EUR/USD finds floor after Eurozone Manufacturing PMI data

- EUR/USD finds a floor and rebounds on the back of better-than-expected Manufacturing data for the Eurozone.

- The pair had been selling off after positive data from the US over Easter.

- The data suggested the Federal Reserve could delay cutting interest rates, supporting USD.

- The ECB continues to target June as the first month to cut interest rates.

EUR/USD finds a floor in the lower 1.0700s and recovers after the release of a better-than-expected final estimate for Eurozone Manufacturing PMI on Tuesday. The release of German inflation data, although lower than expected, did not impact the pair.

EUR/USD recovers on improvement in Eurozone Manufacturing

EUR/USD found a foothold after Eurozone HCOB Manufacturing PMI data showed a rise to 46.1 in the final revision for March when economists had expected no-change from the 45.7 flash estimate. Although it was higher than expected it is still not above the 50 which distinguishes growth from contraction, unlike US Manufacturing PMIs which rose above 50 for the first time since 2022.

The pair had weakened over the Easter weekend after more strong US macroeconomic data and hawkish commentary from the Federal Reserve (Fed) Chairman Jerome Powell, supported the US Dollar (USD), pushing down the probability of the US Federal Reserve (Fed) cutting interest rates by June. The maintenance of higher interest rates is good for the USD as it attracts more capital inflows.

In Europe, slower growth and lower inflation mean rate-setters at the European Central Bank (ECB) are not as cautious about cutting interest rates to help stimulate growth. This divergence of trajectories between both central banks is negative for EUR/USD.

According to data released on Tuesday, German Harmonized Index of Consumer Prices slowed to 2.2% YoY in March from 2.4% in February, which was below the 2.3% expected. Although the data reinforces the likelihood of the European Central Bank (ECB) going ahead with anticipated interest-rate cuts in June, it failed to move the needle on EUR/USD.

EUR/USD declines as US data bears up

On Good Friday, the inflation metric favored by the Fed, the core Personal Consumption Expenditures Price Index (PCE) in February, came out at 2.8%, exactly as expected, if below the 2.9% of January. It showed price pressures remain buoyant and well above the Fed’s 2.0% target.

US Manufacturing data on Easter Monday was also overall quite positive, with the ISM Manufacturing PMI for March vaulting over 50 – the dividing line between expansion and contraction – from a previous level of 47.8. The result was well above expectations of a rise to 48.4. It was the first result denoting expansion in the US manufacturing sector since November 2022.

The Euro was kept under pressure, meanwhile, by another ECB rate setter joining the chorus line for a June rate cut. ECB Governing Council member and Austrian Central Bank Governor Robert Holzmann said that the ECB could cut interest rates before the Fed, and in regards to when, “will depend largely on what wage and price developments look like by June.”

His commetnary contrasted with relatively hawkish comments from Federal Reserve Chair Jerome Powell, who said "we don't need to be in a hurry to cut," at a speech delivered on Good Friday.

