EUR/USD digs in and extends rebound from 1.05

- EUR/USD clawed back further gains on Monday, adding back 0.65%.

- Despite near-term bullish momentum, Fiber remains buried deep in the bear zone.

- With another week of tepid economic data on the books, Euro remains exposed to market flows.

EUR/USD pared away further losses on Monday, rising nearly two-thirds of a percent as markets ease off the Greenback gas pedal and give the Euro a chance to come up for air. Except for a midweek appearance from European Central Bank (ECB) Christine Lagarde on Wednesday, the economic calendar remains tepid until Friday’s global rolling release of Purchasing Managers Index (PMI) figures due on both sides of the pond.

Euro markets will be sent adrift of general market flows until Wednesday, when ECB President Lagarde appears on Wednesday to deliver the opening remarks at the ECB’s Conference on Financial Stability and Macroprudential Policy. The ECB is currently caught between a rock and a hard place as European inflation continues to hold stickier than European policymakers had initially expected, and the broader European economy continues to tilt lopsided.

The rest of this week’s economic calendar remains a tepid affair on both sides of the Atlantic, though Fiber traders will be keeping their heads low on Friday when S&P PMI business activity forecasts land during both the European and US market sessions. European Manufacturing PMI figures are expected to hold steady at 46.0 MoM, with the European Services PMI component forecast to rise to 51.8 from 51.6. On the US side, overall PMIs are broadly expected to rise, with Manufacturing expected to increase to 48.8 in November from 48.5, and Services expected to tick higher to 55.2 from 55.0.

