EUR/USD churns below 1.0800 as upside momentum remains thin

- EUR/USD continues to test a near-term ceiling at 1.0780.

- European PMIs slated for next Thursday, thin data until then.

- US PPIs rose on Friday, pinning markets into the midrange.

EUR/USD is spinning in place on Friday after a brief test into the low side, but tepid markets are keeping the pair hamstrung near the day’s opening bids as traders buckle down for the week’s closing bell.

The Euro (EUR) sees thin economic data until next week’s Purchasing Manager’s Index (PMI) figures, and US data gave traders little to chew on after the US Producer’s Price Index (PPI) rose instead of falling on Friday. US markets will be dark on Monday for the President’s Day holiday, and traders will be waiting until Wednesday’s Federal Reserve (Fed) Meeting Minutes for hints about how close (or far) the US central bank is from trimming interest rates.

Daily digest market movers: EUR/USD struggles to break out of near-term congestion

- US Core annualized PPI rose to 2.0% for the year ended in January, climbing over the forecast 1.6% and the previous period’s 1.7% (revised from 1.8%).

- MoM US PPI rose by 0.3% in January, accelerating above the forecast rebound to 0.1% from the previous month’s -0.1%.

- The Michigan Consumer Sentiment Index rose to 79.6 for February, but less than the forecast 80.0 from January’s 79.0.

- The University of Michigan’s 5-year Consumer Inflation Expectations survey held steady at 2.9% in February.

- Still-high inflation expectations and rising producer-level inflation continue to vex investors hungry for rate cuts from the Fed.

- Next week sees the Federal Open Market Committee’s (FOMC) latest Meeting Minutes, slated to release on Wednesday.

- The Euro sees only light data on the calendar until next Thursday’s Purchasing Manager’s Index (PMI) print.

- The pan-European HCOB Composite is expected to rise slightly to 48.5 in February from January’s 47.9.

- Europe’s HCOB Composite PMI has been in contraction territory below 50.0 since July of last year.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.03% | -0.02% | 0.16% | -0.13% | 0.17% | -0.28% | 0.13% | |

| EUR | 0.03% | 0.00% | 0.19% | -0.10% | 0.20% | -0.25% | 0.16% | |

| GBP | 0.02% | -0.02% | 0.18% | -0.11% | 0.19% | -0.26% | 0.17% | |

| CAD | -0.16% | -0.20% | -0.18% | -0.27% | 0.01% | -0.44% | -0.03% | |

| AUD | 0.13% | 0.11% | 0.12% | 0.30% | 0.31% | -0.14% | 0.27% | |

| JPY | -0.16% | -0.19% | -0.18% | -0.01% | -0.32% | -0.43% | -0.03% | |

| NZD | 0.27% | 0.25% | 0.26% | 0.45% | 0.15% | 0.44% | 0.41% | |

| CHF | -0.14% | -0.16% | -0.15% | 0.03% | -0.26% | 0.04% | -0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD struggles to build bullish momentum, 1.0800 remains the level to beat

