EUR/USD drifts higher as Euro bolstered by recovering market sentiment

- As rate cut hopes persist, EUR/USD recovers from a near-term swing low near 1.0670.

- Investors shrug off cautious Fed tones to bet on September rate cut.

- EU economic data thin this week with mid-tier events, Friday’s global PMIs loom.

EUR/USD recovered to 1.0740 on Monday as market sentiment shifts back into rate cut hopes to kick off the new trading week, with investors shrugging off cautionary statements from Federal Reserve (Fed) officials that warned rate cuts may not materialize at a pace investors are happy with. US data will dominate financial headlines with Retail Sales slated for Tuesday, leaving markets shuffling in place until Friday’s global Purchasing Managers Index (PMI) figures update.

Pan-European economic figures are limited to mid-tier prints this week, leaving markets to focus on Tuesday’s upcoming US Retail Sales print. In May, US Retail Sales are expected to increase to 0.2% month-over-month after remaining flat at 0.0% in the previous month. Core Retail Sales, excluding automobile sales, are also anticipated to remain steady at 0.2%.

Read more: Fed policymakers warns that rates set to hold as the wait for more cooling inflation data continues

Throughout the week’s upcoming economic calendar, various Federal Reserve (Fed) officials are scheduled to make appearances, with a number of policymakers expressing a notably cautious stance on Monday. Although recent inflation data has shown a faster-than-expected decline, the Fed has emphasized a reluctance to implement premature rate cuts, emphasizing the need for further data before making any decisions.

Later in the week, EU and US PMI)figures scheduled for Friday are expected to split results, with market forecasts expecting a slight uptick in pan-EU activity and a slight decrease expected in US PMI figures.