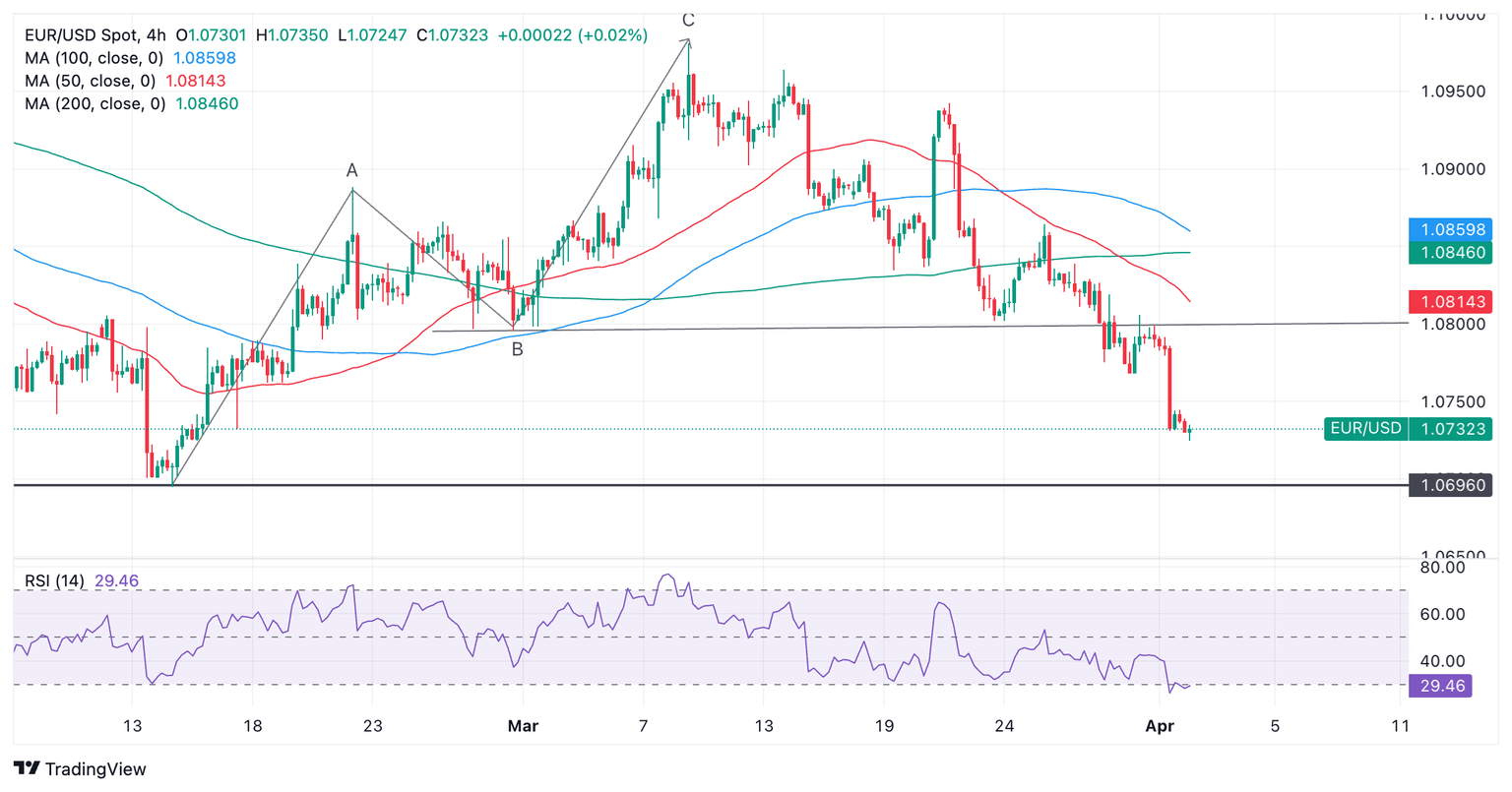

Technical Analysis: EUR/USD continues pushing lower

EUR/USD extends the dominant short-term downtrend that started at the March 8 high. It is currently on its way down to key support at the 1.0694 year-to-date (YTD) lows.

Euro versus US Dollar: 4-hour chart

The pair is oversold according to the Relative Strength Index (RSI) momentum indicator. This is a signal for sellers not to add any more shorts to their positions. If the indicator rises out of oversold (above 30), it will be a signal to close all short positions and open longs. This could lead to a pullback, although the precedence of the downtrend suggests an eventual capitulation.

The 1.0694 February and YTD lows are likely to present substantial support and a bounce off that level is likely at the first test. A decisive break below, however, would usher in another bout of weakness, and target the 1.0650s.

A decisive break is one characterized by a long red down candle breaking cleanly through the level and closing near its low, or three consecutive red candles breaching the level.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.