- EUR/USD reverses the recent weakness and targets 1.0400.

- The dollar looks offered ahead of data, Fed’s Powell.

- EMU Flash Inflation Rate is seen rising 10% YoY in November.

The single currency regains some balance and lifts EUR/USD to daily highs in the 1.0380/85 band on Wednesday.

EUR/USD looks firm ahead of Powell

After three daily pullbacks in a row, EUR/USD prints decent gains and looks to reclaim the 1.0400 neighbourhood on the back of fresh weakness hurting the greenback.

Indeed, the pair marches on a firm foot amidst a flat performance in US and German yields and rising prudence ahead of the speech by Chief Powell later in the NA session.

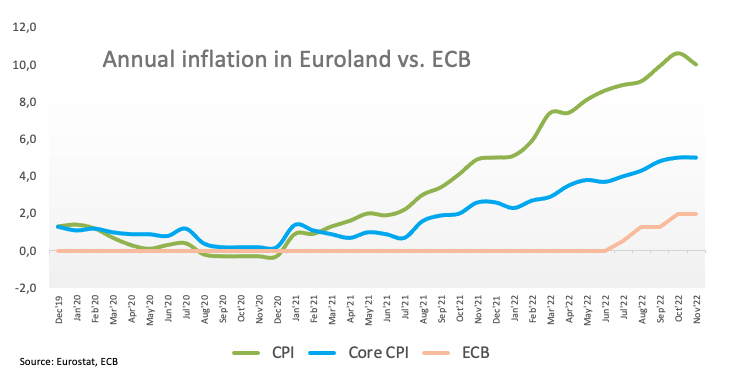

An interesting calendar in the euro area saw Germany’s Unemployment Change rise by 17K people and the jobless rate tick higher to 5.6%, both prints for the month of November. Additionally, flash figures now see the headline CPI in the broader euro area rise at an annualized 10.0% in November and 5.0% when it comes to the Core CPI.

Across the Atlantic, Chair Powell will speak on “Economic Outlook, Inflation and the Labor Market” and FOMC Governor L.Cook will also speak on “The Outlook for Monetary Policy and Observations on the Evolving Economy”.

More from the US data space will see MBA Mortgage Applications, the ADP Employment Change report, Goods Trade Balance, another revision of the Q3 GDP Growth Rate, Pending Home Sales and the Fed’s Beige Book.

What to look for around EUR

EUR/USD sees its upside bias renewed on Wednesday in response to the fresh downside pressure in the dollar, while expectations ahead of the speech by Fed’s Powell remain on the rise.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Unemployment Rate, Unemployment Change, EMU Flash Inflation Rate (Wednesday) - Germany Retail Sales, ECB General Council Meeting, Germany/EMU Final Manufacturing PMI, EMU Unemployment Rate (Thursday) - ECB Lagarde, Germany Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.37% at 1.0367 and faces the next up barrier at 1.0496 (monthly high November 28) ahead of 1.0500 (round level) and finally 1.0614 (weekly high June 27). On the flip side, a breach of 1.0330 (weekly low November 28) would target 1.0222 (weekly low November 21) en route to 1.0037 (100-day SMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.