EUR/USD Price Analysis: Advances to over one-week high, closer to mid-1.0800s

- EUR/USD trades with a positive bias for the third successive day on Thursday.

- The Fed rate cut uncertainty continues to weigh on the USD and lend support.

- The technical setup warrants caution for bulls and positioning for further gains.

The EUR/USD pair attracts some buyers for the third successive day on Thursday and climbs to a one-and-half-week top, closer to mid-1.0800s during the Asian session.

The US Dollar (USD) extends this week's corrective decline from the highest level since February 14 amid the uncertainty over the Federal Reserve’s (Fed) rate cut path. Apart from this, a positive risk tone is seen as another factor undermining the safe-haven Greenback and acting as a tailwind for the EUR/USD pair. That said, expectations that the European Central Bank (ECB) will cut interest rates in June, bolstered by softer-than-expected Eurozone consumer inflation figures on Wednesday, might keep a lid on any further gains for the currency pair.

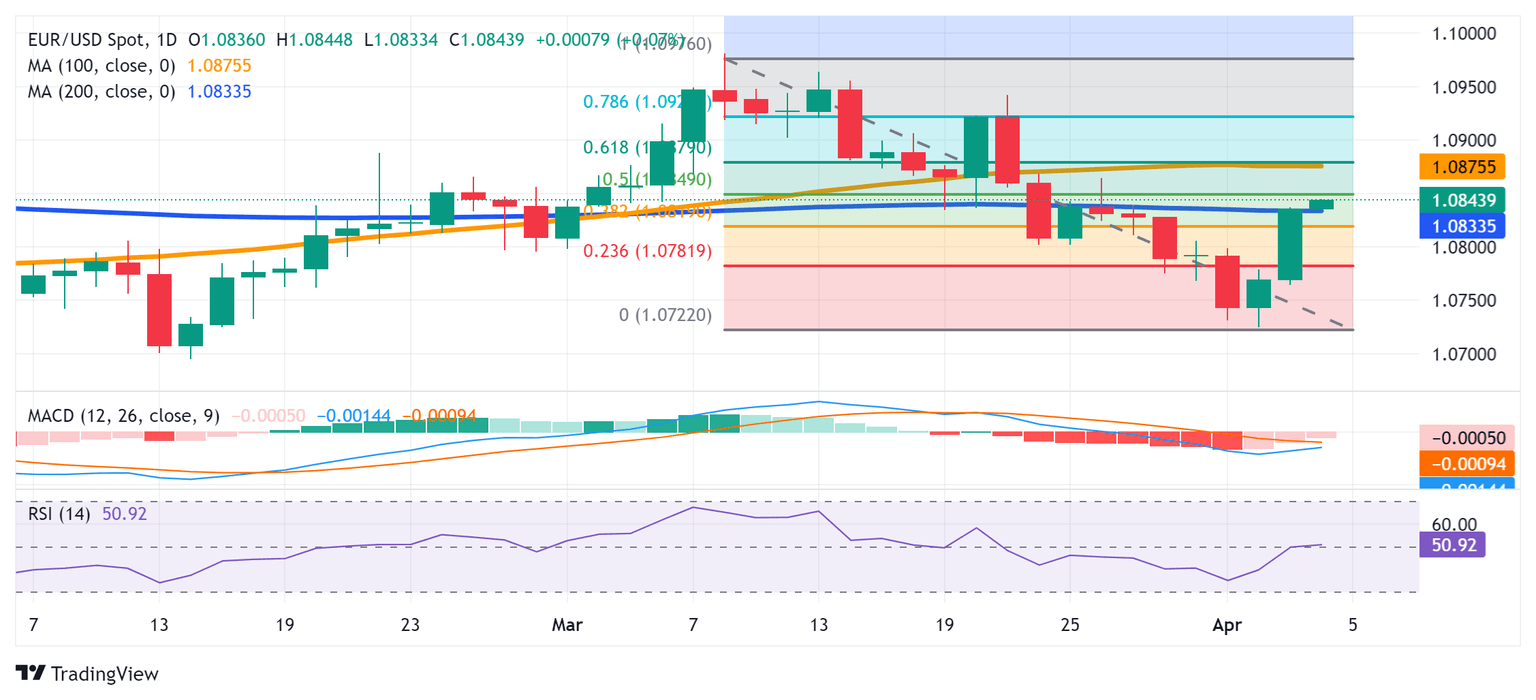

From a technical perspective, the overnight breakout through the 38.2% Fibonacci retracement level of the March-April slide and a subsequent strength beyond the 200-day Simple Moving Average (SMA) favours bullish traders. That said, oscillators on the daily chart – though have been recovering from lower levels – are yet to confirm a positive outlook and warrant some caution before positioning for additional gains. Hence, any further move up beyond the mid-1.0800s is likely to confront stiff resistance near the 1.0880 region, or the 100-day SMA.

The aforementioned area coincides with the 61.8% Fibo. level, which if cleared decisively will set the stage for a further near-term appreciating move. The EUR/USD pair might then surpass the 1.0900 mark and test the next relevant resistance near the 1.0920-1.0925 area before eventually climbing to the 1.0950 supply zone. The momentum could extend further towards the March monthly swing high, around the 1.0980 level, en route to the 1.1000 psychological mark. The latter should now act as a key pivotal point.

On the flip side, weakness below the 38.2% Fibo. level, around the 1.0825-1.0820 region, now seems to find some support near the 1.0800 mark. This is followed by the 1.0785-1.0780 area, or the 23.6% Fibo. level, below which the EUR/USD pair could aim back to challenge a one-and-half-month low, around the 1.0725 region touched earlier this week. Some follow-through selling, leading to a breakdown through the 1.0700 mark, will shift the bias in favour of bearish traders and set the stage for the resumption of a one-month-old downtrend.

EUR/USD daily chart

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.