EUR/USD Price Analysis: Downside thesis gaining traction, bears hunting down 1.0770s that guard 1.0750

- EUR/USD bears are in control and eye the 38.2% Fibonacci retracement that aligns with the prior resistance near 1.0720.

- 1.0720 guards a deeper move into the Fibo scale and a 50% mean reversion within the scale cannot be ruled out near 1.0680.

- EUR/USD bears need to get below 1.0770 first.

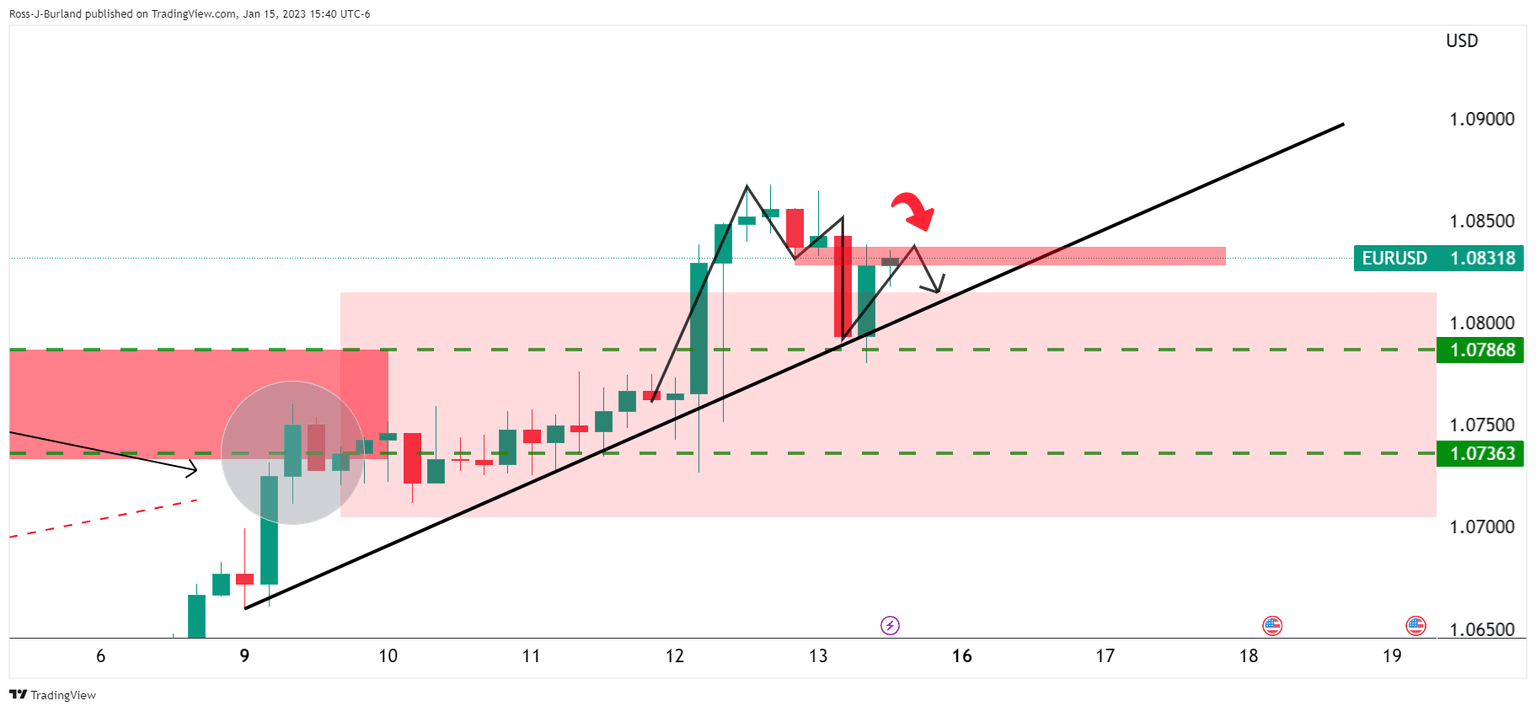

As per the start of the week's analysis, EUR/USD Price Analysis: Bulls have been capped and eyes are on 1.0720, the downside is playing out as the week continues to move along with the price picking up the pace on the offer on Tuesday, helped along by ECB policymakers starting to consider a slower pace of interest-rate hikes.

EUR/USD start of the week analysis

A downside thesis was in play as bulls ran into a trap with breakout traders enthused by the US Consumer Price Index and a move through 1.0800 into 1.0850. However, there has been no follow-through:

The analysis highlighted the downside risks as illustrated above. The price has since stalled and is on track for a re-test of 1.0780s and lower towards 1.0700. However, the bears needed to break trendline support on the lower time frames, such as the 4-hour chart as follows:

EUR/USD update

We got there eventually and today's thrust to the downside likely seals the deal for a deeper bearish correction with a bearish head and shoulders in play:

We have one broken structure at 1.0801 but bears need to get below 1.0780/70 to really nail in the coffin.

Nevertheless, the bears are on track for the daily downside targets as follows:

The 38.2% Fibonacci retracement that aligns with the prior resistance structures could be a target near 1.0720. This structure guards a deeper move into the Fibo scale and a 50% mean reversion within the scale cannot be ruled out near 1.0680.

However, the bears need to get below 1.0770 first.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.