EUR/USD price forecast

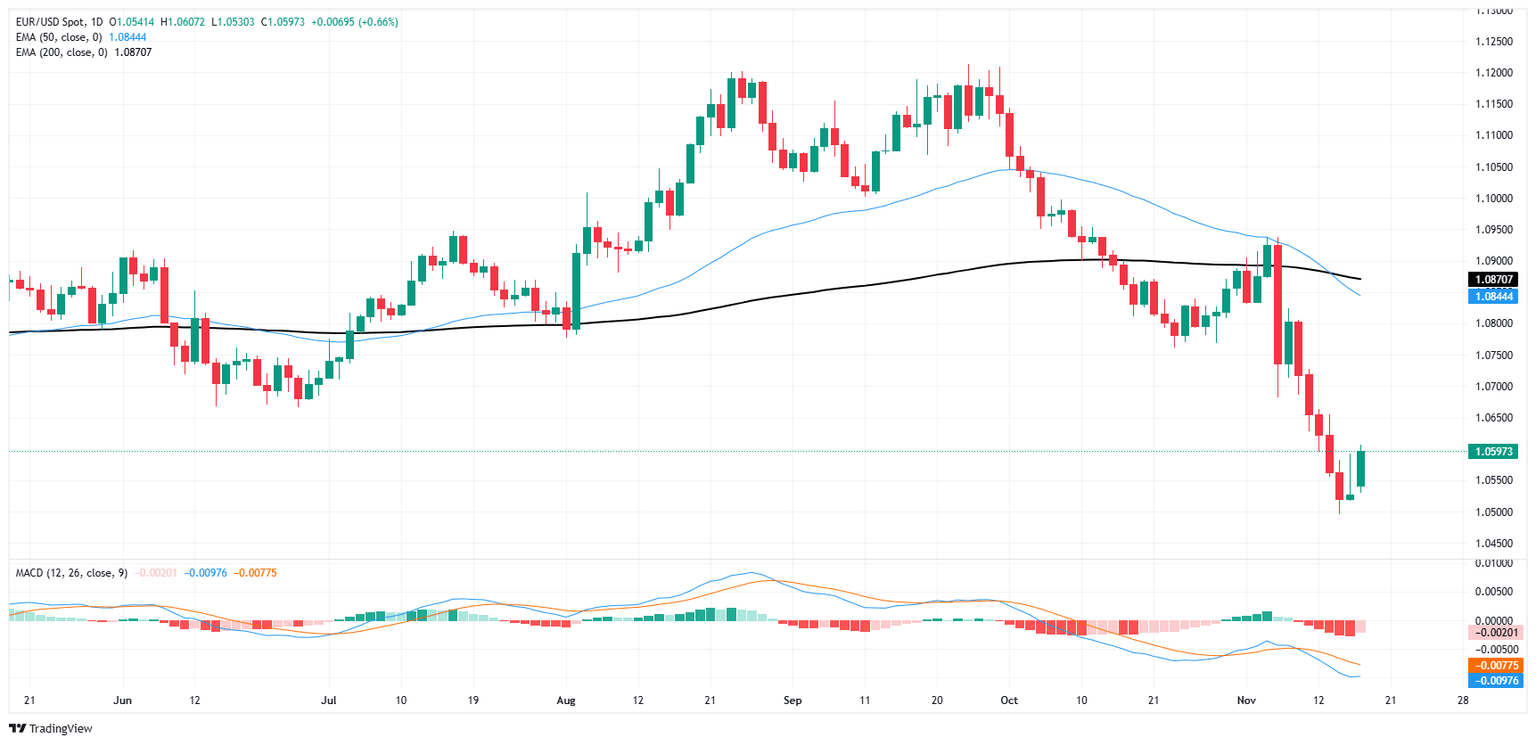

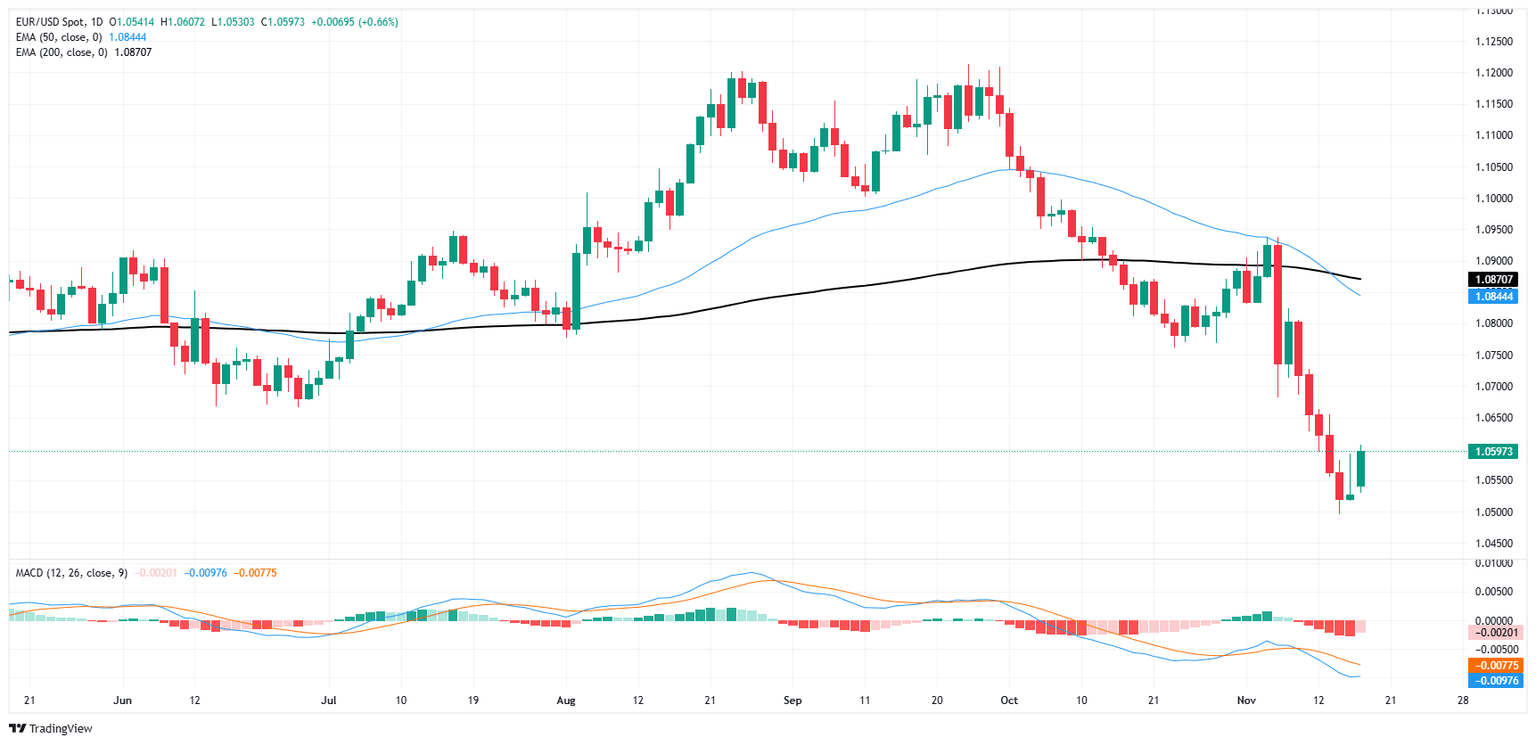

EUR/USD tilted into the bullish side on Monday, reaching for the 1.0600 handle after the pair dug in its heels late last week near 1.0500. The pair still remains buried deep in bear country, with price action stuck far below the 200-day Exponential Moving Average (EMA) at 1.0884.

Fiber found a meager bounce from its lowest prices in over a year, after falling near 6.5% from September’s peaks just north of the 1.1200 handle. With the pair steeply off of its highs, a continued recovery is likely to run into technical resistance between 1.0700 and 1.0800.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.