EUR/USD technical outlook

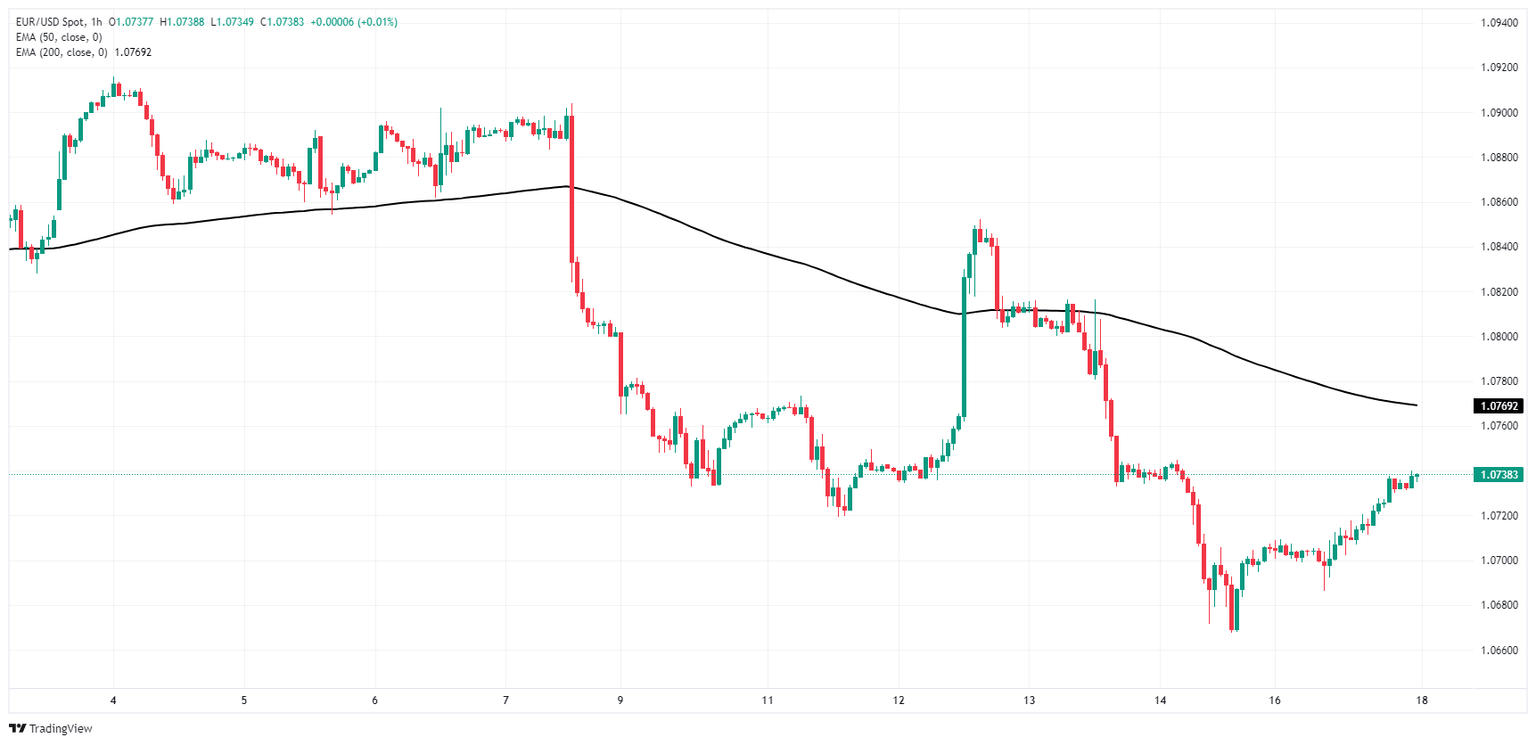

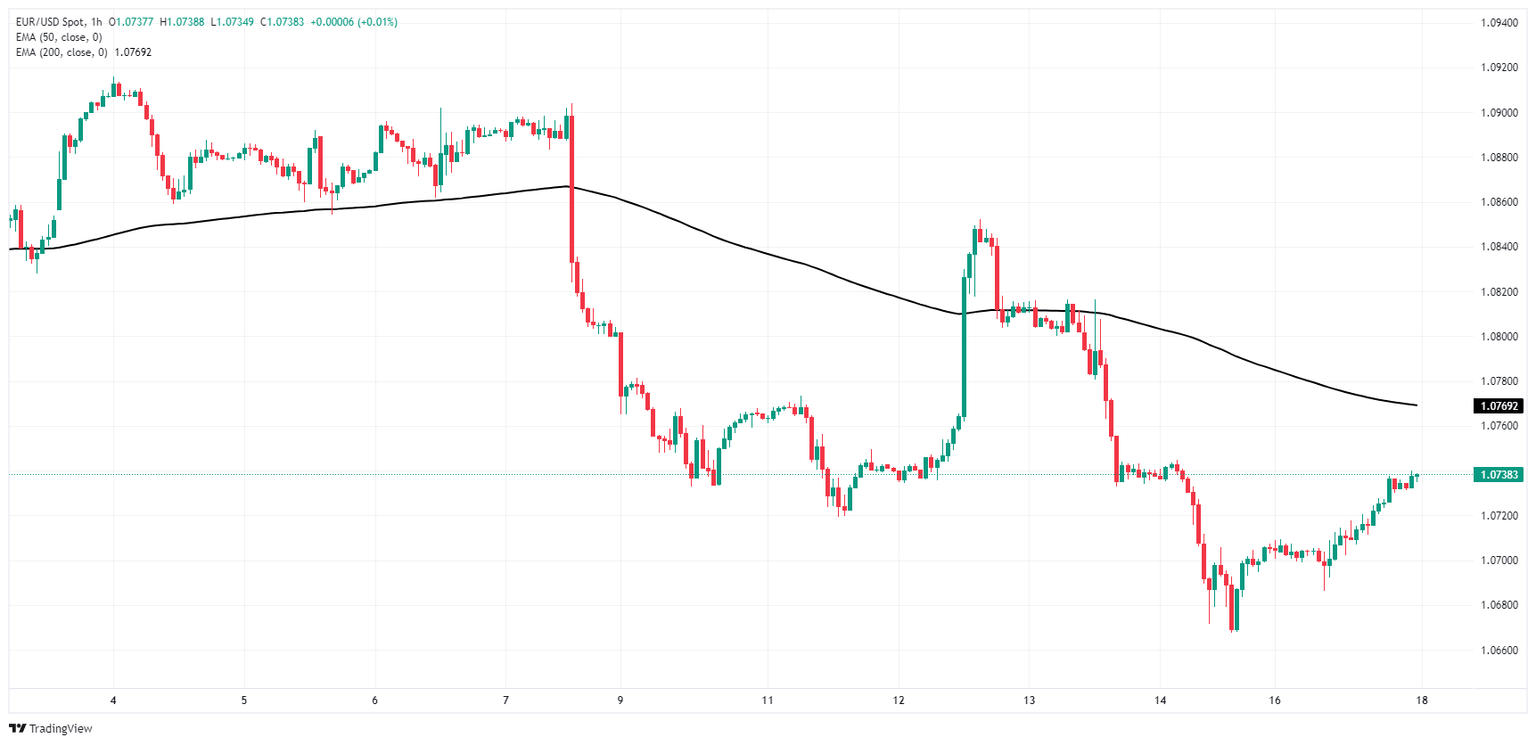

EUR/USD recovered its footing on Monday, extending last Friday’s recovery from a near-term low around 1.0670. Despite intraday recovery, the Fiber remains on the low side, trading south of the 200-hour Exponential Moving Average (EMA) at 1.0770. A pattern of lower highs leaves EUR/USD at risk for a continued bearish slide.

