EUR/USD bulls engage ahead of Federal Reserve and European Central Bank

- EUR/USD bulls rally on Federal Reserve and European Central Bank prospects.

- United States economic data weighed on the US Dollar with more to come before the Federal Reserve,

- EUR/USD bulls are firming from near 1.0480 support and are taking on resistance around 1.0570.

EUR/USD is firmly higher on Thursday due to diminishing expectations for the Federal Reserve (Fed) to keep raising interest rates at the same aggressive pace. A rise in weekly jobless claims suggests that the labour market is slowing down. EUR/USD is currently 0.38% higher having rallied from a low of 1.0489 to a high of 1.0564 on the day so far.

Federal Reserve expectations

Weekly jobless claims rose to 230K, as expected. Continuing claims rose to 1.671M, topping the forecast of 1.6M and the data comes ahead of next week's Federal Reserve meeting. Money markets show there is a 91% chance that the policy-setting Federal Open Market Committee (FOMC) will raise rates by half a point next week, and just a 9% chance there will be another 75 basis point increase.

There will be more key data events coming up before the Federal Reserve December 14 meeting. The Producer Price Index and the University of Michigan's consumer sentiment survey on Friday as well as November's Consumer Price Index are due. Investors will be on the watch for any signs that the Federal Reserve is getting ready to pause its hikes.

Noting the shift in market sentiment following last Friday's Nonfarm Payrolls (NFP) and this week's ISM Services data, analysts at Danske Bank said ''we acknowledge that our earlier call of a 75bp hike next week appears unlikely, but do not think the need to tighten monetary policy further has disappeared. We adjust our Federal Reserve call, and now expect a 50 basis points (bp) hike next week, followed by 50bp in February and 25bp in March. Thus, we maintain our call for a terminal rate of 5.00-5.25% unchanged.''

European Central Bank in focus

The European Central Bank (ECB) and the Bank of England (BoE) are also set to announce interest rate decisions next week and are expected to act in order to thwart stubbornly high inflation.

''At next week's meeting, we expect the European Central Bank to deliver a 50bp rate hike with a hawkish twist,'' analysts at Danske Bank said. ''Specifically, we expect the European Central Bank to present key principles of the end to reinvestments under the Asset Purchase Programme (APP) process (in which reinvestments will almost come to a full stop) and an open-ended wording for more rate hikes to come. This will be a compromise, which we believe will be palatable to both hawks and doves.''

''We currently expect European Central Bank rate hikes into Q1 next year, with the deposit rate peaking at 2.75%, but with risks skewed for more hikes,'' the analysts added.

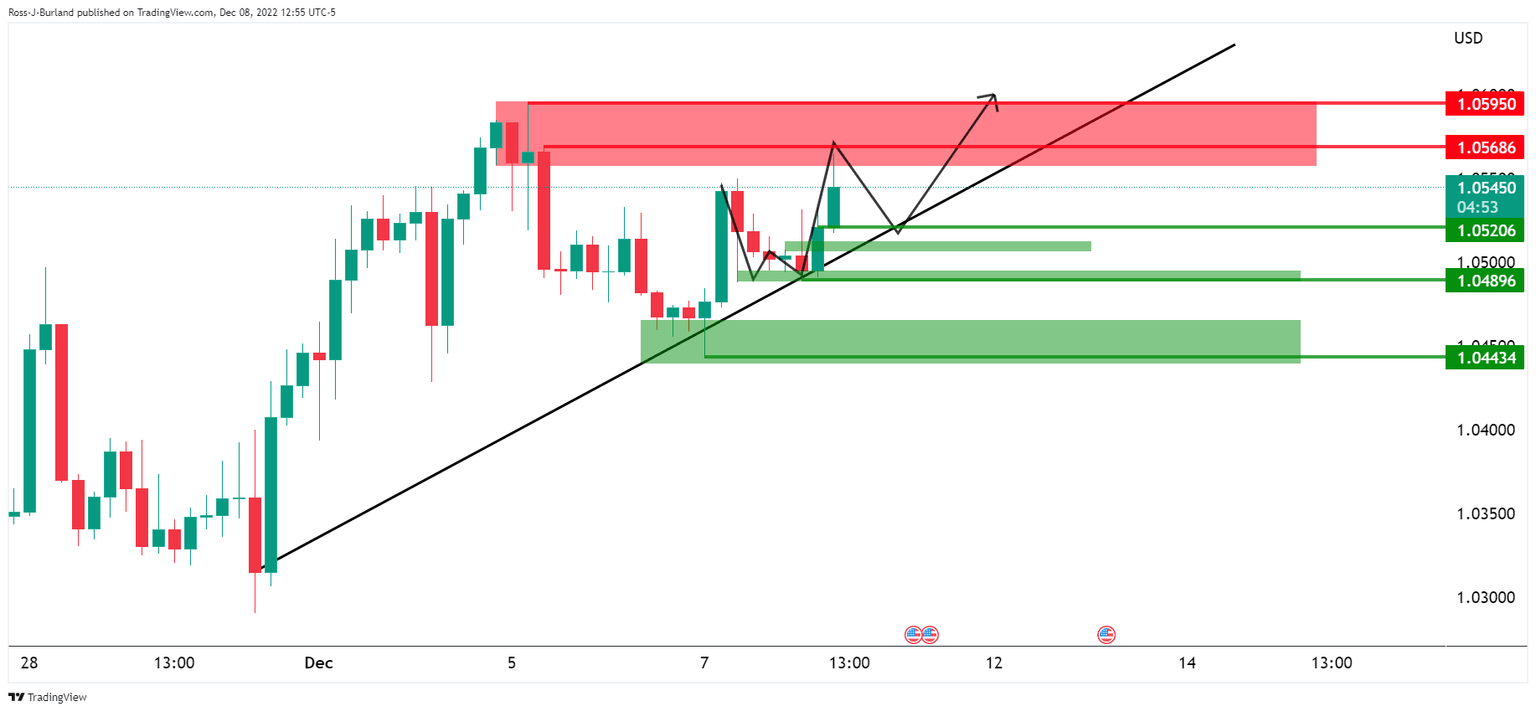

EUR/USD technical analysis

While on the front side of the daily trendline, EUR/USD bulls are firming from near 1.0480 support and are taking on resistance around 1.0570. A break there opens the risk of a move in EUR/USD beyond 1.0600:

A move in EUR/USD below the trendline, however, will expose supports near 1.0490 and 1.0440 and open prospects of a deeper correction towards 1.0400.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.