EUR/USD Price Analysis: Bulls have been capped and eyes are on 1.0720

- EUR/USD's 1.0820 structure has been broken.

- Eyes are on a test below 1.0770 that guards the risk of a drop towards 1.0700/20 support.

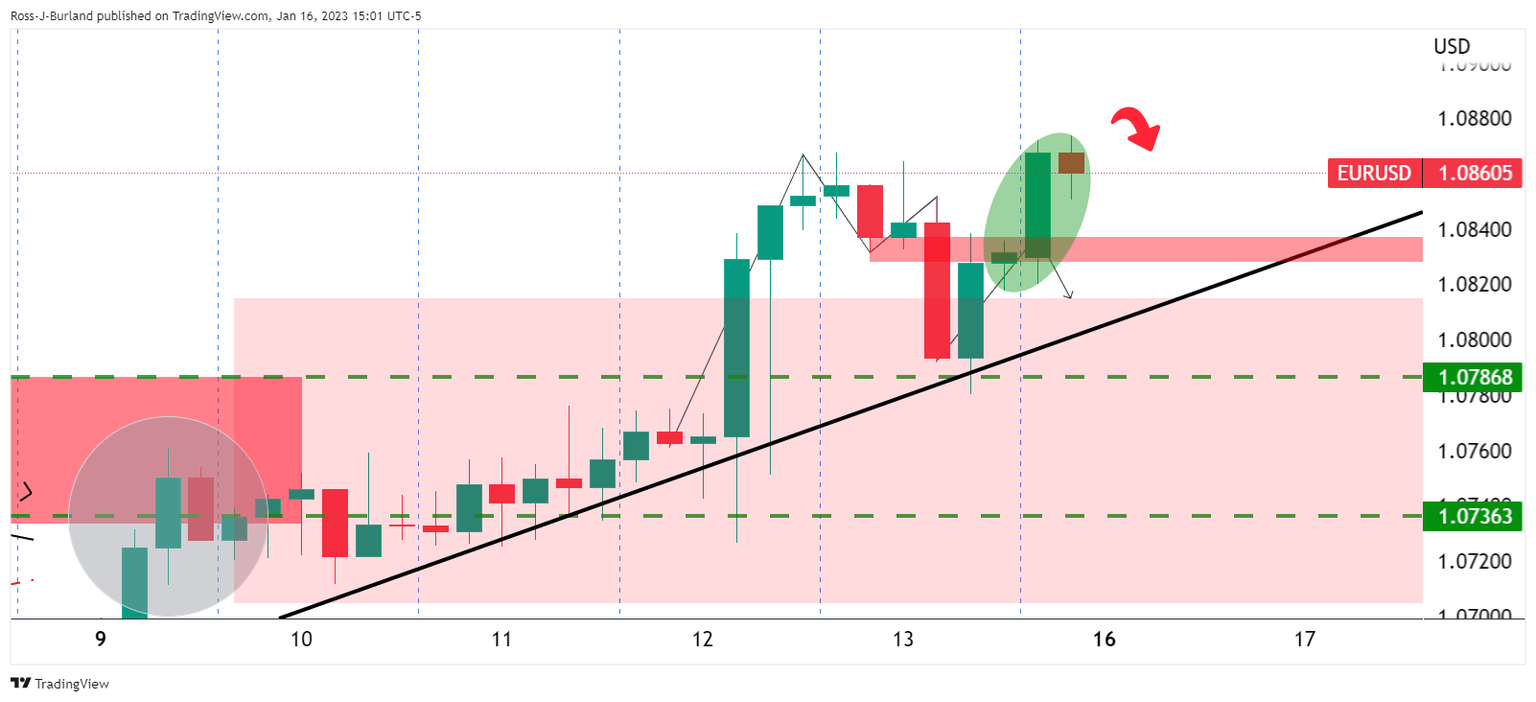

As per the start of the week's analysis, EUR/USD Price Analysis: Bears attacking the bullish H4 trendline support, the bears needed to break trendline support on the lower time frames, such as the 4-hour chart as follows:

It was stated that The M-formation was compelling in this regard, but the neckline needed to hold for the open to reaffirm a bearish bias and prospects of a break of the trendline and downside potential for the week ahead.