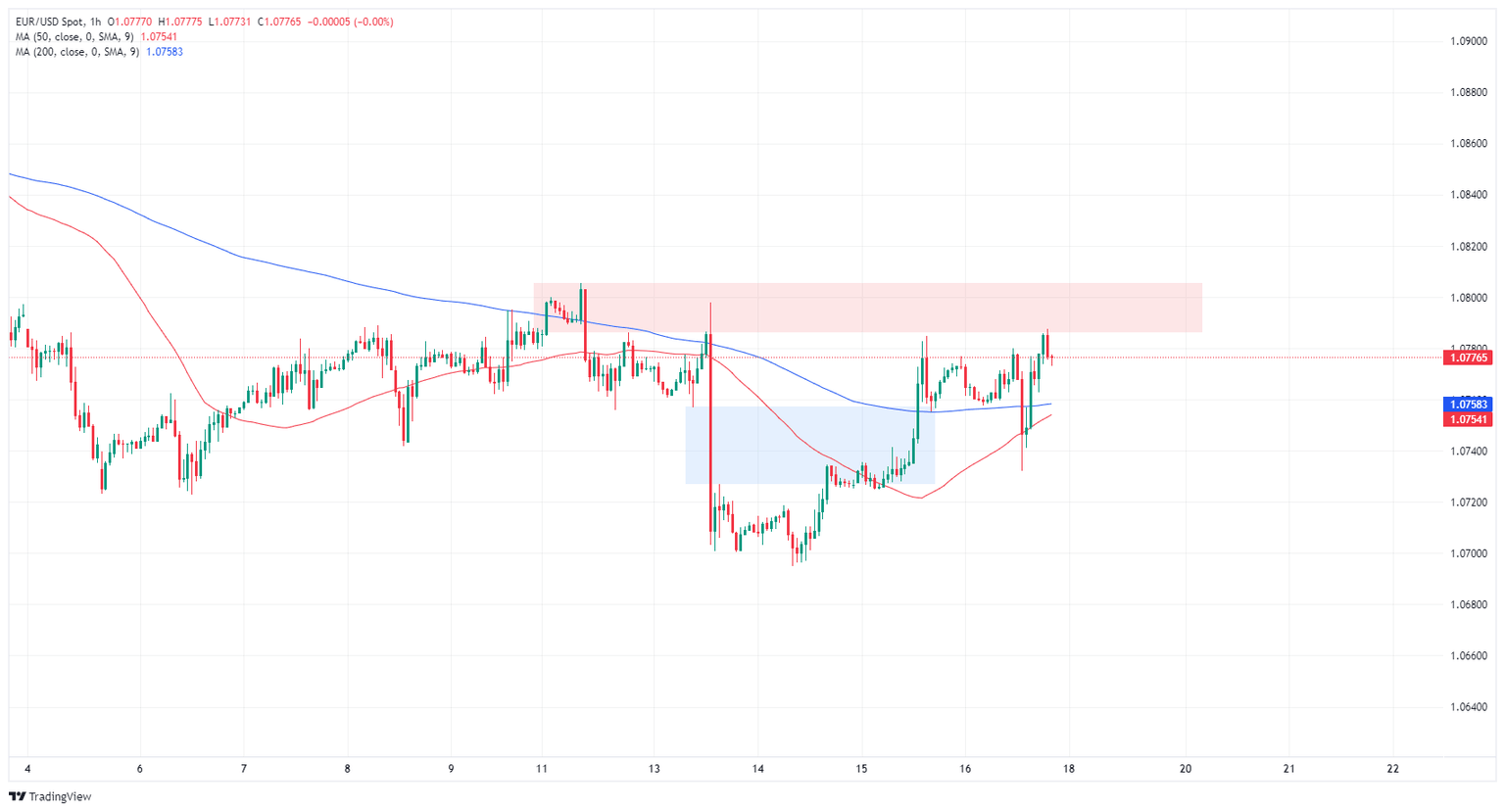

EUR/USD is stuck in churn around the 200-hour Simple Moving Average (SMA) near 1.0760 with the pair struggling to find the topside momentum needed to reclaim the 1.0800 handle. EUR/USD has tested in both directions on Friday, and the pair is testing a scant tenth of a percent up on the day at the time of writing.

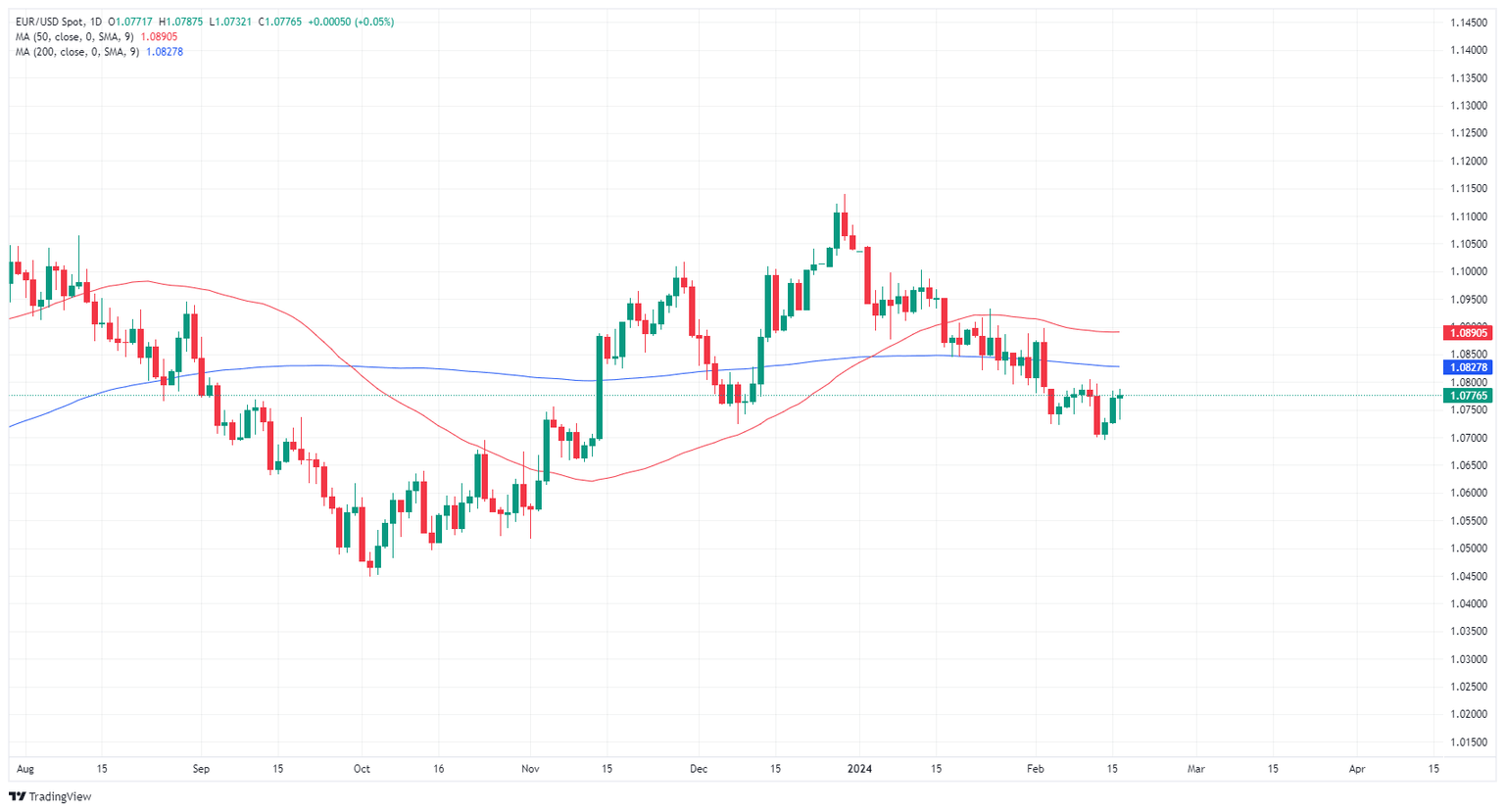

The EUR/USD is on pace to close on the down side of the 200-day SMA near 1.0830 for the tenth consecutive trading day as the pair gets plagued by regular bearish shocks, and bidders are struggling to dig their heels in and prevent further downside. The pair is still down over 3% from December’s peak bids near 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.