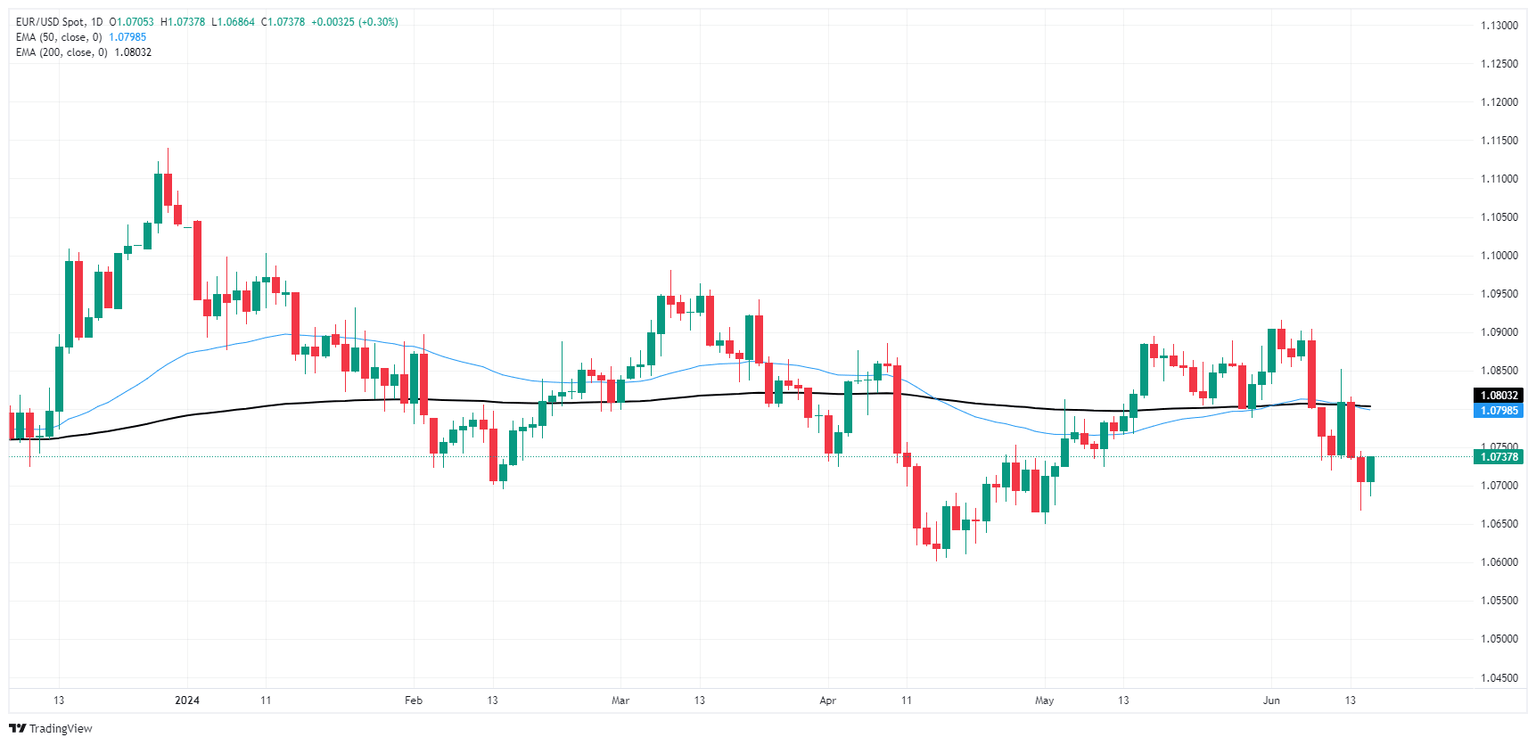

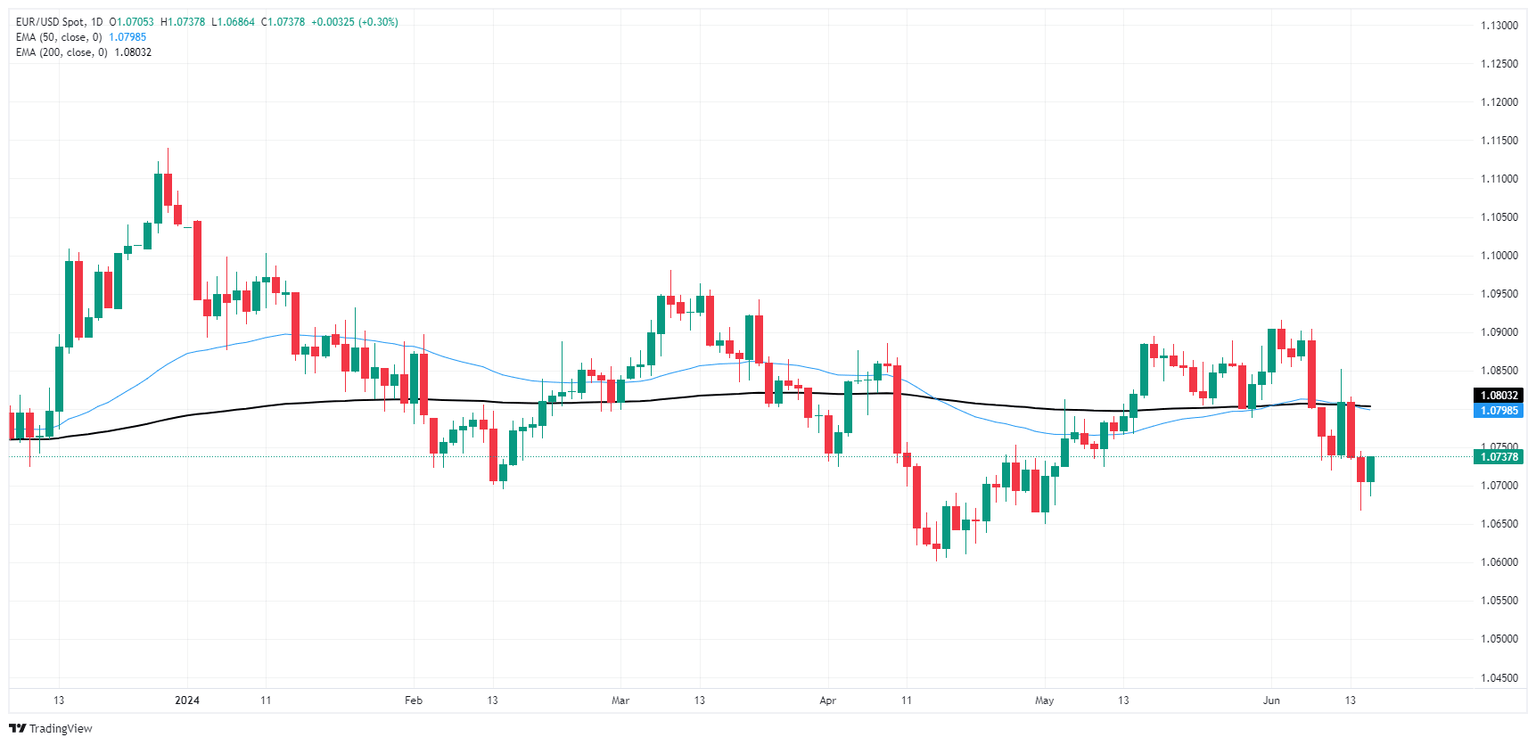

Daily candlesticks remain firmly planted in bear country after tumbling back from the 200-day EMA at 1.0803. Bullish momentum is on pace to build a firmer bounce from recent lows below the 1.0700 handle, but pressure is mounting with a pattern of lower highs weighing on price action from December’s peak near 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.