Instead, the bulls moved in and took out the neckline as follows:

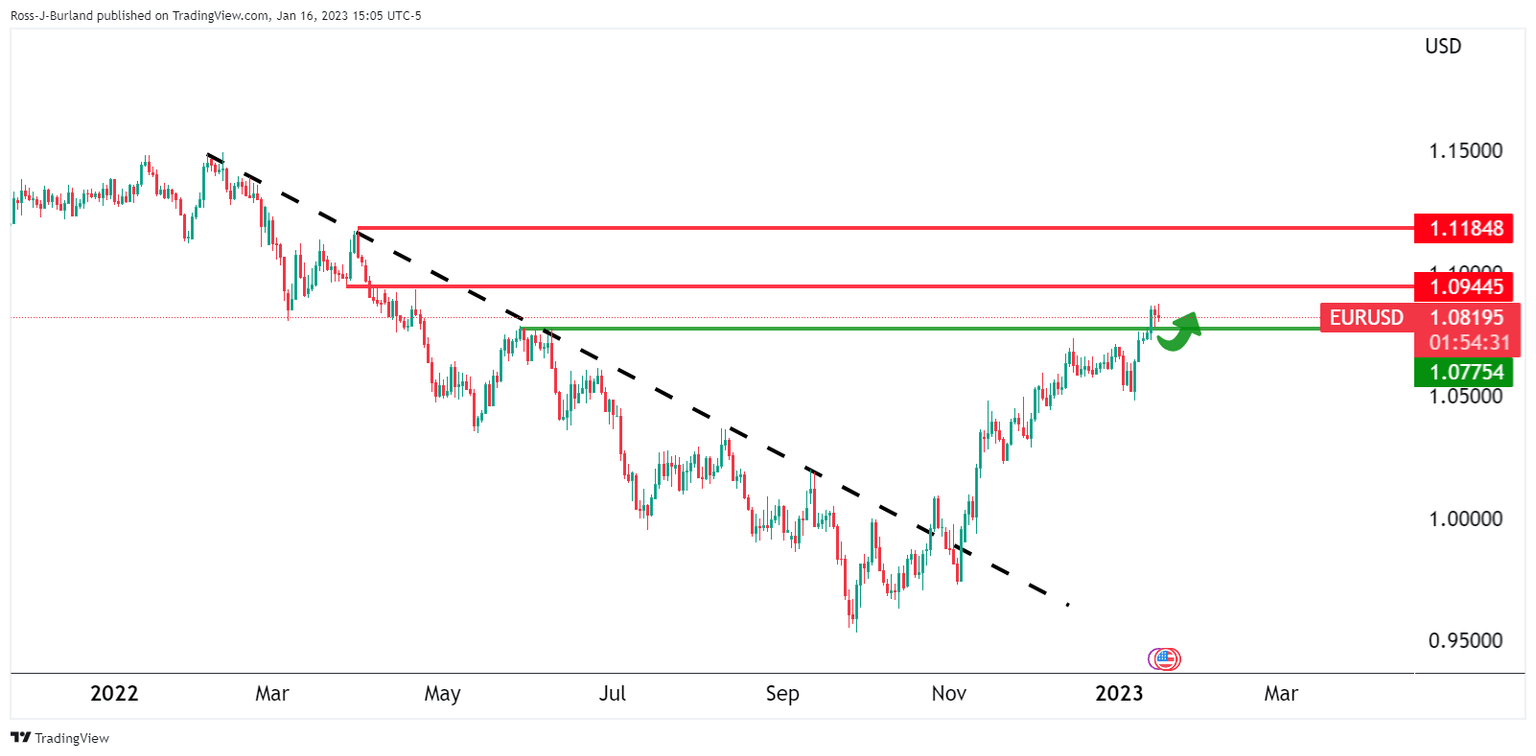

The move has been significant as it has taken out the 1.90775 horizontal resistance that could now start to act as support:

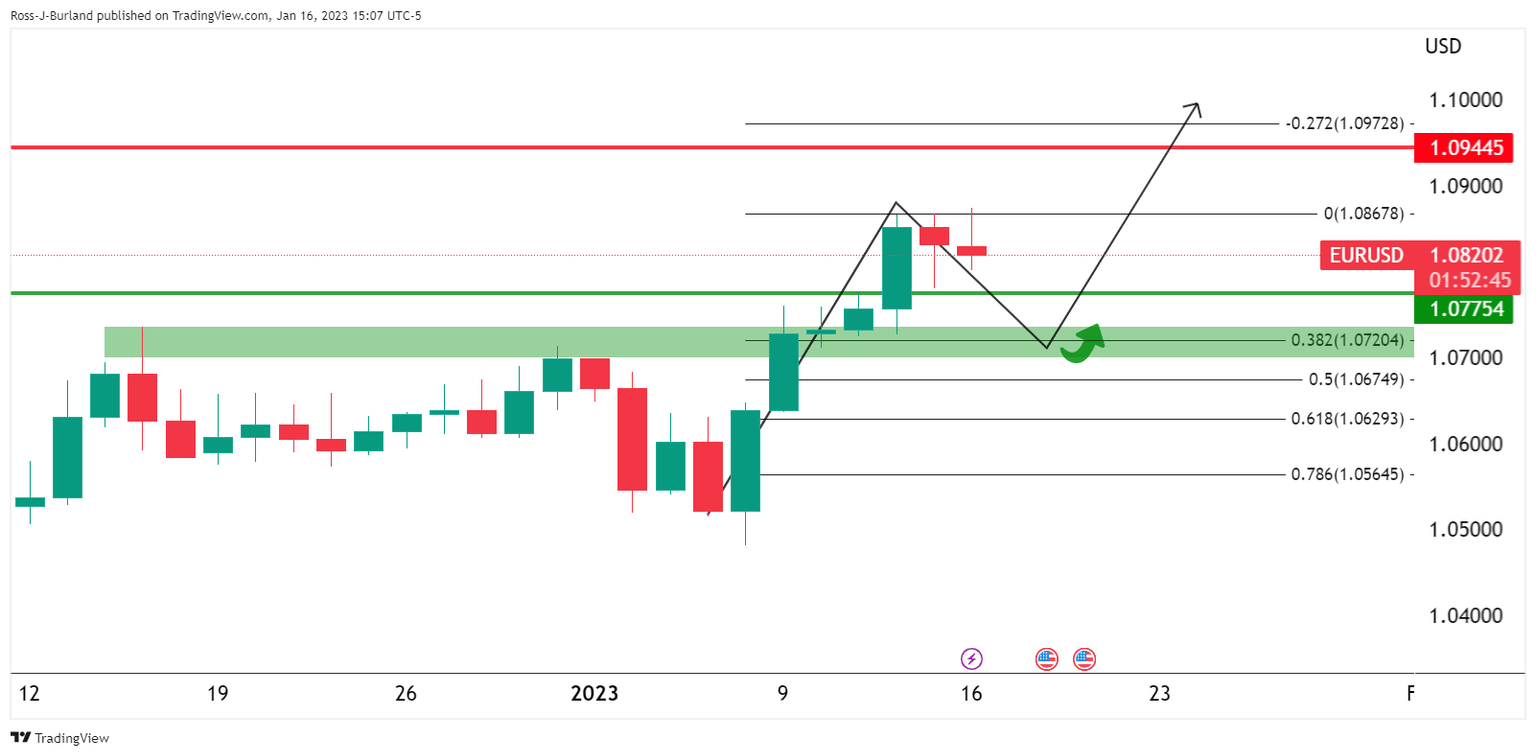

With that being said, the daily W-formation remains compelling as the price decelerates on the bid:

The bulls will be expected to defend the 1.0700 figure on a retest and that could lead to an onward continuation as illustrated in the chart above.

