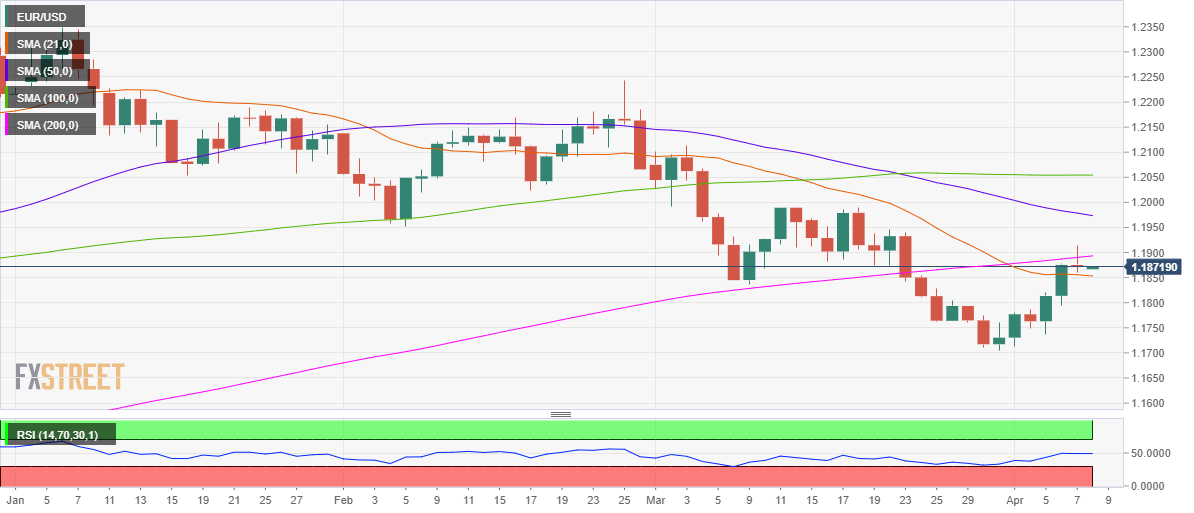

- EUR/USD failed to close Wednesday above 200-DMA at 1.1890.

- 21-DMA at 1.1853 back in sight for EUR sellers.

- Bearish RSI, USD rebound keep EUR/USD vulnerable.

EUR/USD is holding the lower ground while hovering within Wednesday’s trading range in early Asian dealings, as the US dollar remains broadly in demand amid tepid close on Wall Street.

Markets weigh in US President Joe Biden’s remarks on his infrastructure plans, FOMC minutes and a recovery in the Treasury yields heading into the earnings season and Fed Chair Jerome Powell’s speech.

From a near-term technical perspective, EUR/USD did take out the 200-daily moving average (DMA) at 1.1890 but failed to sustain above the latter.

Sellers returned and prompted the spot to finish the day near just above the 1.1860 level. The major currently trades at 1.1870, almost unchanged on the day.

The 14-day Relative Strength Index (RSI) trades flat just below the 50.00 level, suggesting that the bearish bias remains intact for EUR/USD.

Therefore, a test of the 21-DMA at 1.1853 remains on the cards following a breach of Wednesday’s low of 1.1861.

Further south, Tuesday’s low of 1.1795 could be put at risk.

EUR/USD: Daily chart

Meanwhile, the sellers remain hopeful so long as the main currency pair holds below the 200-DMA.

A sustained break above the latter is needed to revive the recovery momentum towards the bearish 50-DMA at 1.1973.

EUR/USD: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.