier at the 2018 high in the mid-1.2500s.

Looking at the broader scenario, extra gains in EUR/USD are likely while above the critical 200-day SMA, today at 1.1426. The 200-week SMA at 1.1437 also reinforces this view.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.