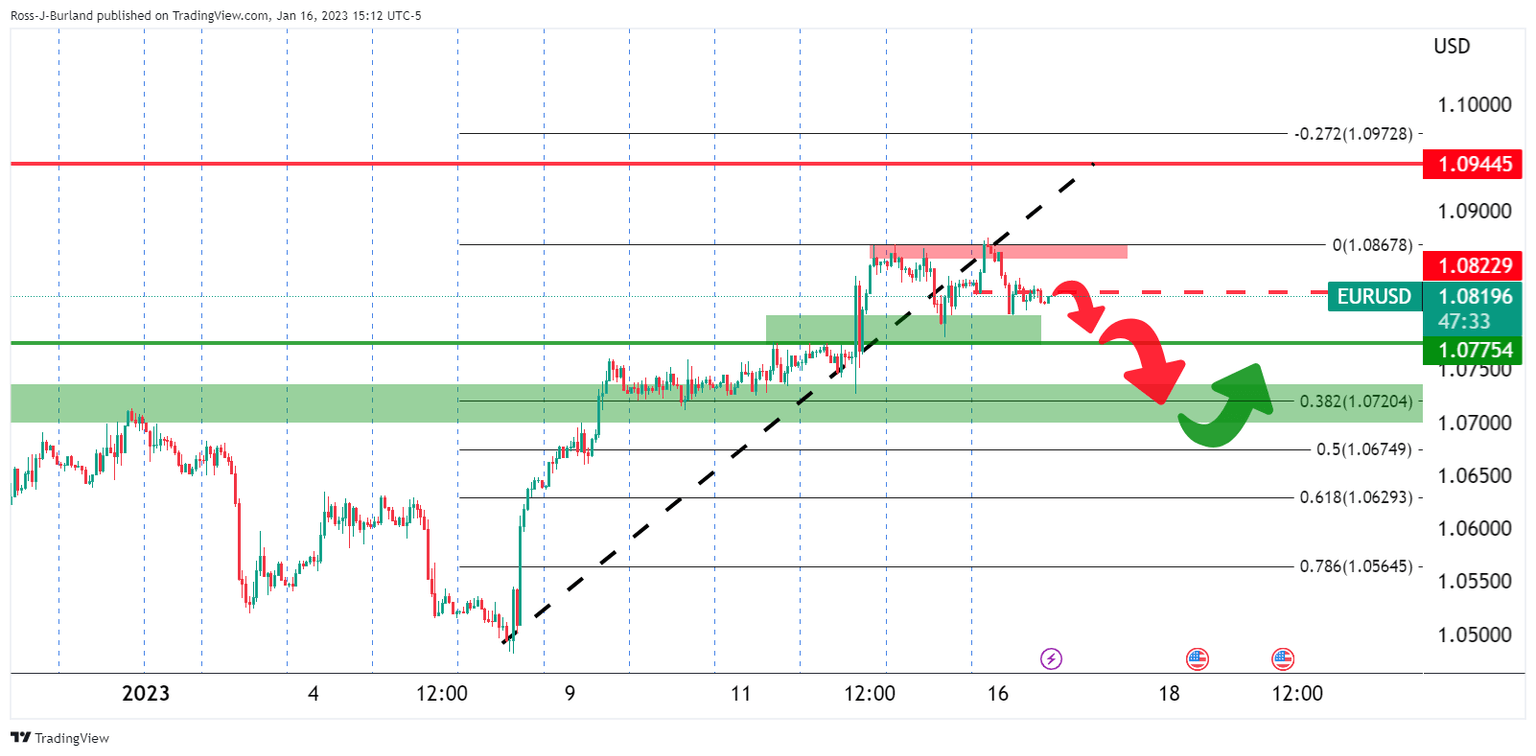

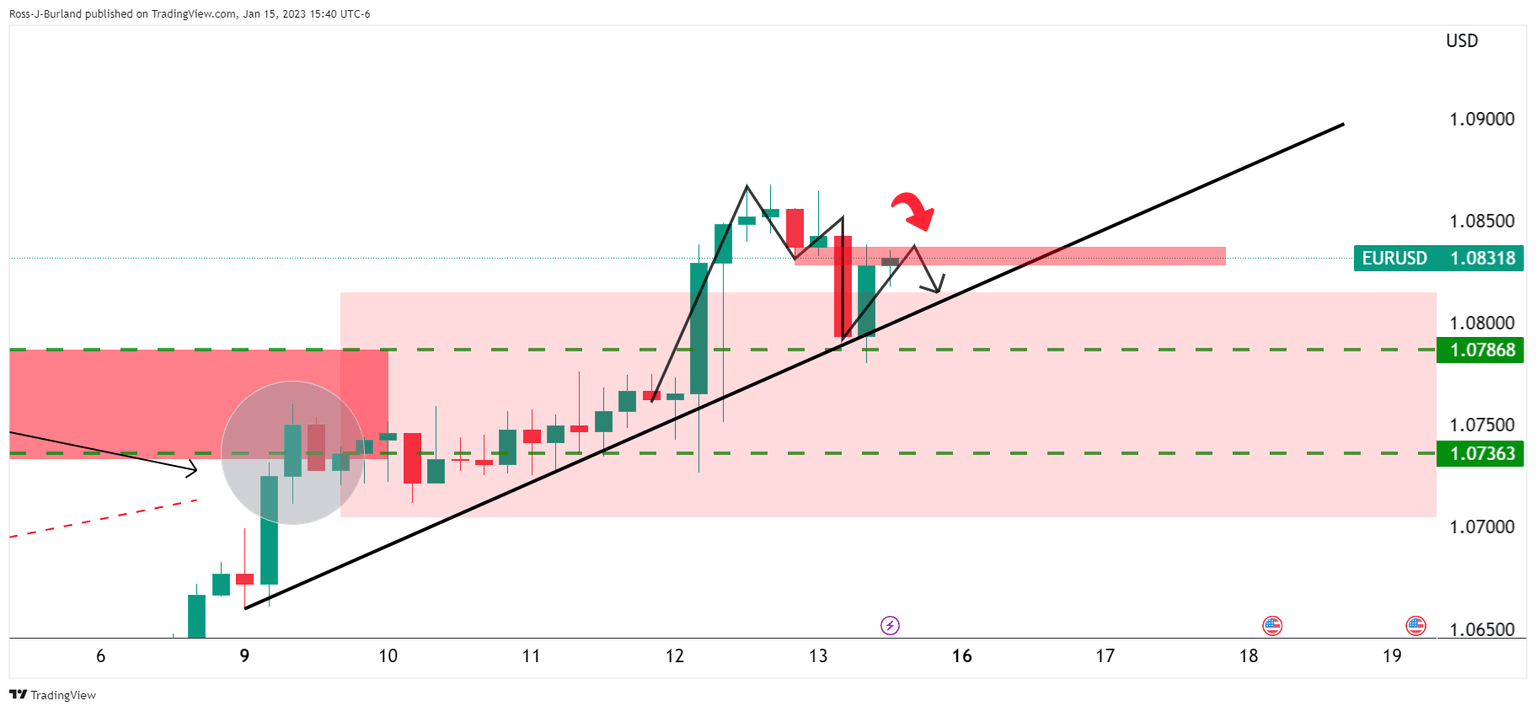

EUR/USD H1 chart

Meanwhile, the hourly trendline was broken and so to a micro horizontal structure that makes for a bearish prospect for the coming sessions:

1.0820 structure has been broken and all eyes are on a test below 1.0770 that guards the risk of a drop towards 1.0700/20 support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.